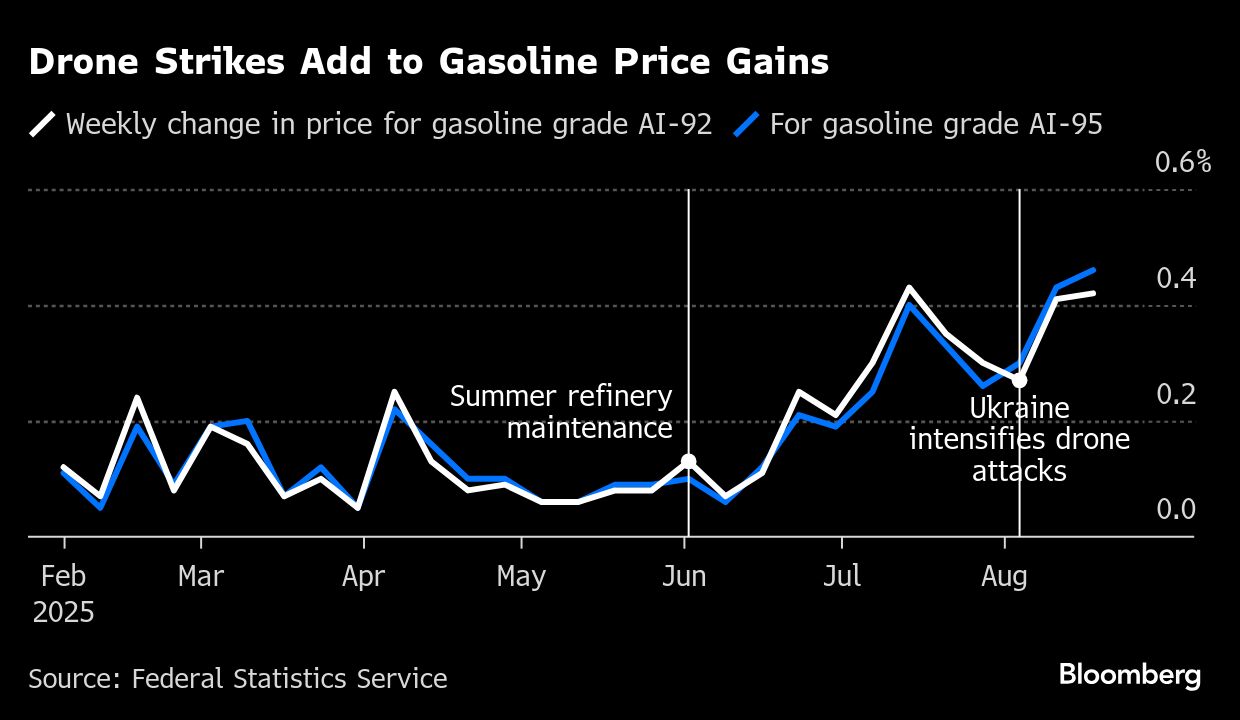

Ukrainian drone strikes on Russian oil refineries have exacerbated a summer crisis on the domestic fuel market, leading to a spike in prices amid high seasonal demand.

Wholesale fuel prices in Russia have hit records in August as supplies shrank. That's squeezed the ability of smaller gas stations not operated by Russian oil majors to stay in business, particularly in areas where logistics are costly.

Officials in the Russian-occupied Crimea Peninsula and part of Zaporizhzhia regions of Ukraine also reported shortages that left some filling stations dry as a result of refinery interruptions from drone attacks.

Fuel shortages have been reported in Russia's Far East. In the Zabaikalsky region, near the border with China, deliveries were hampered by an overburdened railway, local officials said. Filling stations in Primorye, on the Pacific coast, have struggled with the surge in demand.

Residents in Vladivostok have said motorists faced hours-long queues for gasoline for two weeks and some stations shut down, while others hiked prices.

Rising prices at the pump are a headache for the authorities and costly gasoline has triggered protests in the past, including in 2018. To avoid shortages and ensure domestic supply, the government restricted fuel exports in August and extended the ban through September. Deputy Prime Minister Alexander Novak, who oversees the energy sector, was due to hold a meeting Monday on domestic fuel supplies, the state-run Tass news agency reported.

Ukraine has attacked eight Russian refineries so far this month, sending offline around 10% of the country's active capacity, as Kyiv seeks to disrupt the Kremlin's war machine by reducing fuel supplies to frontline forces and cutting its oil revenue. Most of the targeted facilities — including Rosneft PJSC's Ryazan plant and Lukoil PJSC's Volgograd refinery — supply oil products primarily to the domestic market.

Refinery disruptions after recent strikes have added pressure to crude-processing rates already limited by longer-than-normal maintenance following a wave of drone attacks in the winter. Upkeep work can take longer than expected due to equipment delivery delays linked to sanctions, Energy Minister Sergei Tsivilev said in July.

At the same time, seasonal domestic demand has risen as holidaymakers hit the roads and farmers began harvesting crops.

The Russian-installed head of Crimea, Sergey Aksyonov, blamed the shortfall on significant reductions in production volumes at three refineries in southern Russia, according to local media. The situation in Russian-held parts of Zaporizhzhia is further complicated by “logistics issues and the threat of attacks on railroad tank cars,” its Moscow-appointed leader Yevgeny Balitsky wrote on his Telegram channel.

Independent fuel retailers are under pressure, facing losses if they keep prices unchanged and the prospect of losing customers to vertically integrated majors if they raise them.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.