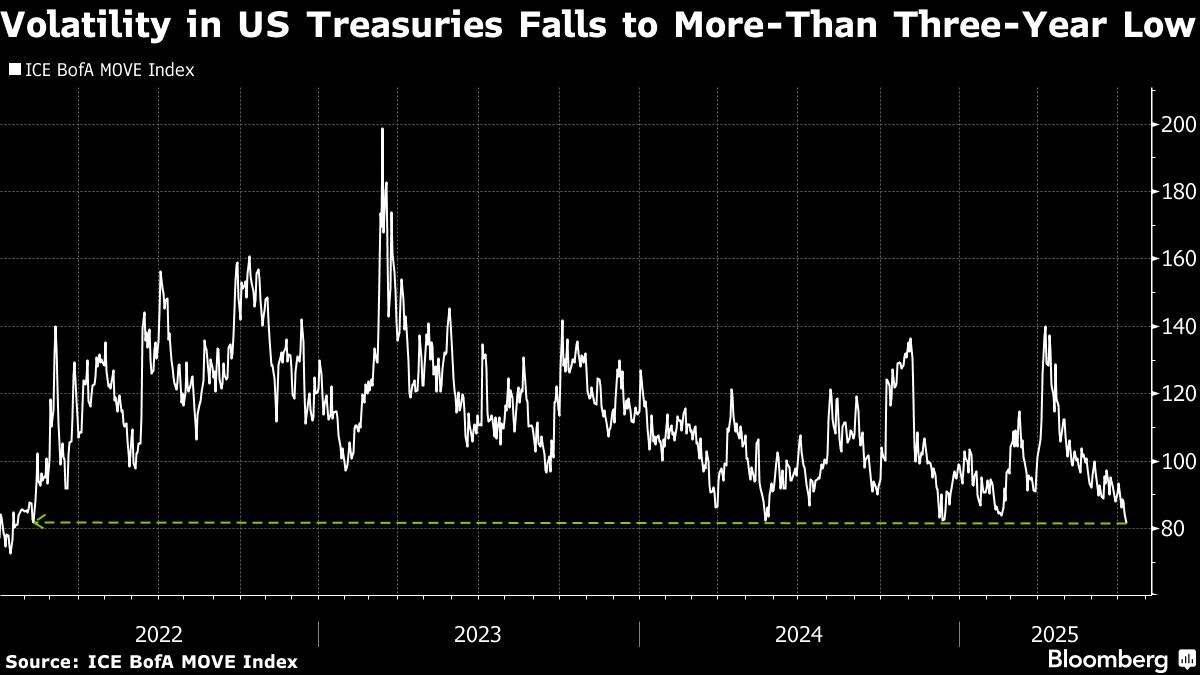

A gauge of volatility in US Treasuries fell to its lowest level in nearly three-and-a-half years, adding to evidence the market is stabilizing after months of turmoil.

The ICE BofA MOVE Index, a measure of expected fluctuations in yields, closed at its lowest level since early 2022 on Thursday. In another sign of optimism, auctions this week for US 10-year and 30-year government bonds received ample demand.

Government bonds have seen bouts of volatility this year in response to President Donald Trump's tariff threats and concerns over increased fiscal spending. Those headwinds haven't entirely gone away though, and 10-year yields rose on Friday, putting the bonds on track to fall for a second consecutive week.

Thursday's auction of 30-year Treasuries was “well received, easing some concern,” Mohit Kumar, the chief European strategist at Jefferies International, wrote in a note. He added that he's still “staying away from the long end” in the US, Europe and the UK given fiscal concerns.

Later on Friday, the US government will release its budget balance for June, and send out its primary dealer questionnaire to companies. Investors will be looking for “clues” in the latter that the Treasury could be considering shifts in its debt management strategy, a team of strategists at JP Morgan Chase & Co. led by Jay Barry said.

European government bonds are following Treasuries lower after they started the day fairly steady. In the UK, gilts showed little reaction to the economy's surprise contraction in May, as GDP figures illustrated how tariffs had weighed on production activity. Meanwhile, French 30-year yields rose to the highest since 2011.

Concerns about the inflationary impacts of President Donald Trump's threatened tariff hikes may also weigh on Treasuries today, even after Federal Reserve rate-setter Mary Daly reiterated on Thursday that she expects to see two interest rate cuts this year. Chicago Fed President Austan Goolsbee is due to speak later.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.