- Gallard Steel IPO oversubscribed 349.40 times, led by NIIs and RIIs demand

- IPO allotment to be finalised Monday; shares list on BSE SME Nov 26

- IPO proceeds will fund facility expansion, repay borrowings, and corporate needs

The allotment for the Gallard Steel IPO will be finalised on Monday, and the company's shares will list on the BSE SME on Wednesday, November 26.

The initial public offering of Gallard Steel received an overwhelming response from the investors as the SME issue was oversubscribed 349.40 times on the last day of bidding on Friday. According to BSE data, NIIs and RIIs led the demand, subscribing 463.85 and 351.58 times, respectively. The QIB portion was oversubscribed 228.48 times.

Investors can check the Gallard Steel SME IPO allotment status on the official websites of BSE and Ankit Consultancy, the registrar for the issue, by following the step-by-step guide provided below.

Gallard Steel IPO is a book-building issue of Rs 37.50 crores. The issue is entirely a fresh issue of 0.25 crore shares of Rs 37.50 crore. The price band for the SME IPO is set at Rs 142.00 to Rs 150.00 per share. Seren Capital Pvt. Ltd is the book-running lead manager and Ankit Consultancy Pvt. Ltd is the registrar of the issue. The Market Maker of the company is Asnani Stock Broker Pvt.Ltd..

How To Check Gallard Steel IPO Allotment Status On BSE Website

Go to the official BSE website at https://www.bseindia.com/investors/appli_check.aspx.

Select the issue type as 'Equity.'

Choose "Gallard Steel Limited" from the dropdown menu.

Enter your application number or PAN (Permanent Account Number).

Complete the 'Captcha' for verification.

Click on the 'Search' button to view your allotment status.

Direct Link To Check Gallard Steel IPO Allotment Status

Investors who bid for the SME IPO can verify their share allotment status by visiting this direct link - https://www.ankitonline.com/PublicIssue/FrmPublicIssue.aspx.

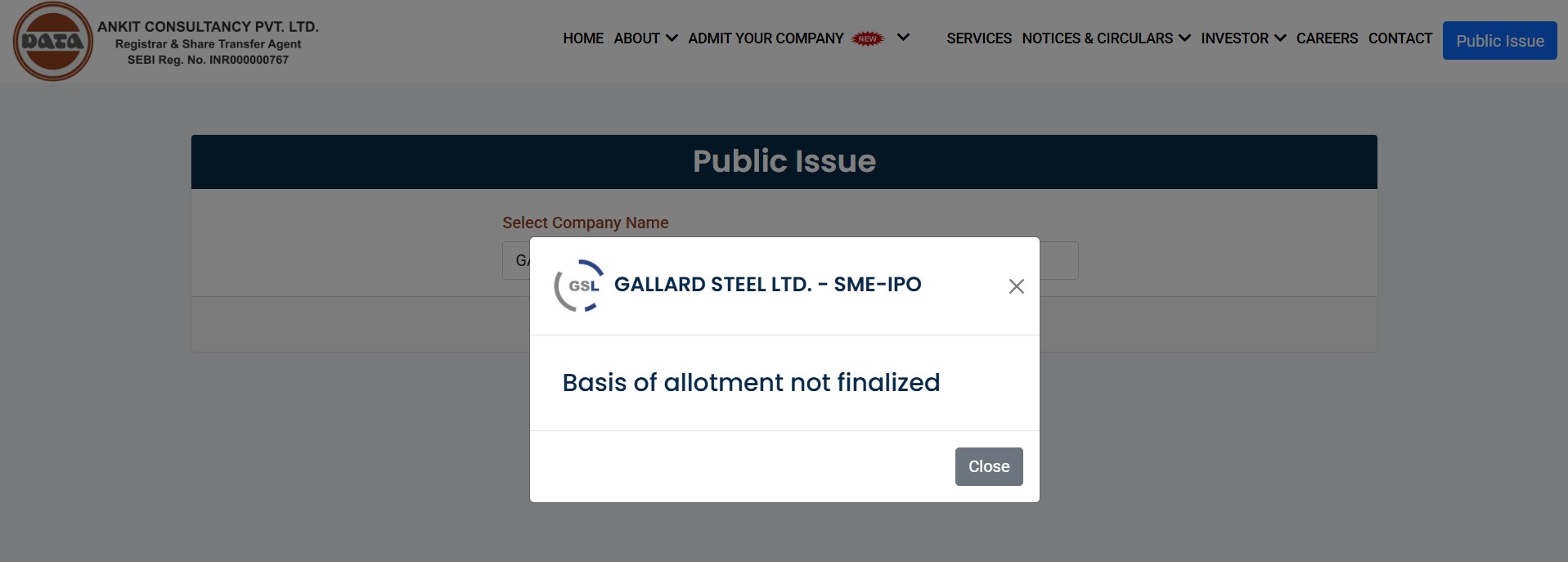

How To Check Gallard Steel IPO Allotment Status On Ankit Consultancy

Visit the Ankit Conultancy website at - https://www.ankitonline.com.

Click on the 'Public Issue' button displayed on the top-right corner of the screen.

Select the company name "Gallard Steel Limited" from the drop-down list and click on 'Go'. (the details will be displayed only once the allotment status is finalised)

Choose your preferred search method – Application Number, DP/Client ID, PAN, or Account/IFSC.

Enter the relevant details as per your selection.

Click Submit to view your allotment status.

image:ankitonline.com

Gallard Steel IPO: Listing Date

Shares of Gallard Steel Ltd. are expected to be listed on BSE SME on Wednesday, November 26. The company will initiate refunds and share transfers to demat accounts on November 25.

Gallard Steel IPO - Use Of Proceeds

Gallard Steel will utilise the proceeds from the fresh issue for various purposes. It will use the majority of the proceeds to fund capital expenditure towards the expansion of the existing manufacturing facility and construction of an office building. The remaining portion will be used for repayment of a portion of certain borrowings availed by the company and for other general corporate purposes.

About Gallard Steel

Incorporated in 2015, Gallard Steel Limited is engaged in the manufacturing of S.G. (Ductile) Iron and Grey Cast Iron Castings and special alloy Castings and components primarily for the automobile sector.

The company focuses on high-precision, long-life components, such as traction motor components, bogie assembly parts, and turbine parts. Gallard Steel manufactures its products at its facility in Pithampur, Madhya Pradesh

The company supplies components for railway traction motors, defence cradles, power generation guide vanes, and industrial machinery liners, serving sectors such as railways, defence, power generation, and heavy engineering industries.

Mr Zakiuddin Sujauddin serves as the Managing Director and plays a key role in developing the operational structure and strategic direction of the company.

Recent financial data shows that profit rose to Rs 6 crore in fiscal 2025 from Rs 3.2 crore the previous year, while revenue doubled to Rs 53.3 crore from Rs 26.8 crore. For the second quarter, the firm posted a profit of Rs 4.3 crore on revenue of Rs 31.6 crore.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.