- Indian households hold an estimated $3 trillion worth of gold, mostly idle in lockers

- Unlike idle household gold, equities fund companies and actively support economic growth, Nithin Kamath said

- The Zerodha co-founder called for better financial uses of gold, beyond the existing gold loan schemes

Indian households collectively hold an estimated $3 trillion worth of gold, according to World Gold Council estimates. Yet most of it sits idle in lockers, doing little to support the country's economic engine, said Zerodha co-founder and CEO Nithin Kamath in a post on X. He also believes it's time that this vast reservoir of wealth is put to more productive use.

In his post, Kamath said, “Indian households hold $3 trillion in gold (World Gold Council estimate), sitting idle in lockers. Meanwhile, equity investments fund companies that need capital to grow (sic).”

Indian households hold ~$3 trillion in gold (World Gold Council estimate), sitting idle in lockers. Meanwhile, equity investments fund companies that need capital to grow. We need better ways to financialize this gold beyond just gold loans. pic.twitter.com/j0D4DI0bOi

He argued that India must develop “better ways to financialise this gold beyond just gold loans”, suggesting that while equities actively drive business expansion, gold remains largely unutilised as a financial asset.

Kamath's comments reignite a long-standing conversation around how to mobilise India's household gold — a deeply cultural store of value but an economically underperforming one. Despite government schemes such as Gold Monetisation and Sovereign Gold Bonds (SGBs), uptake has remained limited, reflecting both emotional attachment and a lack of practical incentives for investors.

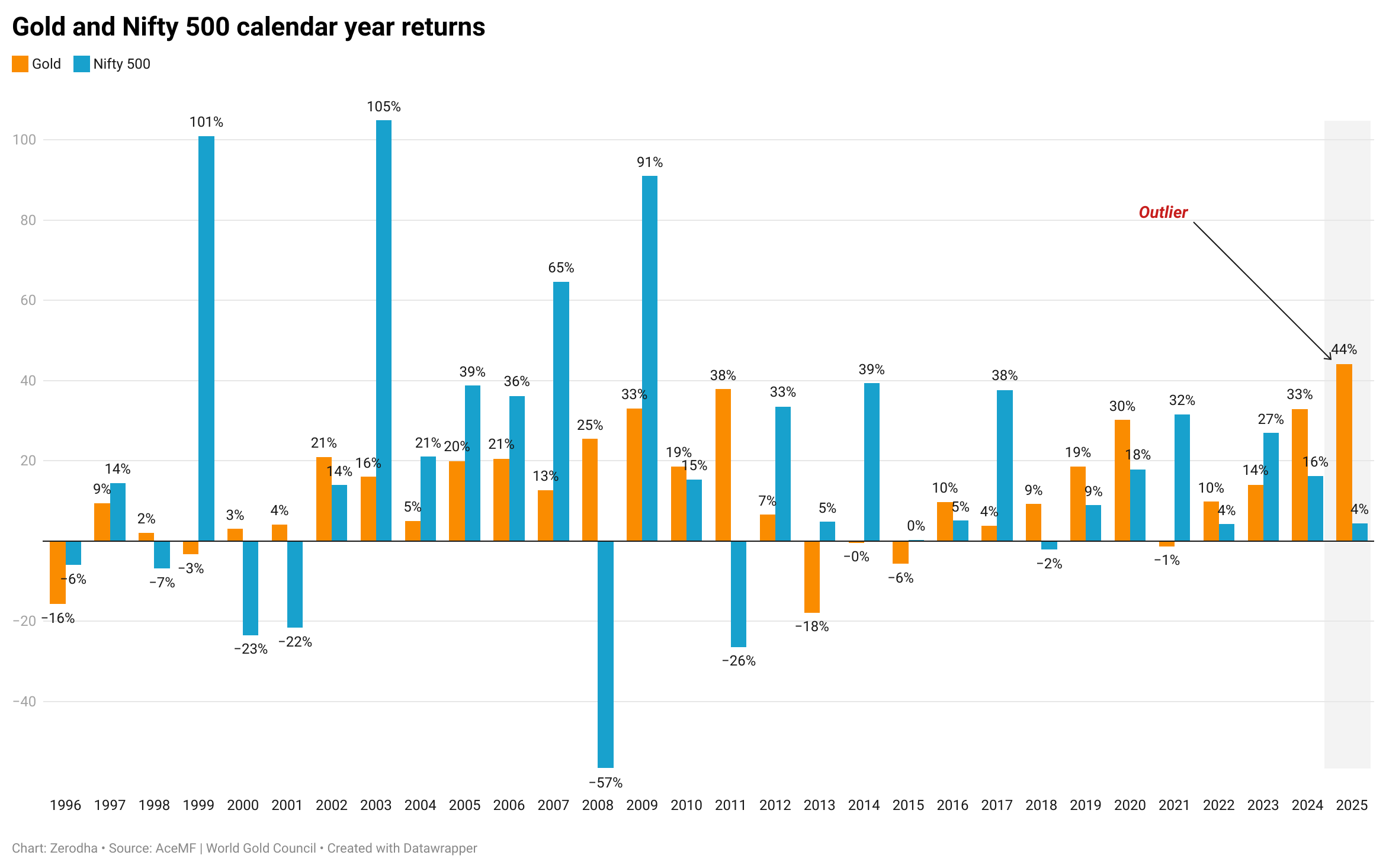

To highlight the contrast between gold and equity performance, Kamath shared a comparative chart of annual returns for gold and the Nifty 500 index spanning 1996 to 2025.

The data reveals that equities have historically offered higher, albeit more volatile, returns. The Nifty 500 surged an extraordinary 101% in 2003, 105% in 2004, and 91% in 2009, underscoring its potential to create wealth when markets are buoyant.

However, it also faced sharp declines of 22% in 2001, 57% in 2008, and 26% in 2011, exposing its cyclical nature.

Gold, in contrast, showed steadier performance with fewer negative years and moderate but consistent returns. It saw major spikes in 2011 (32%), 2020 (27%), and a projected 16% in 2024, serving as a stable store of value during market downturns and crises.

Kamath's chart marked 2020 as an “outlier” year, when both gold and equities performed strongly — gold rising 27% and the Nifty 500 gaining 16%, reflecting the pandemic-induced rush to safety and liquidity.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.