EQT-backed Indira IVF Hospital Ltd. is said to have temporarily withdrawn plans for a market debut over a Bollywood biopic on the company's founder Ajay Murdia.

The company, which was originally looking for a Rs 3,500-crore initial public offering, allegedly ran into trouble with the country's market regulator over the timing of the movie Tumko Meri Kasam's release, according to people aware of the matter.

The movie, which is a fictionalised version of Murdia's life and his chain of clinics, was released on March 21 — just over a month after the company announced that it had confidentially filed for an IPO.

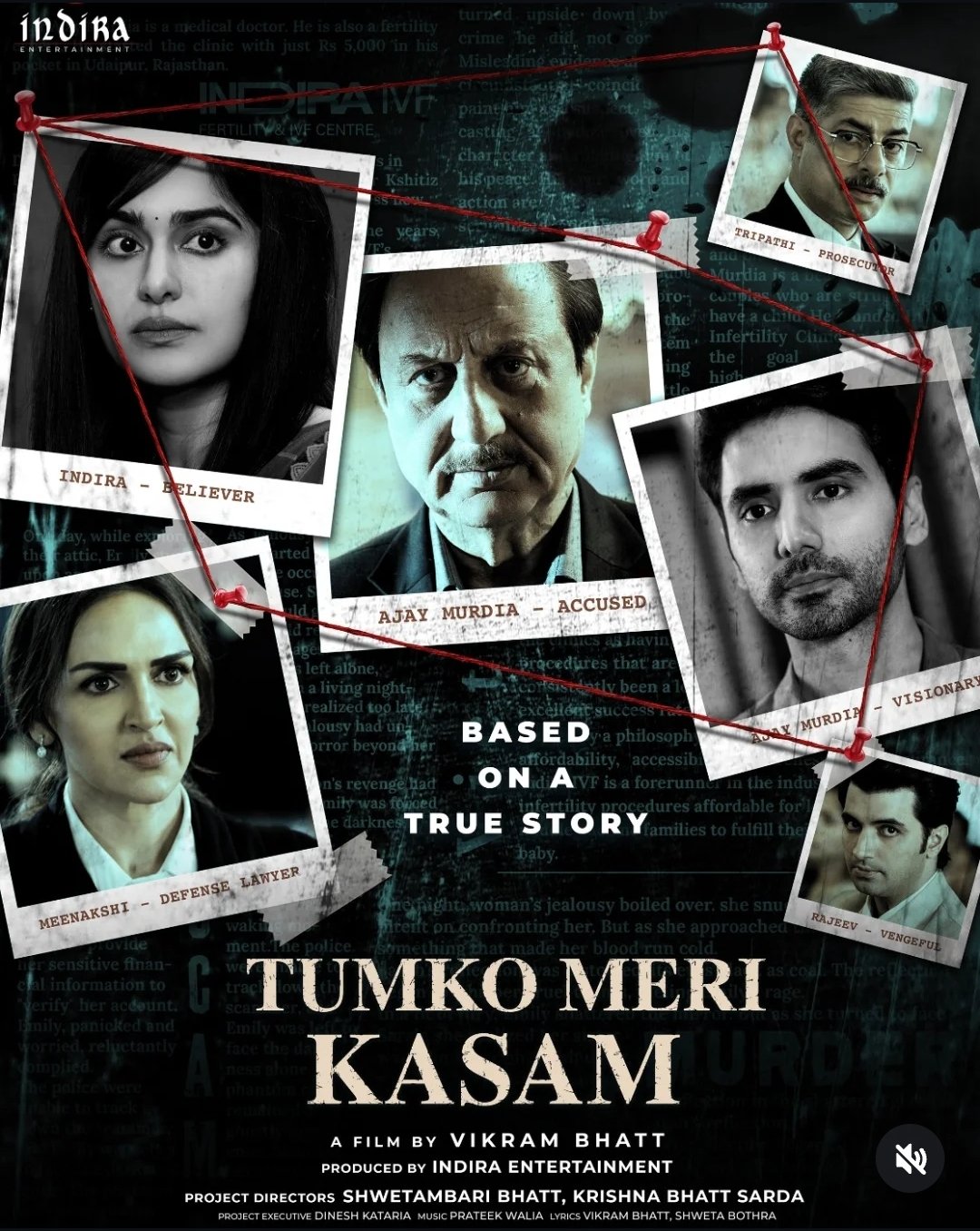

The Vikram Bhatt-directed film stars Anupam Kher, Esha Deol, Adah Sharma and Ishwak Singh in lead roles. It is produced by Indira Entertainment, with Ajay Murdia's sons Nitiz and Kshitiz credited as producers.

Poster of the film Tumko Meri Kasam (Photo source: Vikram Bhatt on Instagram)

The Securities and Exchanges Board of India had taken notice of this, and subsequently raised concerns about Indira IVF indirectly promoting itself at a time when details about the offer were not disclosed to the wider public.

The regulator's lens on the biopic, and how close its release was to the IPO filing, is what is said to have pushed the company to withdraw the offer, the above-mentioned sources said.

"The company had decided to withdraw the pre filed DRHP pursuant to evaluation of various factors and commercial considerations," Indira IVF told NDTV Profit in an emailed statement. It also added that SEBI did not direct it to withdraw the offer.

There is no indication as to when the company might reattempt the offer. The Economic Times was the first to report on this development.

Stockholm-based investment firm EQT had acquired a controlling stake in Indira IVF from Boston-based TA Associates and the company's founders in 2023. While TA Associates exited the business through the deal, the Murdias retained a minority stake and continued leading the company.

"The filing of the pre-filed draft red herring prospectus shall not necessarily mean that the company will undertake the initial public offering," the company had said after filing papers with SEBI.

Indira IVF was among the many companies which have lately opted for the confidential route of filing. Other companies that opted for this route include edtech unicorn Physicswallah Ltd., Swiggy Ltd., Credila Financial Services Ltd. and Vishal Mega Mart Ltd.

Confidential IPO is an optional mechanism where companies opting for this file their IPO confidentially. SEBI enabled this in December 2022, and Tata Play Ltd. became the first company to make use of this.

Under this route, a company files its DRHP, but the document is not made public immediately. It is released only when the company decides to go live with its IPO. A confidential filing allows a company to protect what it believes to be sensitive data from its competitors.

NDTV Profit has reached out to SEBI for comments on the story.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.