Shares of Aarti Drugs Ltd. closed 12% higher on Tuesday, after the US Food and Drug Administration issued 'voluntary action indicated' tag for its active pharmaceutical ingredient manufacturing facility in Maharashtra's Tarapur.

The company received the establishment inspection report from the US drug regulator for its Tarapur facility on Dec. 20.

"FDA has determined that the inspection classification of this facility is 'voluntary action indicated', an exchange filing said. "Based on this inspection, this facility is considered to be in a minimally acceptable state of compliance with regard to current good manufacturing practice."

"Due to this company can export the products such as Ciprofloxacin HCl API, Zolpidem Tartrate API, Raloxifene HCl API, Celecoxib API and Niacin API in US Market," the filing added.

Notably, VAI classification from the USFDA means objectionable conditions or practices were found, but they are not severe enough to attract any administrative or regulatory action. The company can fix the observed loopholes without the watchdog's intervention and operations can carry on as usual.

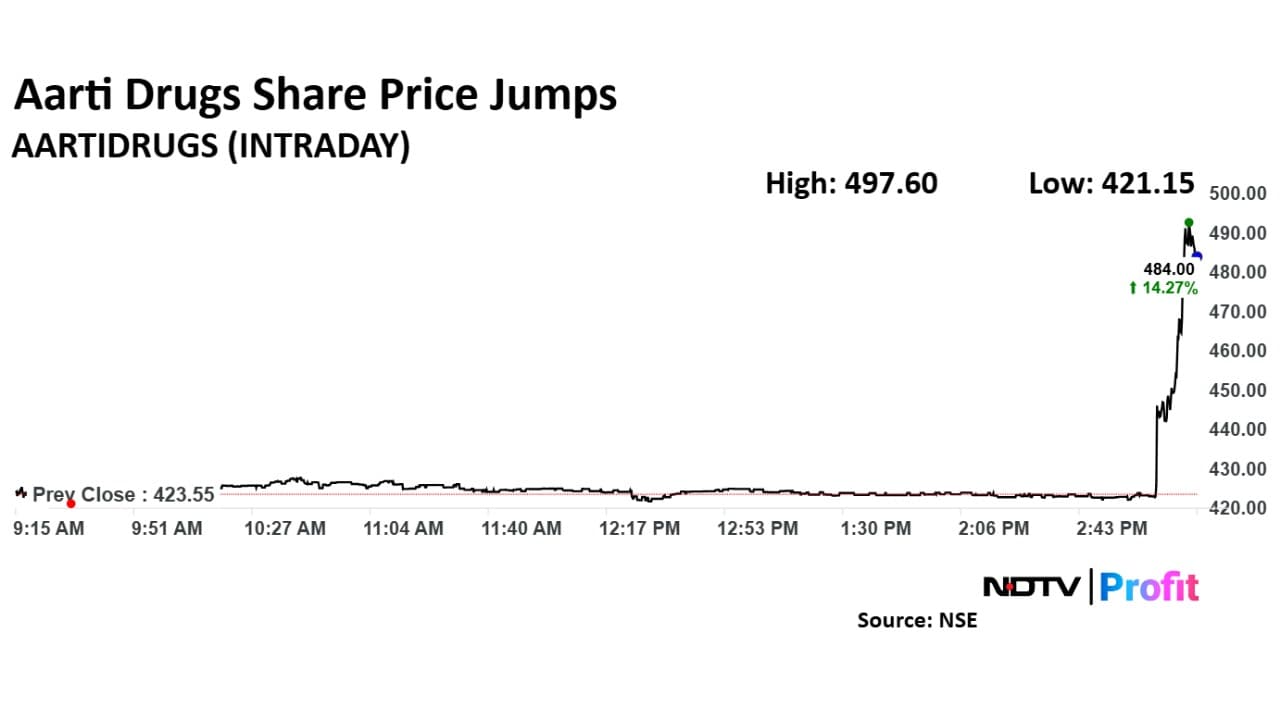

Shares of Aarti Drugs rose as much as 17.48% to Rs 497.6 apiece, the highest level since November 7. It pared gains to close 12.4% higher at Rs 475.90 apiece. This compares to a 0.1% decline in the NSE Nifty 50 Index.

On a year-to-date basis, however, the stock is down 2.7%. One analyst tracking the company has a 'buy' rating, according to Bloomberg data. The average of 12-month analysts' price target implies a potential upside of 17.3%.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.