The Securities and Exchange Board of India granted Life Insurance Corp. an additional three years for meet the 10% minimum public shareholding. This is in addition to the previous five-year listing period.

As such, the revised timeline for the life insurer to achieve 10% public shareholding is on or before May 16, 2027, the company said in an exchange filing on Wednesday.

At present, the public shareholding with the life insurer stands at about 3.5%, or 22.13 crore equity shares, according to the data from BSE.

The government currently holds 96.5% stake in the life insurer. The LIC IPO saw central government raise Rs 21,000 crore by offloading a 3.5% stake in May 2022. The state-run insurer was listed on the exchanges on May 17, 2022, at Rs 867.2 apiece on the BSE, a discount of 8.6% to its IPO price.

Additionally, the Union government last year granted a one-time exemption to the state-owned life insurance company for achieving a minimum 25% public shareholding by May 2032, as mandated by regulations of Securities and Exchange Board of India.

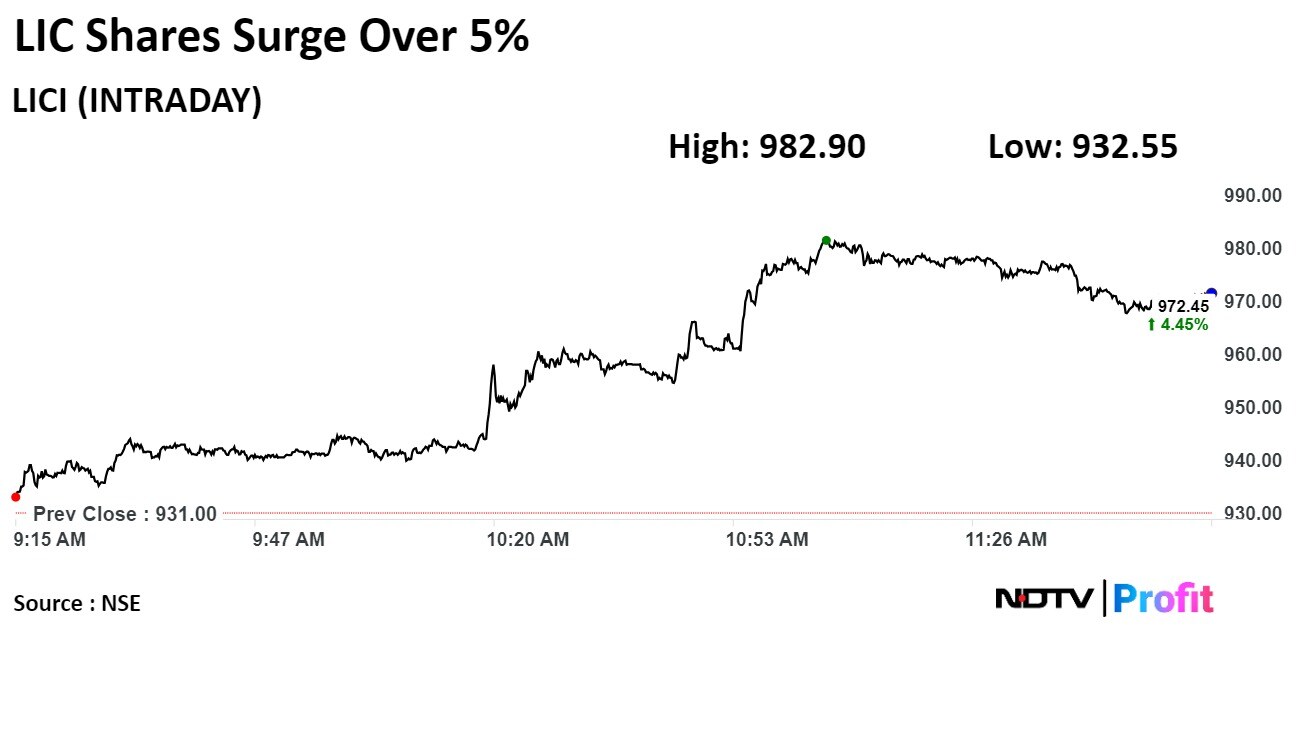

Shares of LIC rose as much as 5.57% during the day to Rs 982.9 apiece on the NSE. It was trading 4.29% higher at Rs 970.95 apiece, compared to a 0.14% decline in the benchmark Nifty 50 as of 11:54 a.m.

The stock has risen 71% in the last 12 months and 16.5% on an year-to-date basis. The total traded volume so far in the day stood at 2.6 times its 30-day average. The relative strength index was at 53.

Fourteen out of the 20 analysts tracking LIC have a 'buy' rating on the stock, four recommend a 'hold' and two suggest a 'sell', according to Bloomberg data. The average of 12-month analyst price targets implies a potential upside of 15%.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.