Shares of ABB India Ltd. hit an all-time high on Thursday after brokerages said that the company is on course to post a sustained earnings annually over the long term.

Led by structural trends around electrification, industrial automation, urban infrastructure, and constant order flows, ABB is well on course to sustain earnings CAGR over the medium to long term, UBS said in a Feb. 21 note.

The brokerage has a 'buy' rating on ABB with a 12-month price target of Rs 5,380 per share, compared to the current price of Rs 5,376 apiece.

The company's management observes a notable shift in customers' preference towards reliability over price sensitivity, which is leading to increased demand for high-quality products and services, Nomura said in its note on Wednesday.

The brokerage also has a 'buy' rating on the stock, with a target price of Rs 5,740 per share.

However, Kotak Institutional Equities noted that the company reported a weak sequentially flat execution, with all segments beyond electrification declining quarter-on-quarter, despite the fourth quarter seasonality.

Kotak has a cautious sectoral view, with a "reduce" call and a target price of Rs 4,600 apiece. This implies a downside of 7%.

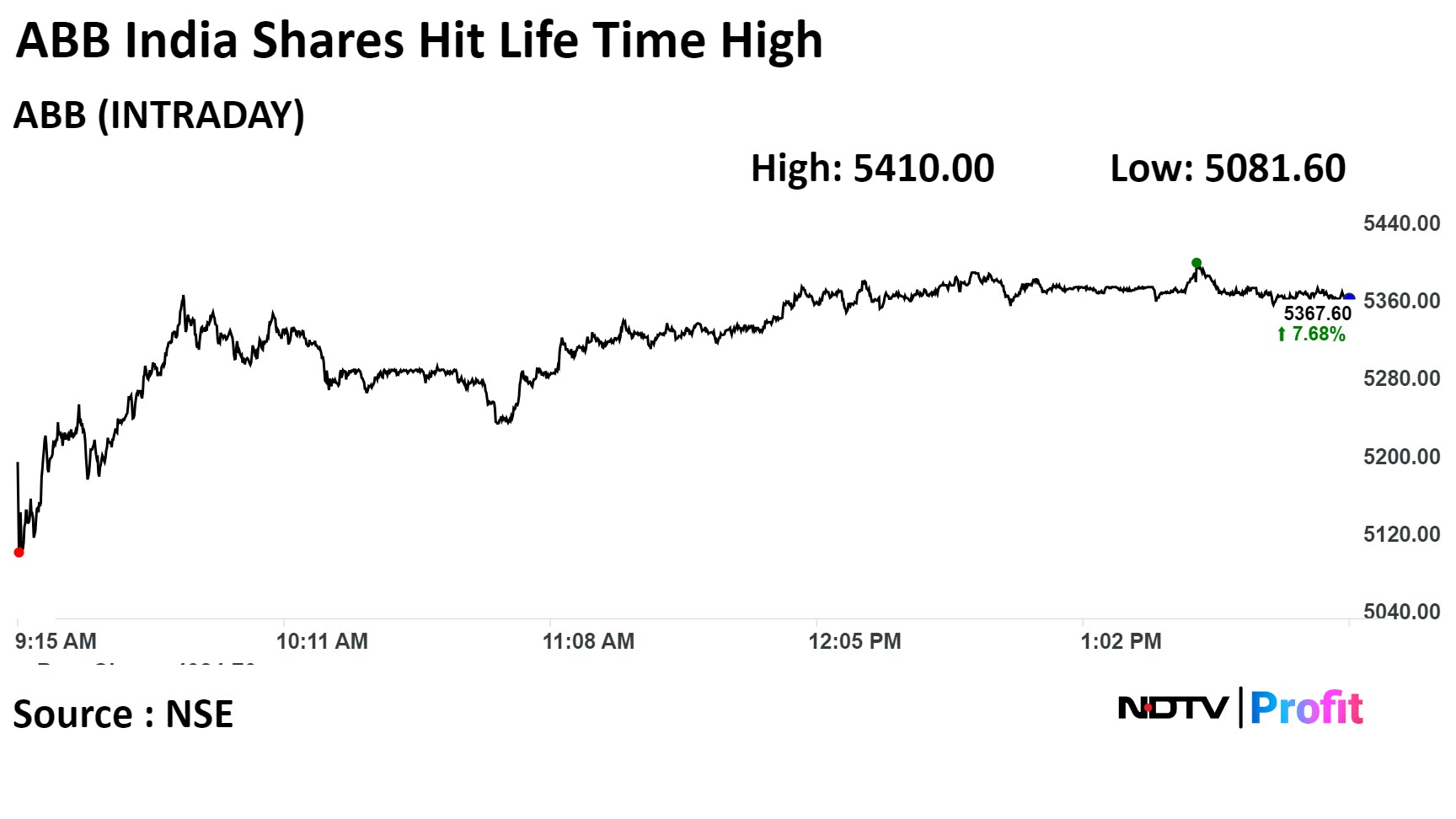

Shares of the electrification and automation major rose as much as 8.53% before paring gains to trade 7.85% higher at 1:53 a.m., compared to a 0.06% decline in the benchmark Nifty 50.

The stock has risen 64% in the past 12 months. The total traded volume so far in the day stood at 14 times its 30-day average. The relative strength index was at 73.70.

Of the 29 analysts tracking the company, 16 maintain a 'buy' rating, eight recommend a 'hold' and five suggest a 'sell', according to Bloomberg data. The average of 12-month analysts' price targets implies a potential downside of 4.2%.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.