Turmoil In Venezuela Sends A Jolt Through Oil Market's Outlands

Here are three major moves since the US captured Nicolas Maduro at the weekend and launched a reshaping of the country’s petroleum industry.

While benchmark oil futures have largely shrugged off Nicolas Maduro's downfall, the former Venezuelan leader’s ouster has reverberated through some of the less well-known corners of the market.

West Texas Intermediate futures, the US benchmark, are down about 1% on the week, a limited move that reflects the South American nation’s steadily declining output over the last decade, rather than its status as the holder of a vast amount of oil reserves.

Beyond that, though, here are three major moves since the US captured Maduro at the weekend and launched a reshaping of the country’s petroleum industry.

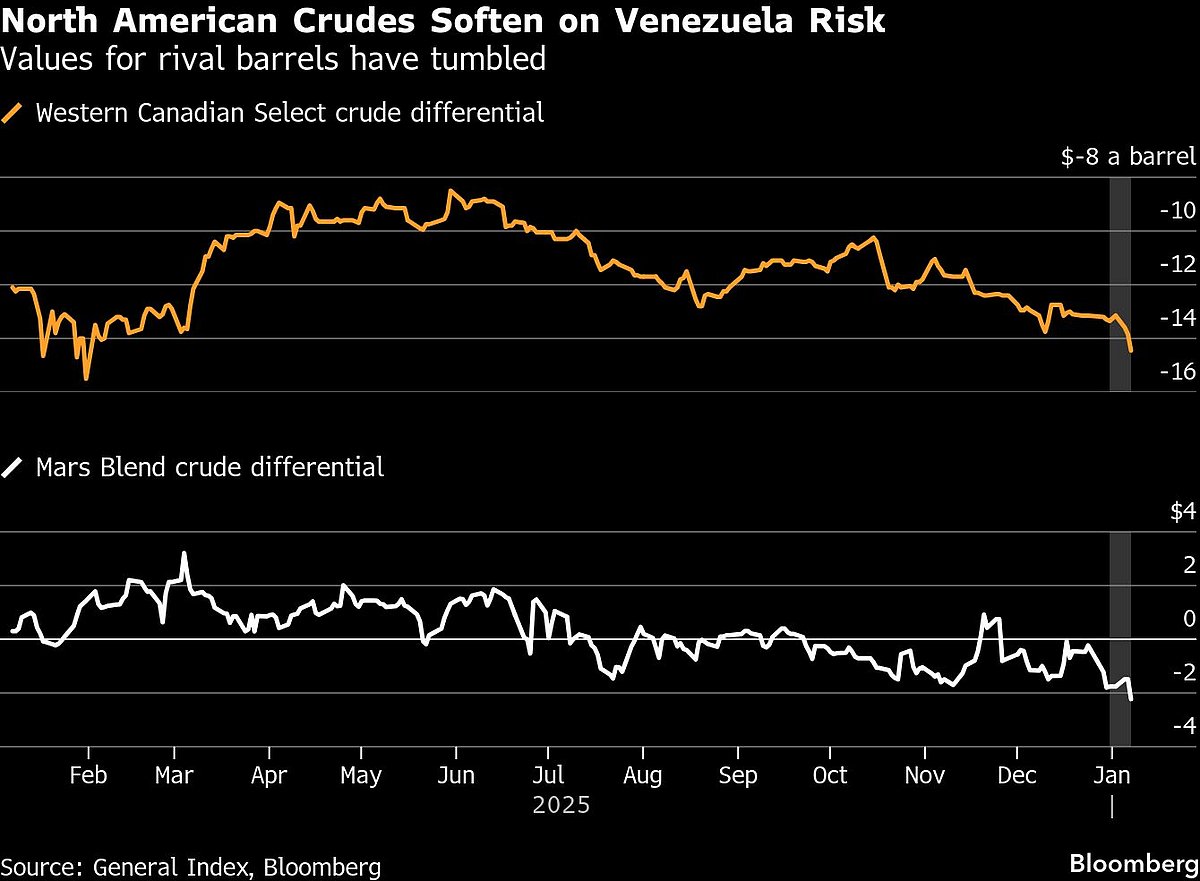

1: Sour Crude

Sour crudes in North America have fallen on expectations that more Venezuelan supplies will head to the US Gulf Coast. Canadian crude’s discount to WTI is the largest since last January. Mars Blend, a sulfurous grade pumped in the Gulf, is the weakest since September 2024. Those barrels will face increased competition if bigger volumes do arrive from the South American country.

“The prospect of a sale of 30-50 million barrels of Venezuelan crude is a near-term headwind to pricing,” RBC Capital Markets LLC analysts including Brian Leisen and Helima Croft said.

Still, with US refiners running lighter barrels than usual recently, it’s possible they will return to buying more heavy supplies, which could limit any further price losses, they added. Physical prices for lighter, sweeter crudes on the Gulf Coast have fared better in recent days, in part as shipping costs fall.

2: High-Sulfur Fuel Oil

A left-over from the refining process, high-sulfur fuel oil is used to power ships and as a feedstock for electricity generation. In recent days, the East-West spread for this product — the difference in prices between Rotterdam and Singapore — has blown out, hitting the widest since May. That’s likely in response to the prospect of Venezuelan barrels being redirected to western markets and away from Asian customers like China.

“In Rotterdam, HSFO has become relatively cheaper than Brent, while in Singapore it has become relatively more expensive,” said Arne Lohmann Rasmussen, chief analyst at A/S Global Risk Management. “This simply reflects that now the oil is ‘American.’”

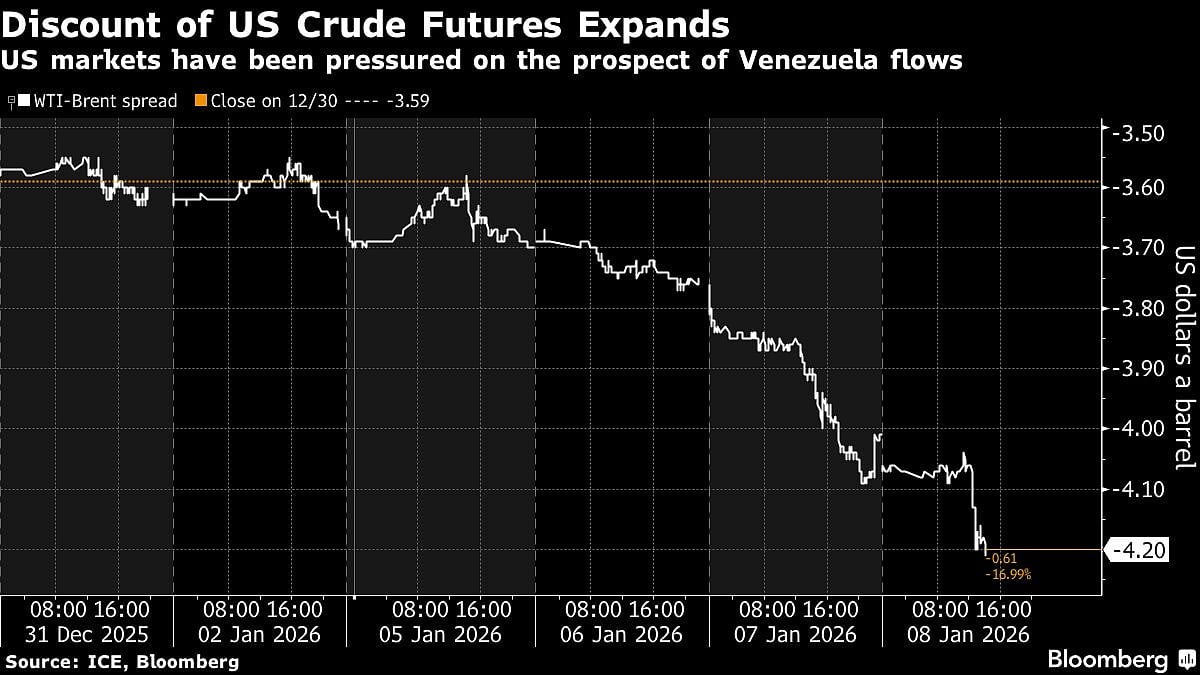

3: Discounts for US Futures Grow

In addition, US crude futures have been consistently more pressured than other parts of the oil market since Maduro’s capture. WTI’s nearest time spread — a gauge of market health — softened to the weakest since November on Wednesday. WTI’s discount to Brent has also expanded over recent sessions.