The shares of Adani Green advanced over 3% in trade so far Friday after the Securities and Exchange Board of India gave a clean chit to the group firm in the Hindenburg case.

On Thursday, the Markets regulator, Securities and Exchange Board of India cleared Adani Group and its Chairman Gautam Adani of allegations levelled by US based Hindenburg Research of routing funds through three entities to hide related party transactions.

Further, Jefferies has also maintained its 'Buy' rating with a target price of Rs 1,300. The brokerage noted that management reinforced confidence in its journey to raise capacity 3.5 times from 14 GW in FY25 to 50 GW by 2030.

Improving net debt to Ebitda ratio trends also remain underway. The brokerage further added that, "we estimate 4.5 GW addition in FY26E and 6.3 GW in FY27E. Guidance of 5 GW addition in FY26E was reiterated, which gives upside scope to our estimates if achieved."

Jefferies highlighted that Adani Green is developing 30 GW RE capacity of its planned 50 GW at Khavda with a phase-wise evacuation plan that broadly matches project commissioning timelines.

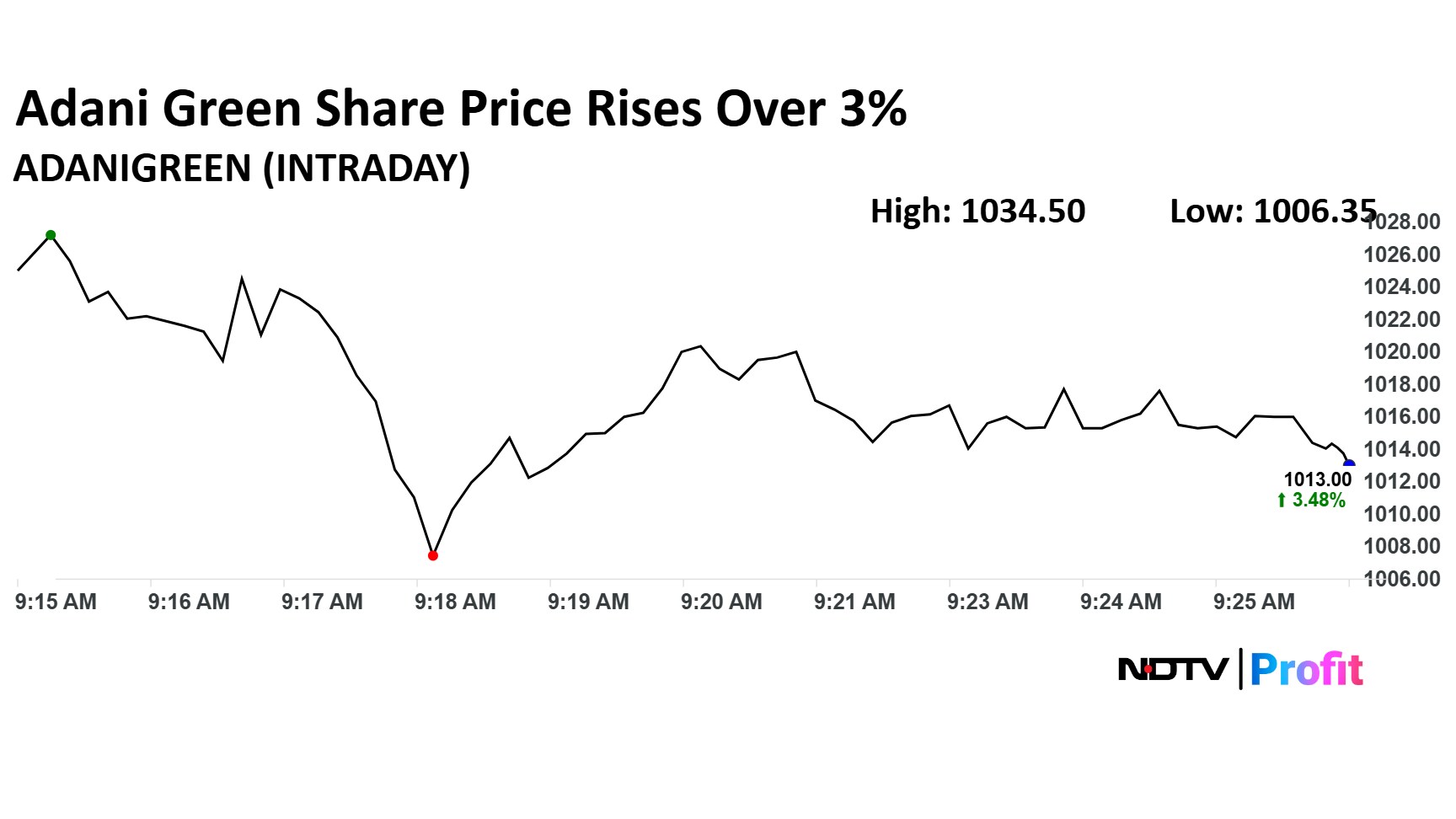

Adani Green Share Price

Adani Green stock rose as much as 5.68% during trade so far to Rs 1,034.5 apiece on the NSE. It was trading 3.59% higher at Rs 1,014.05 apiece, compared to an 0.25% decline in the benchmark Nifty 50 as of 9:30 a.m.

It had declined 48.44% in the last 12 months and 2.88% on a year-to-date basis. The total traded volume so far in the day stood at 25 times its 30-day average. The relative strength index was at 58.74.

Six out of the seven analysts tracking the company have a 'buy' rating on the stock and one suggest a 'sell', according to Bloomberg data. The 12-month analysts' consensus target price on the stock is Rs 1,240.4, implying a upside of 21.1%.

Disclaimer: NDTV Profit is a subsidiary of AMG Media Networks Limited, an Adani Group Company.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.