Treasury yields climbed after the Federal Reserve cut interest rates for a third straight time as expected and signaled that their pace next year is likely to be slower.

The two-year note's yield, more sensitive than longer maturities to Fed policy shifts, led the move, rising as much as eight basis points to 4.33%, the highest level since Nov. 25. The US central bank lowered its target range for a key overnight lending rate by a quarter percentage point to 4.25%-4.5%, a full percentage point lower than its recent peak.

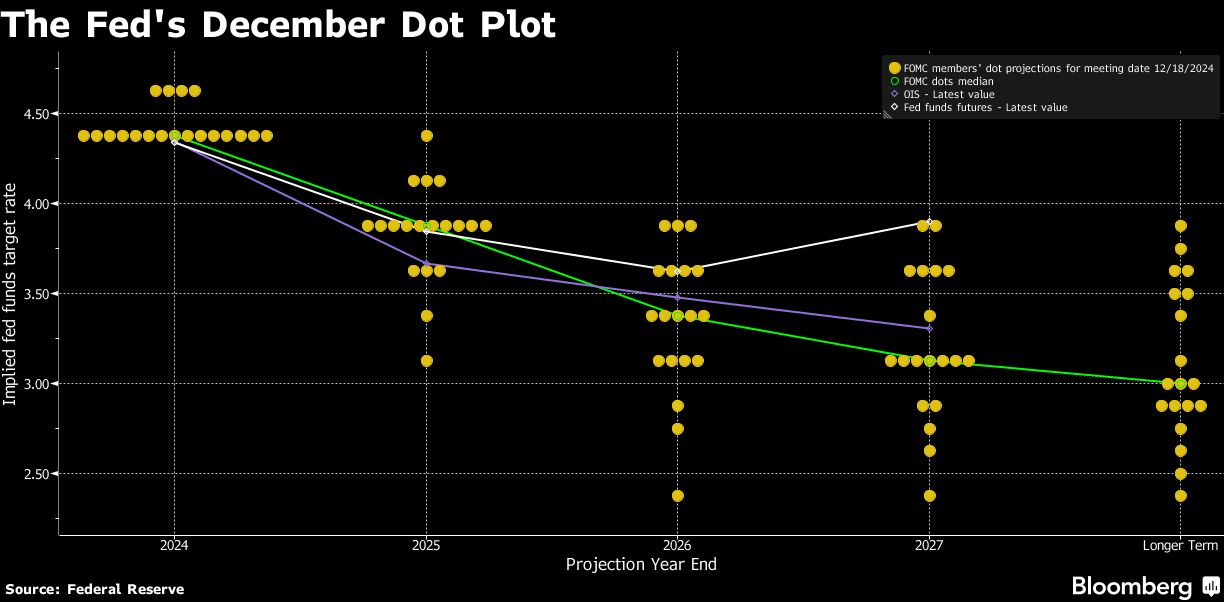

At the same time, policymakers revised quarterly projections anticipate less additional easing than in September. The new median forecasts imply 50 basis points of easing in 2025 and another 50 basis points in 2026. Their updated median estimate of the long-run neutral rate — a theoretical level that neither stimulates or restricts the economy — increased to 3% from 2.90%.

The new rate projections align more closely with investor expectations, which have shifted higher since mid-September based on economic growth and inflation data. Ahead of the announcement, swap contracts linked to the outcome of future Fed decisions were priced for today's quarter-point cut and another half point of easing next year, with little chance of a move in January. Subsequently, the contracts priced priced in even less easing.

“This was a hawkish Fed cut,” said Priya Misra, portfolio manager at JP Morgan Asset Management. With Fed Chair Jerome Powell set to speak, Misra said it's key how he “balances the two narratives — an easing bias because they think policy is restrictive and two, a slower pace and less overall amount of easing.”

The Fed's policy rate is a key input for Treasury yields, and fading expectations for additional rate cuts since September have driven them back above the 4% threshold to the highest levels since at least July. The benchmark 10-year note's yield at about 4.43% is about 80 basis points higher since mid-September, creating losses for investors who bought at the lowest yield levels.

Bond investors also are mindful of the potential for tax policies advocated by President-elect Donald Trump — who takes office next month — to fuel both growth and inflation.

“Higher bond yields are what you would expect after the election of Trump in November,” said Brij Khurana, portfolio manager at Wellington Management. “The Fed will go on hold next year if inflation stays at current levels.”

The inflation gauge the Fed is trying to bring back down to a long-term average of 2% increased to 2.3% in October. The November reading, to be released Friday, is expected to be 2.5%, with a increase to 2.9% for core prices.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.