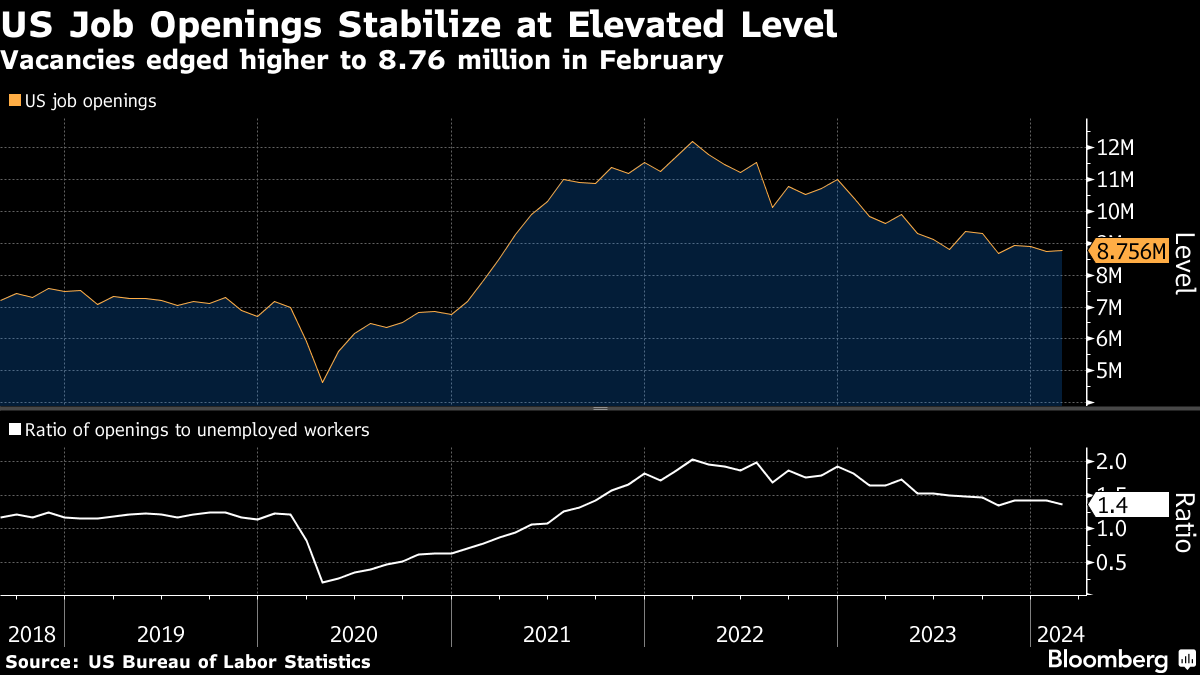

(Bloomberg) -- US job openings were little changed in February from the prior month, suggesting labor demand is stabilizing at an elevated level.

The number of available positions edged up to 8.76 million, mainly reflecting a pickup in finance and state and local government, from a downwardly revised 8.75 million in January. The report Tuesday from the Bureau of Labor Statistics Job Openings and Labor Turnover Survey also showed an increase in hiring.

The Federal Reserve has been looking for softer labor-market conditions ideally through fewer job openings rather than outright job losses. As long as vacancies stay elevated, wages will likely continue to grow, which could risk stubborn inflation as well.

Fed Chair Jerome Powell reiterated last week that the central bank is in no rush to cut interest rates, and that policymakers would like to see more evidence that inflation is sustainably retreating before doing so.

At the same time, there are some signs that the labor market is softening. Openings fell in information, health care and retail trade. Also, layoffs rose to an almost one-year high on a pickup in dismissals within leisure and hospitality, the JOLTS report showed.

The so-called quits rate, which measures voluntary job-leavers as a share of total employment, held at 2.2% — the lowest since 2020. The moderation in quits suggests Americans are feeling less confident in their ability to find other positions in the current market or reflects a smaller wage premium for people looking to switch jobs.

The ratio of openings to unemployed people eased to a four-month low of 1.36. While still somewhat indicative of a tight labor market, the figure has eased substantially over the past year. At its peak in 2022, the ratio was two-to-one.

What Bloomberg Economics Says...

“With the ratio of vacancies to unemployed workers falling amid rising unemployment, we expect wage pressures to abate further ahead. As the labor market comes into better alignment and wage pressures subside, the Fed should grow more comfortable about cutting rates this summer.”

— Stuart Paul. To read the full note, click here

The JOLTS data precede the government's monthly jobs report at week's end, which economists forecast to show employers added more than 200,000 jobs for a fourth straight month in March.

Some economists have questioned the reliability of the JOLTS statistics in part because of the survey's low response rate.

--With assistance from Kristy Scheuble.

(Adds video, Bloomberg Economics comment)

More stories like this are available on bloomberg.com

©2024 Bloomberg L.P.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.