- US jobless claims rose by 44,000 to 236,000 in the week ended Dec. 6, the largest increase since March 2020

- The four-week average of claims increased slightly to 216,750, indicating steady new jobless claims

- Layoffs rose in recent months, with October nationwide layoffs highest since early 2023

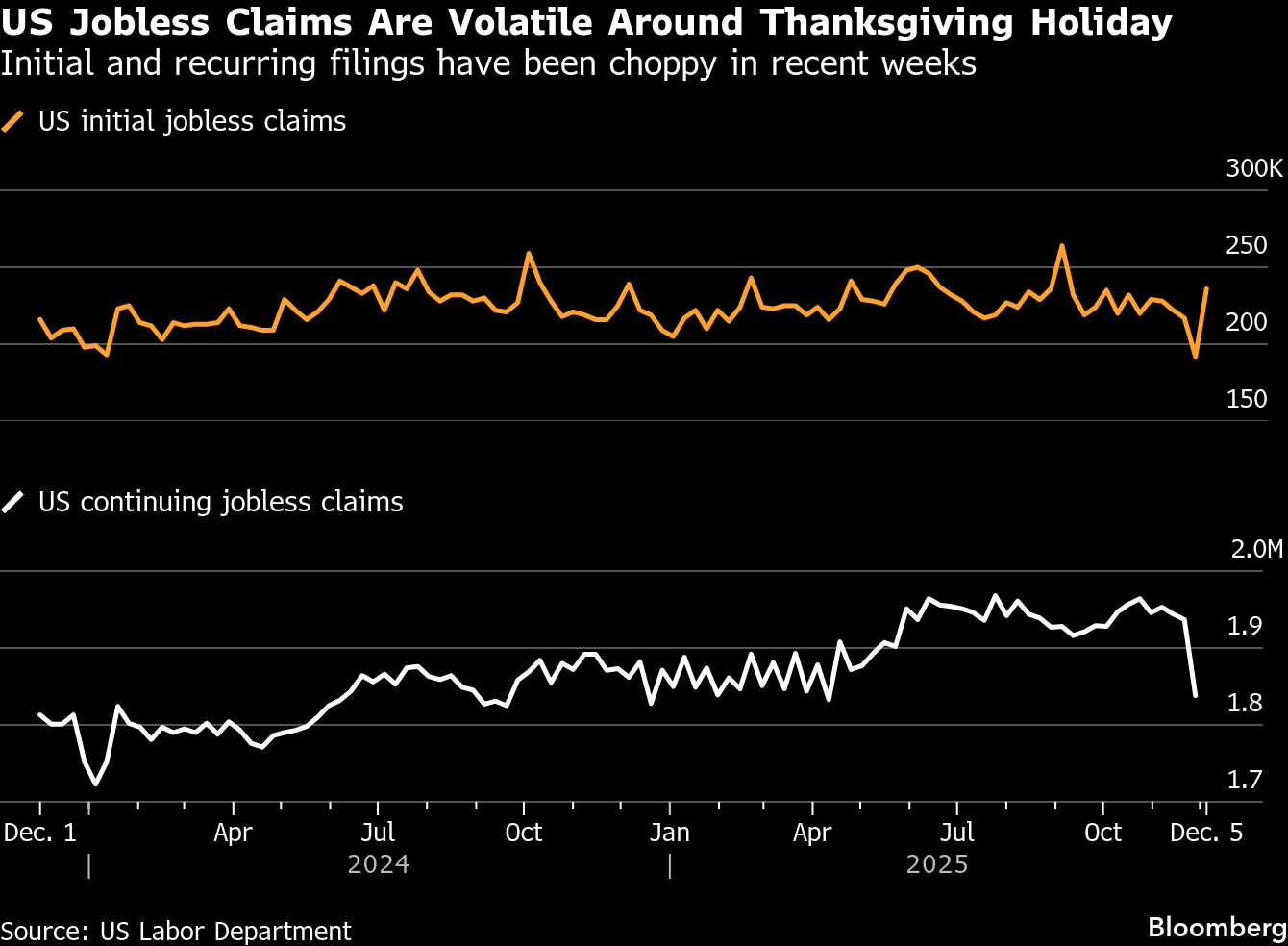

Applications for US unemployment benefits rose last week by the most since the onset of the pandemic, underscoring the volatile nature of claims at this time of year.

Initial claims increased by 44,000 to 236,000 in the week ended Dec. 6, according to Labor Department data released Thursday. That was the biggest jump since March 2020 and followed the lowest level of applications in more than three years in the previous week, which included Thanksgiving. The figure exceeded all but one estimate in a Bloomberg survey of economists.

Weekly initial claims tend to be choppy around the holidays and will likely continue to fluctuate through the end of the year, but Thursday's figures are toward the higher end of readings seen in 2025. Companies like PepsiCo Inc. and HP Inc. have laid out plans to reduce headcount in recent weeks, and nationwide layoffs in October were the highest since early 2023.

Pantheon Macroeconomics said the jump in claims suggests layoffs are picking up. Others like High Frequency Economics disagreed, noting that the claims figure is still quite low over a longer period of time. Either way, it's too hard to make a real judgment about the labor market from these numbers alone given the seasonal noise.

“Don't read too much into the jump in jobless claims,” Heather Long, chief economist at Navy Federal Credit Union, said in a note. “Smoothing it out, this still looks like an economy averaging 215,000 to 220,000 new jobless claims a week. That's not a cause for concern.”

The four-week moving average of new applications, which helps defuse the volatility, landed in that range. It ticked up to 216,750 last week.

What Bloomberg Economics Says...

“Addressing media after the Dec. 10 FOMC decision, Fed Chair Jerome Powell said rates of job creation and job finding are “extremely low” and payrolls are running at a negative monthly pace — a dynamic that should keep continuing claims elevated.”— Eliza Winger.

Federal Reserve officials lowered interest rates for a third straight meeting Wednesday to support what Chair Jerome Powell called a “gradually cooling” labor market. While officials didn't project higher unemployment next year compared to their September forecasts, Powell said the job market faces “significant” downside risks.

Before adjusting for seasonal factors, initial claims surged last week by nearly 115,000, also the most since March 2020. That was led by populous states like California, Illinois, New York and Texas.

Concerns about the labor market have weighed on consumer sentiment in recent months. A majority of respondents in a preliminary December survey by the University of Michigan expect unemployment to rise in the coming year.

Continuing claims, a proxy for the number of people receiving benefits that are reported on a one-week lag compared to initial claims, were similarly volatile. Those dropped to 1.84 million in the Thanksgiving week, marking the biggest decline in four years.

A separate report Thursday showed the US trade deficit unexpectedly narrowed in September to the smallest since mid-2020 as exports surged.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.