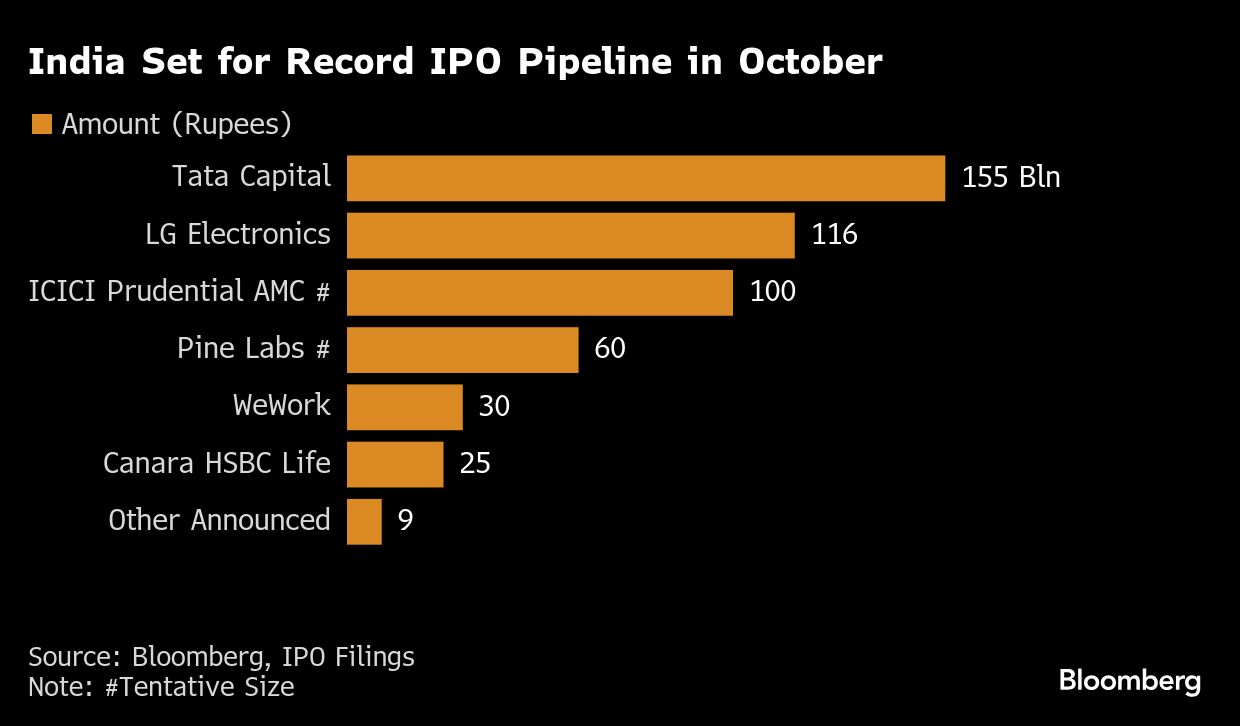

India's bustling market for new equity listings is entering a crucial period, with proceeds from initial public offerings in October expected to cross a record $5 billion.

Two billion-dollar-plus IPOs, including the year's biggest, will start taking orders from the public in the coming week. The offers by Tata Capital Ltd. and LG Electronics Inc.'s Indian arm are set to test investor appetite in one of the world's busiest IPO venues of 2025, which has seen the pace of share sales accelerate despite global tariff shocks and geopolitical tensions.

The IPO rush in India has been powered by corporates seeking funds to expand operations in the world's fastest-growing major economy. Demand has been fueled by a strong pool of domestic capital as well as millions of retail investors encouraged by an unprecedented nine-year rally in the nation's benchmark stock index.

“There is now ample capacity to absorb supply,” said Raghuram K, a partner at Uniqus Consultech, a consulting firm that prepares companies for IPOs. He was pointing to the growing influence of domestic institutions such as mutual funds and insurance firms in India's market.

Mutual funds are awash with money flowing in through monthly investment plans set up by retail investors, giving them the confidence to keep deploying capital, he added.

Big-IPO Curse

For investors, the $1.7 billlion Tata Capital deal is a chance to own shares in the financial services unit of one of India's largest and most-reputed conglomerates — the Tata Group. It is set to be the biggest IPO since Hyundai Motor India Ltd.'s record $3.3 billion offering last year.

The IPO attracted funds managed by Morgan Stanley, Goldman Sachs Group Inc., White Oak Capital Partners, Marshall Wace and local mutual funds as anchor investors, according to an exchange filing.

LG Electrnonics India Ltd. gives investors exposure to the booming consumption theme in the world's most-populous nation.

Companies have been able to raise money even as India's $5.1 trillion stock market has lost momentum in 2025, weighed down by concerns over a slowdown in earnings growth as well as US-India tension. The benchmark NSE Nifty 50 Index is up just 5% this year — a sharp, and rare underperformance versus a broader gauge of Asian equities that has climbed about 23%.

With 2025 proceeds at $11.2 billion as the third quarter ended, India ranked as the world's fourth-busiest IPO market this year based on fundraising volume, according to data compiled by Bloomberg. That adds to last year's record tally of $21 billion.

JPMorgan Chase& Co., JM Financial Ltd. and Kotak Mahindra Capital Co. are among those who have predicted the boom to continue, with regulatory changes also adding to the optimism. India's securities market regulator last month tweaked norms to make it easier for very large private firms to go public, while the central bank last week relaxed rules on loans to investors participating in IPOs.

Investor response to the Tata Capital and LG offerings will help set the tone for a slew of other deals this month. Tata will take orders from the broader public from Oct. 6 to Oct. 8, with trading to start on Oct. 13.

LG Electronics India's IPO will open for public subscriptions from Oct. 7 and close Oct. 9, with shares to be listed on Oct. 14.

For the two companies, history is not on their side when it comes to debut performance, given that large Indian listings have in the past shown a tendency to disappoint investors on their listing day.

Shares of Hyundai Motor sank more than 7% on their first day of trading last October. Prior to that, the debut by state-run Life Insurance Corp. of India in May 2022, whose IPO was the nation's biggest ever until Hyundai's, saw its stock tumble almost 8% on the first day. Before that, One 97 Communications Ltd., the operator of digital-payments provider Paytm, plunged over 25% on its debut in late 2021 after raising about $2.5 billion.

“Tata and LG are both big brands and they should attract investor interest” unless there is a negative global event in the next few days, said Varsha Valecha, senior vice president of investments at portfolio management firm Chanakya Capital in Mumbai.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.