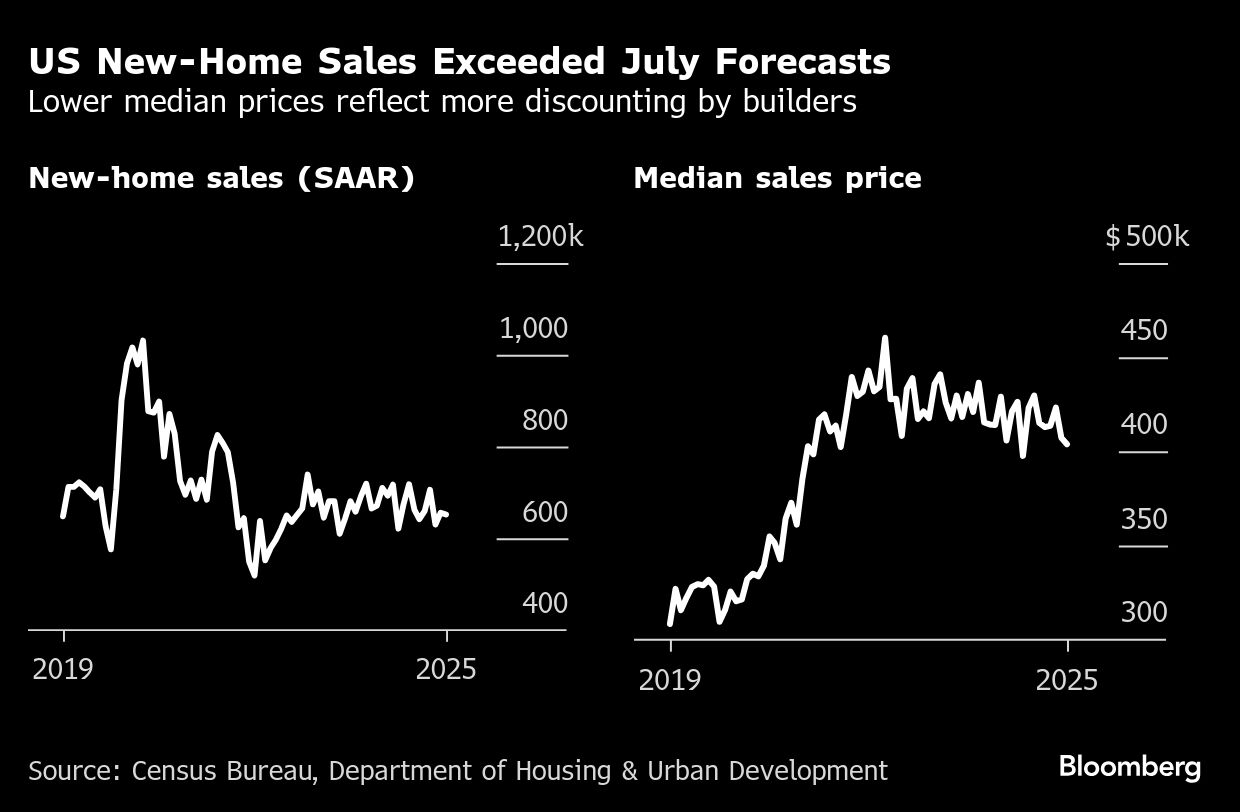

Sales of new US homes exceeded forecasts in July after an upward revision to the prior month, as prices eased and heavy incentives enticed more buyers off the fence.

Contract signings on new single-family homes ticked down to a 652,000 annualized rate, with the strongest demand in the West, according to a government report issued Monday. The median estimate in a Bloomberg survey of economists was a 630,000 pace.

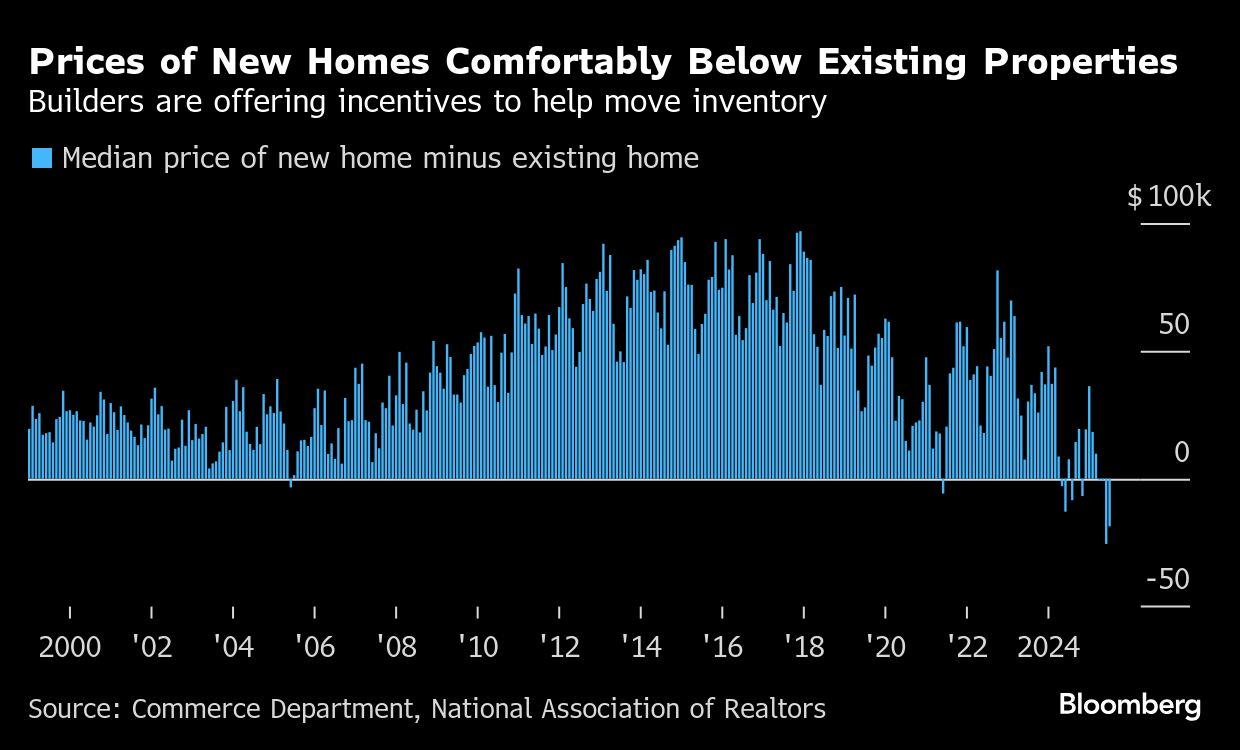

While sales topped projections, the new-home market has grown dependent on price cuts and incentives to entice customers amid high mortgage rates. The share of builders who reported using sales incentives reached a post-pandemic high of 66% this month as they seek to unload an inventory of completed homes at the highest level since 2009.

That glut will continue to give builders reason to hold back on future groundbreaking, said Stephen Stanley, chief economist at Santander Capital Markets.

“The slowdown in construction activity is starting to help at the margin, as the number of new homes for sale that are under construction dropped,” Stanley said in a note. “So, this is hopeful but until it translates to a drop in the number of completed new homes for sale, builders are still likely to regard cutting construction as an urgent priority.”

What Bloomberg Economics Says...

“Home builders are bloated with inventories, a growing share of which are completed units. We expect inventories and elevated mortgage rates to weigh on housing-market activity and home prices in the months ahead.”— Stuart Paul. To read the full note, click here

Entry-level builder DR Horton Inc. reported on its latest earnings call that it was offering heavy subsidies to bring down some customers' mortgage rates to 3.99% as more buyers opt for loans backed by the Federal Housing Administration, which often accepts customers with lower credit scores.

More generally, overall housing demand may start to stabilize as potential homebuyers find a little more relief on financing costs. Mortgage rates in the week ended Aug. 15 were near the lowest level since April.

The government's report showed the median sales price of a new home decreased nearly 6% in July from a year earlier to $403,800, the lowest for July since 2021. Prices have fallen on an annual basis every month this year except one.

For a fourth straight month, the median selling price of a new home was less than that of an existing property.

Even with lower prices, it's still taking some time for builders to clear through inventory. The supply of new homes for sale, including those not yet started or under construction, decreased slightly to 499,000 units, still near the highest since 2007.

By region, sales in the West increased 11.7%, while they dropped in the South and Midwest.

New-home sales are seen as a more timely measurement than purchases of existing homes, which are calculated when contracts close. However, the data are volatile on a monthly basis. The government report showed 90% confidence that the change in new-home sales ranged from a 16.1% decline to a 14.9% gain.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.