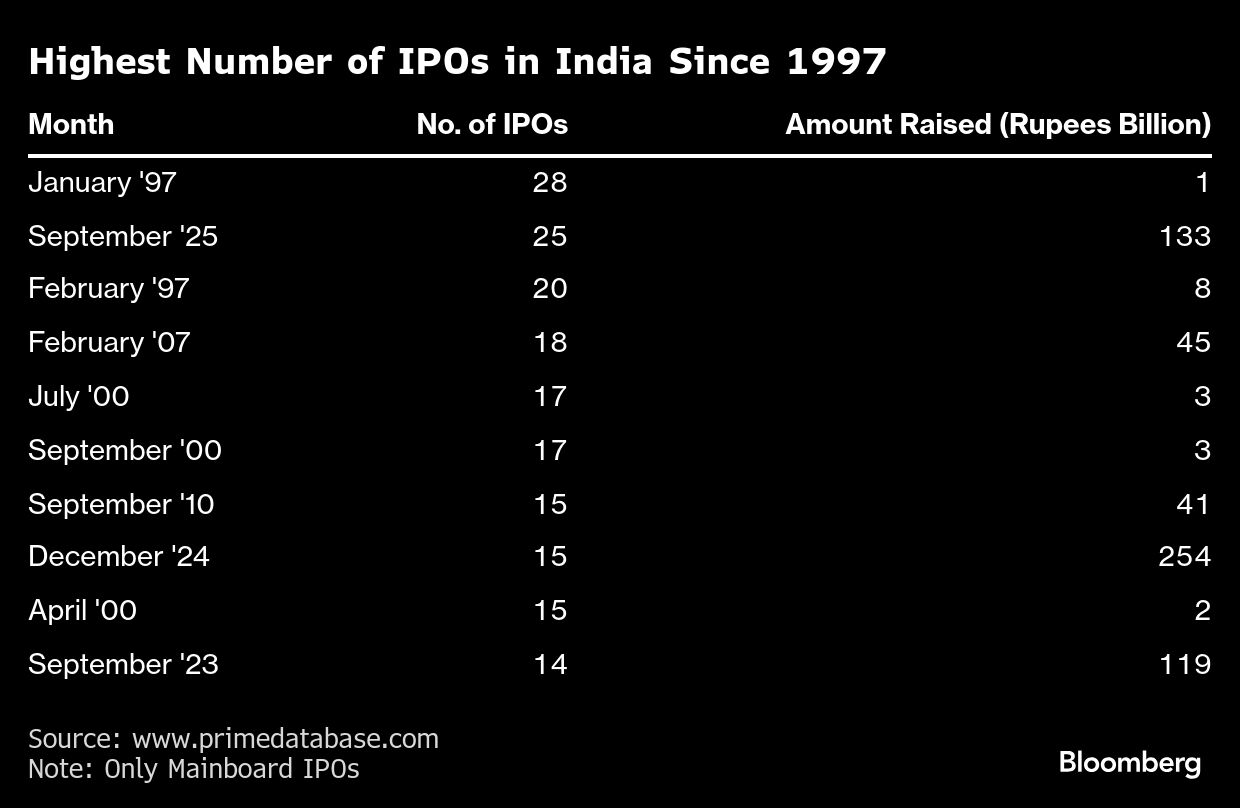

India could see 25 companies launch their IPOs in September on the nation's main exchange board, making it the busiest month for such kind of deals in nearly three decades.

More precisely, it would be the highest since there were 28 in January 1997, according to primedatabase.com. Of the ones this month, 15 companies have collectively raised nearly $1 billion, while the remaining 10 are are expected to raise an a total of about $500 million, according to India's National Stock Exchange.

It's an annual ritual for Indian firms to try to cram in their IPOs by the end of September because dragging their deals into October would force them to audit an extra set of earnings, then update them into their draft prospectuses. But this year's batch of last-minute entries is unusually high thanks to a confluence of tailwinds, according to Dharmesh Mehta, CEO at DAM Capital.

Mehta cited robust business prospects, buoyant equity capital markets, attractive valuations and ample domestic liquidity for driving so many firms to try to go public.

He also pointed to the increase of foreign investors participating in local stock offerings. Foreign institutional investors have bought almost 429 billion rupees ($4.8 billion) of stock via IPOs or placements this year. By contrast, they were net sellers equivalent to 1.8 trillion rupees in the broader stock market, according to the National Securities Depository.

That doesn't mean that there won't be any IPOs launching from next month. In fact, there are about 75 companies that have secured regulatory approval — including Tata Capital and LG Electronics India — but have yet to launch.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.