Indian Stock Valuations Now Normal But Not Yet Cheap, Says Pankaj Murarka

Valuations in India's stock market have normalised andare now in line with long-term averages but that does not mean they are cheap, according to Pankaj Murarka, chief investment officer at Renaissance Investment Managers.

"After a year of consolidation, valuations have normalised at 29 times one-year forward earnings. India is no longer as expensive as it was a year ago. Valuations are now in line with long-term averages," Murarka told NDTV Profit in a televised interview.

"Valuations are reasonable, but not cheap or too attractive," he added. The fund manager also asserted the point that India remains a long-term growth story and foreign funds will eventually return.

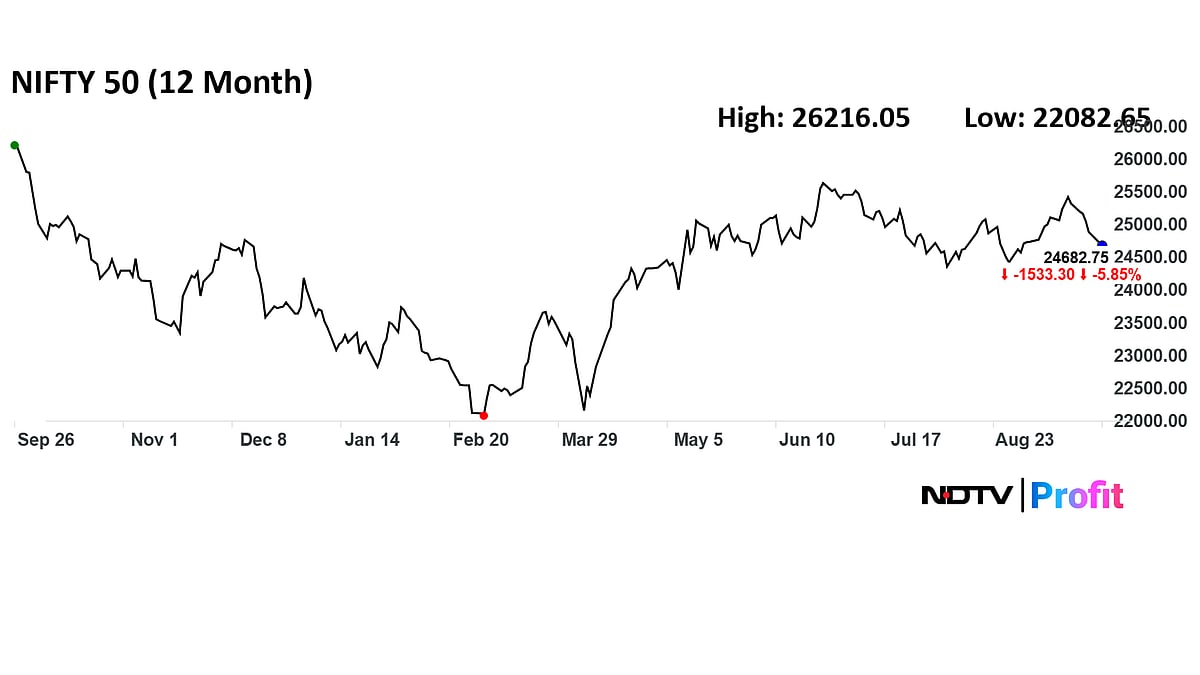

Indian stocks are still below their life highs reached at the end of September 2024. The benchmark Nifty 50 and BSE Sensex have declined around 6% in the last 12 months. Besides, India has been the worst-performing equity market in Asia, primarily due to a pullout of foreign capital.

Murarka said the worst of earnings slowdown in India Inc has passed. "We are in the second consecutive season of single digit earnings growth. We will gradually see earnings momentum from hereon. The worst of earnings slowdown is behind us," he said.

Moreover, the fund manager suggested that investors should exercise caution regarding the Midcap and Smallcap indices as some pockets of stretched valuations persist.

Pankaj Murarka said that the consumer sector has underperformed over the last six years, but he is now seeing a recovery in both staples and discretionary consumer segments. He projects that growth will be higher in the discretionary segment compared to staples.

Overall, he believes there is a "very strong tailwind for the consumer sectors" anticipating the upcoming budget will also provide a boost to consumption. Murarka said a sustainable recovery in consumption lasting for the next three years is possible on the back of income and GST tax cuts and easy liquidity.

Watch the full interview here: