Tata Capital Ltd. and LG Electronics India Ltd. will begin trading in Mumbai over the next couple of days after they concluded two of the nation's biggest initial public offerings this year, with their debuts set to test the strength of one of the world's hottest equity capital markets.

Tata Group's shadow-lending unit, which raised 155 billion rupees ($1.7 billion) in India's largest IPO this year, will list on Monday, followed by the Indian unit of South Korea's LG Electronics Inc. a day later. LG's sale was the most oversubscribed deal of that size in 17 years.

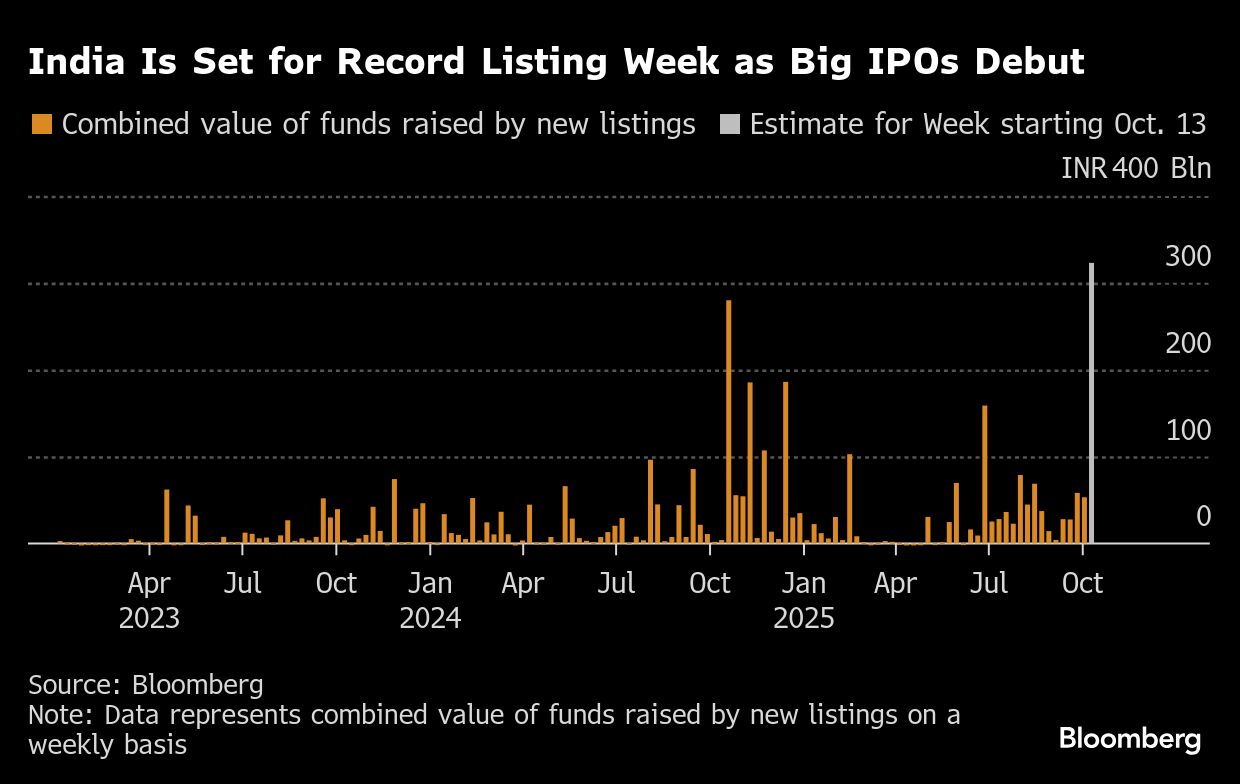

The two listings underscore India's growing status as a global fundraising hub, powered by deep domestic liquidity and an expanding retail investor base. The country has become one of the busiest IPO markets worldwide over the past two years, drawing global investors eager to tap its fast-growing consumer economy. October is shaping up to be India's biggest month ever for IPOs — with proceeds expected to top $5 billion.

Much is riding on these debuts for the companies, but more broadly, they are likely to set the tone for the hundreds of firms waiting to go public in India. The surge in activity in recent weeks is fueling optimism that proceeds from new Indian listings in 2025 could even exceed last year's record haul of almost $21 billion.

“A strong debut of at least one of the big IPOs could set the stage for a fresh wave of jumbo listings in the coming months, as companies rush to capitalize on buoyant investor sentiment and record liquidity,” said Dharmesh Mehta, chief executive at DAM Capital Ltd. “But any signs of weakness could quickly temper the optimism, and may result in delaying the offers.”

Still, the scale of the offerings and the name recognition of the companies — Tata is one of the country's most well-known brands and LG dominates various home-appliance categories in India — doesn't guarantee success as the nation's three largest IPOs since 2020 all fell during their first day of trading. But this year, India's only other billion-dollar offerings both rose, according to data compiled by Bloomberg.

As of Friday in Mumbai, LG Electronics India was trading at about 30% above the IPO price in the gray market, while Tata Capital was slightly higher than the IPO price, according to data from IPOCentral.in.

Based on the IPO prices, Tata Capital and LG India are still undervalued relative to local peers based on measures such as earnings and book value, according to the likes of SBI Securities and Centrum Capital.

The prospect of getting a bargain helped with demand, particularly with LG, which ended up attracting bids that were 54 times the number of shares being offered — second only to Reliance Power Ltd.'s deal in 2008 among billion-dollar IPOs in India, according to exchange data. The sale drew a lineup of marquee names such as sovereign wealth funds from Abu Dhabi, Norway, and Singapore, as well as the likes of BlackRock Inc. and Fidelity International Ltd. as anchor investors.

That's a contrast to earlier this year, when LG suspended its IPO plans and scaled back expectations about how much the deal would raise.

Meanwhile, bids for Tata were double the number of shares being offered, with demand mainly coming from institutional investors. Funds managed by Morgan Stanley, Goldman Sachs Group Inc. and Nomura Holdings Inc. were among its anchor investors.

And based on the IPO price, Tata Capital is poised to rank as India's fourth-largest shadow lender by market value, after Bajaj Finance Ltd., Bajaj Finserv Ltd. and Jio Financial Services Ltd.

The sale went ahead despite recent concerns about non-bank finance companies and over their ability to cope with rising bad loans, overexposure to risky borrowers and an economic slowdown. It also came amid a turbulent time for Tata — a boardroom fight atop the philanthropic body that controls India's oldest conglomerate got so heated that the government stepped in to mediate.

Tata and LG's offerings will push total IPO proceeds in India this year above $15 billion, according to data compiled by Bloomberg. And many more are on the way including two joint ventures of state-run Canara Bank, ICICI Prudential Asset Management Co., Pine Labs Ltd. and Lenskart Solutions Ltd.

IPO momentum

The IPO momentum reflects India's broader effort to modernize its capital markets and attract long-term foreign capital. India's securities market regulator last month tweaked norms to make it easier for very large private firms to go public, while the central bank recently relaxed rules on loans to investors participating in IPOs.

The flood of new listings on the way could push India's IPO market, the world's fourth largest this year, above last year's record, according to the likes of Jefferies Financial Group Inc.

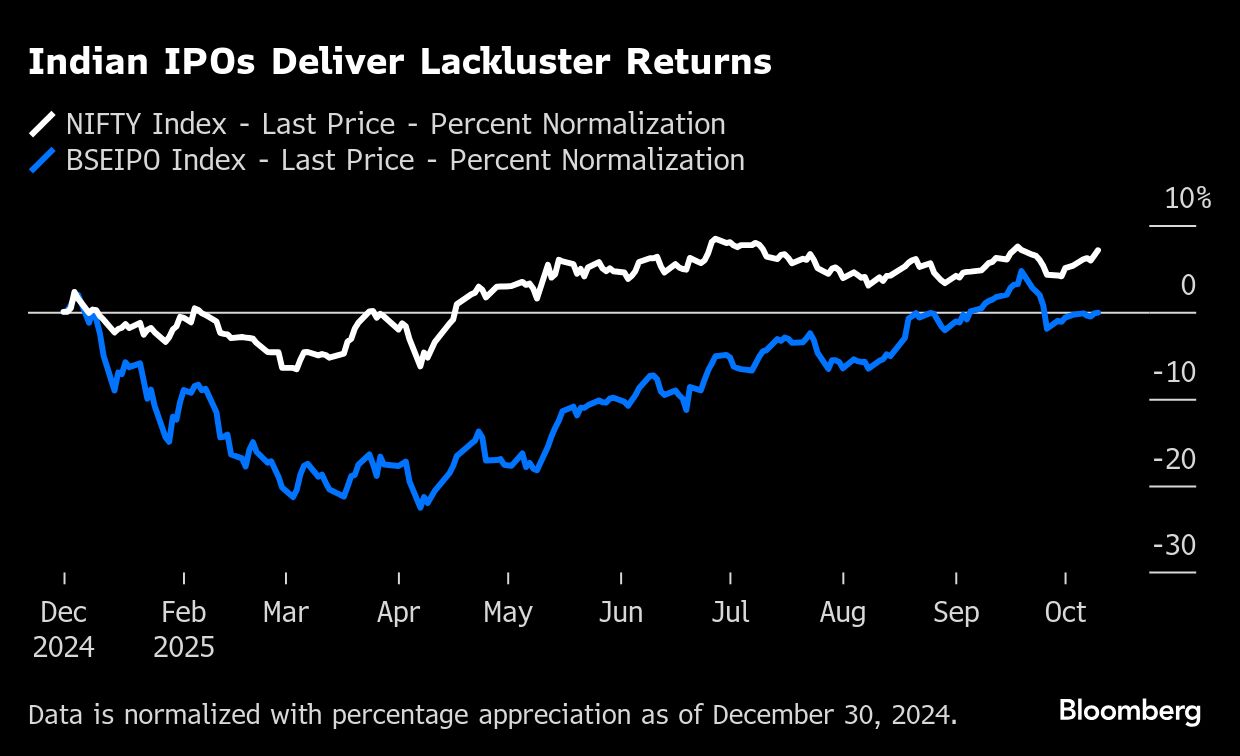

The popularity of IPOs has been a contrast to the broader stock market, where the Nifty 50 has underperformed other regional peers all year, with foreign investors on course to pull out a record amount of money from Indian stocks this year. An index tracking the performance of shares for about a year after listing did even worse, with a 0.2% loss for the year.

“The success of these two marquee offerings will send a strong signal to issuers and investors alike,” said Rajat Rajgarhia, executive director at Motilal Oswal Financial Services Ltd. “India's markets are now deep and liquid enough to absorb large deals like LG and Tata Capital, paving the way for a robust pipeline of big-ticket IPOs in the coming months.”

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.

.jpg?im=FeatureCrop,algorithm=dnn,width=350)