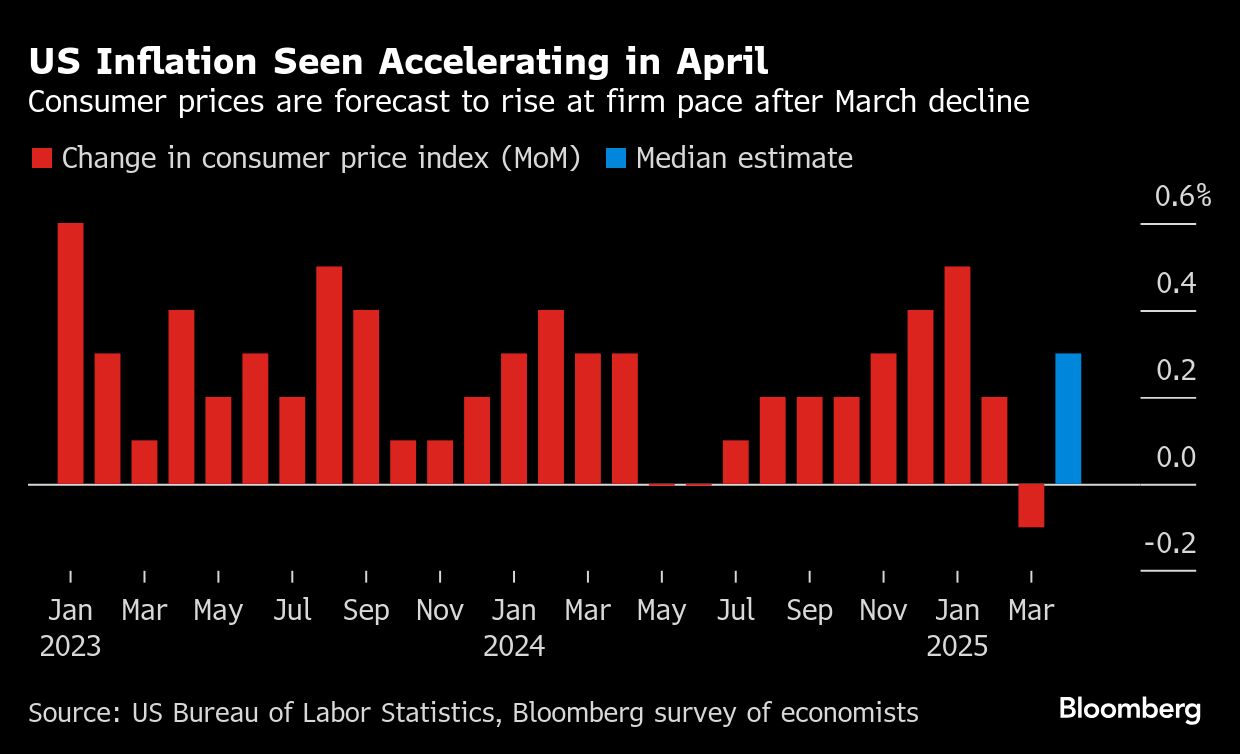

US inflation likely accelerated in April after an unexpected cooldown the previous month, with higher tariffs on Chinese goods in particular starting to impact prices.

The consumer price index is seen rising 0.3% from March after declining in the prior month, according to the median forecast in a Bloomberg survey of economists. A core metric that excludes the often volatile food and energy categories advanced at a similar pace, based on the consensus.

Most forecasters say Tuesday's report by the Bureau of Labor Statistics will show the first signs of the punishing tariffs implemented on China last month as well as other duties. The impact may be limited because many imported goods on US shelves last month arrived in the country before the new levies came into effect.

“CPI categories that are China import-intensive — such as toys, shoes, and apparel – may see modest inflation,” Bloomberg Economics forecasters led by Anna Wong wrote in a note Monday. “Retailers are finding it difficult to pass on higher prices without suffering a sharp drop in demand — though they'll still try. If that effect prevails, then the net impact of tariffs will be less inflationary than commonly thought.”

Going forward, forecasters are still assessing the recent agreement between the US and China to temporary lower tariffs on each others' products. It could lead to a “catch-up period” when retailers rush to restock inventories and items on US shelves are scarce, which could fuel consumer-price growth, Bloomberg Economics wrote.

Goods Front-Loading

Bank of America economists estimate goods inflation excluding food and energy commodities rose 0.1% in April after declining in the prior month.

“Tariffs should be a modest boost to goods prices this month, but larger increases are in the pipeline,” Stephen Juneau and Jeseo Park wrote last week — before the 90-day trade pact was announced. Within that category, they anticipated higher car prices “due in part to front-loaded demand in anticipation of higher prices from tariffs.”

Other economists anticipate the impact from the extra levies was limited.

The CPI report is expected to be “largely unaffected” by the tariffs President Donald Trump announced on April 2, Julien Lafargue, chief market strategist at Barclays Private Bank, said in a note Monday. That's because exemptions were granted for goods that were already on the way to the US, and consumers and businesses rushed to buy products earlier in the year to avoid tariffs.

“Both the Fed and global investors will still need to be a bit more patient before they can properly assess the impact of the trade uncertainty on consumer prices,” Lafargue said.

On the groceries front, economists at Morgan Stanley and Pantheon Macroeconomics noted a notable decline in egg prices — a key driver of food inflation in the CPI data this year through March. A drop in bird flu cases may have provided some relief.

Services Weakness

Economists and policymakers are closely tracking certain services categories that are a barometer for changes in discretionary spending.

Citigroup Inc. economists say travel-related categories such as airfares and car rental saw prices drop for another month. The price weakness reported in March, and a further pullback in April, would support the view that travel demand softened, economists Veronica Clark and Andrew Hollenhorst wrote.

The shelter category — which includes rents and is the biggest by far in the index — is seen cooling after a strong increase in March.

“Looking ahead, we still doubt the tariffs will prevent services inflation from continuing to fade gradually, enabling the Fed to start easing policy again in the second half of this year,” Pantheon Macroeconomics economists Samuel Tombs and Oliver Allen wrote in a note Monday.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.