For months, Vipin Raina had been bracing for a stampede of buying from Indian customers loading up on silver to honor the Hindu goddess of wealth.

But when it came, he was still blown away. At the start of last week, his company, India's largest precious metals refinery, ran out of silver stock for the first time in its history.

“Most people who are dealing silver and silver coins, they're literally out of stock because silver is not there,” said Raina, who is head of trading at MMTC-Pamp India Pvt. “This kind of crazy market — where people are buying at these levels — I have not seen in my 27-year career.”

Within days, the shortages were being felt not just in India, but around the world. India's festival buyers were joined by international investors and hedge funds piling into precious metals as a bet on the fragility of the US dollar — or simply to follow the market's irrepressible surge higher.

By the end of last week, the frenzy had rippled across to the London silver market, where global prices are set and where the world's biggest banks buy and sell in huge quantities. Now, it had run out of available metal. Traders describe a market that was all but broken, where even large banks stepped back from quoting prices as they fielded repeated calls from clients yelling down the line in frustration and exhaustion.

Prices ratcheted higher over the following week, on Friday reaching never-before-seen highs above $54 an ounce, before suddenly tumbling as much as 6.7%. For weary traders, the plunge was just the latest indication of the extreme stress being felt across the silver market – the worst crisis it has faced since the Hunt brothers attempted to corner the market 45 years ago.

This account of how the silver market broke is based on conversations with more than two dozen traders, bankers, refiners, investors and other market participants, many of whom spoke on condition of anonymity as they weren't authorized to speak publicly.

It's a story of how a perfect storm of events coincided to drain the silver market's buffer of inventories — including a multi-year solar power boom, a rush to ship metal to the US to beat possible tariffs, a wave of investment in precious metals as part of the so-called “debasement trade,” and a sudden spike in demand from India.

100-to-1 Ratio

When traders and analysts try to pinpoint the immediate cause of the silver crisis of 2025, they inevitably point to India.

During the Diwali holiday season, hundreds of millions of devotees buy billions of rupees worth of jewelry to celebrate the goddess Lakshmi. Asia's refineries usually meet this demand, which typically favors gold. But this year, many Indians turned to a different precious metal: silver.

The pivot wasn't random. For months, India's social media stars promoted the idea that after gold's record rally, silver was next to soar. The hype began in April, when investment banker and content creator Sarthak Ahuja told his nearly 3 million followers that silver's 100-to-1 price ratio to gold made it the obvious buy this year. His video went viral during Akshaya Tritiya, an auspicious day for buying gold — second only to the Dhanteras festival on Oct. 18.

“It's never been like this before. The demand this time for silver has been humongous,” said Amit Mittal, general manager at M.D. Overseas Bullion, a dealer in gold and silver in New Delhi.

The premiums for silver in India above global prices, usually no more than about a few cents an ounce, started to rise above $0.50, and then above $1, as supplies ran short.

And just as Indian demand was soaring, China — a key source of supply — closed for a week-long holiday. So bullion dealers turned to London.

They soon discovered that the city's precious metals vaults were largely sold out. While London vaults underpinning the global market hold more than $36 billion in silver, the majority of it was owned by investors in exchange-traded funds.

Demand for silver ETFs has soared in recent months, amid concerns about the stability of the US dollar, a wave of investment that's become known as the “debasement trade.” Since the start of 2025, ETF investors have hoovered up more than 100 million ounces of silver, according to data compiled by Bloomberg — leaving a dwindling stockpile available to supply the sudden boom in Indian demand.

Around two weeks ago, JPMorgan Chase & Co. — the largest precious metals trader and an important bullion supplier to the Indian market — told at least one of its clients that it had no more silver available to deliver to India for the month of October, and the soonest it could offer supplies was in November. A JPMorgan spokesperson declined to comment.

As the buying frenzy gathered pace in India, Satish Dondapati was keeping a close eye on supplies. A fund manager at Kotak Asset Management, he runs several precious metals exchange-traded funds, which need physical silver to back the holdings when new investors buy in.

Dondapati watched in amazement as the bullion dealers who dominate the Indian market ran out of silver in their vaults, while local premiums kept surging above international silver prices.

Eventually, the situation became so severe that Kotak decided to halt new subscriptions to its silver fund. Similar funds run by UTI Asset Management Co. and the State Bank of India also followed suit.

“Analysts, bullion dealers were all giving bullish calls on silver in Indian media in a way that has not happened in the last 14 years,” he said. “The FOMO factor has worked.”

Elsewhere in the country, dealers in Mumbai's busiest gold bazaars began charging prices well above international benchmarks, while bidding wars broke out between wealthy buyers who cared more about availability than price.

Premiums soared above $5 an ounce, well beyond the normal spread of a few cents. “I have been here in this company for the last 28 years and I have never seen these kind of premiums,” said M.D. Overseas's Mittal.

JPMorgan's reluctance to ship more silver to India indicated that the strain on supplies was going global.

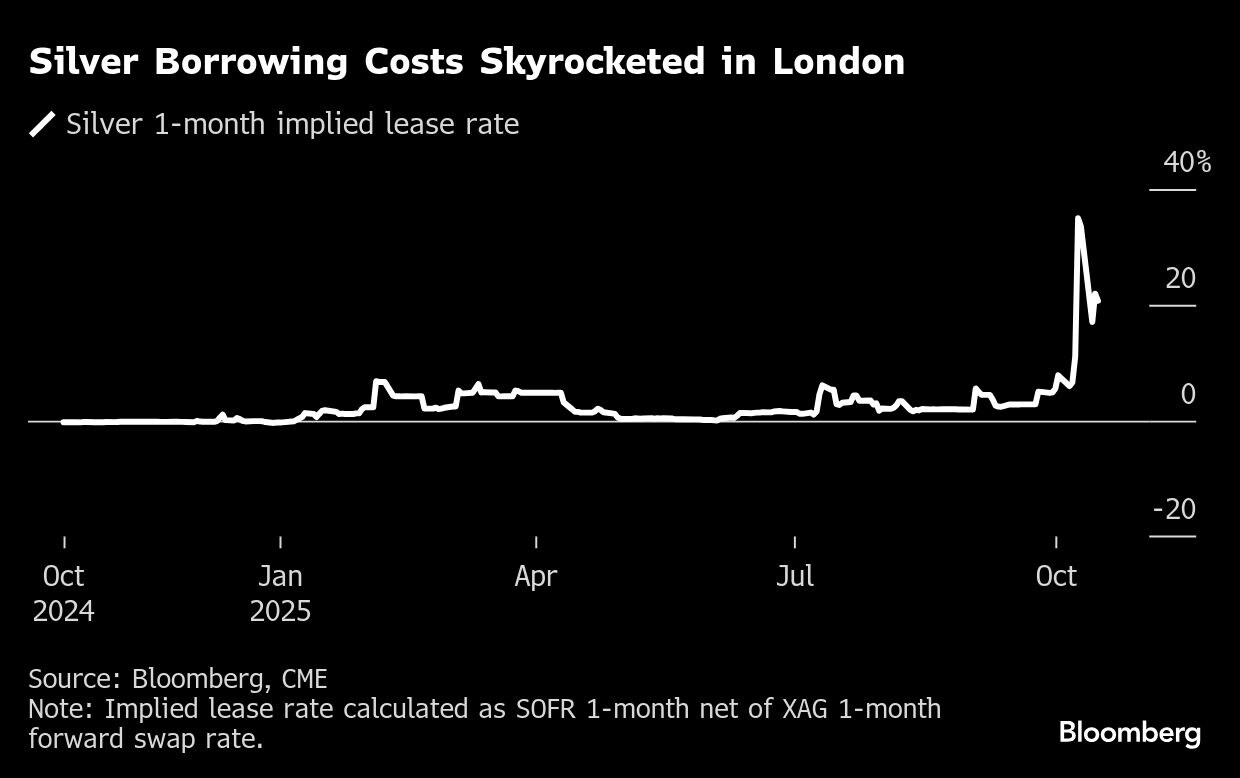

By Oct. 9, with the Dhanteras festival just a week away, the London silver market would be gripped by the biggest squeeze that any of the multiple traders Bloomberg spoke to had seen in their careers.

Panic in London

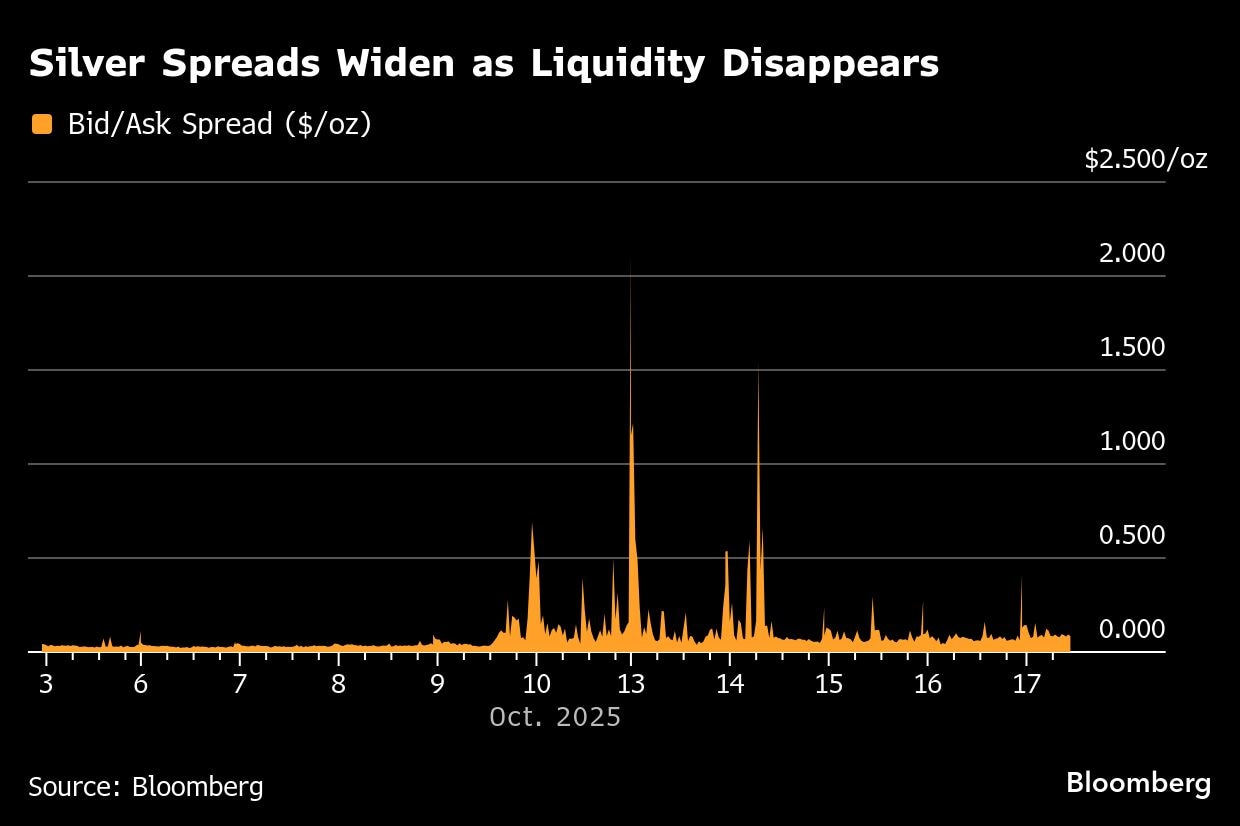

Traders described a growing panic as liquidity dried up. The cost of borrowing silver overnight soared to annualized rates of as high as 200%, according to consultancy Metals Focus. As the big banks that dominate the London market started to step back from the silver market, bid-ask spreads became so wide as to make trading near impossible.

One senior banker described how tempers rose as clients who had borrowed silver — typically companies in the physical supply chain, like refiners and dealers — called repeatedly to ask for the latest cost of borrowing. When his bank could no longer offer a price to roll forward its clients' loans, some started screaming down the phone lines, he said.

In another sign of the disarray in the market, one trader said the big banks were offering such wildly different quotes that he was able to buy from one bank at its ask price and simultaneously sell to another at its bid for an immediate profit – a rare sign of dysfunction in such a large and competitive market.

“There is more or less little to no liquidity actually available in terms of leases in London,” said Robin Kolvenbach, co-CEO of Swiss precious metals refiner Argor-Heraeus. “We have basically stopped all silver intake that is not committed contractually.”

Breaking the Squeeze

The silver market is known for its wild swings, and on past occasions the market regulators have stepped in. The Hunt brothers' attempted corner in 1980 was broken when the main exchanges prevented traders from taking new positions, allowing them only to liquidate.

In 1998, after Warren Buffett's Berkshire Hathaway Inc. bought the equivalent of about a quarter of the world's annual mine output and triggered a squeeze in London, the London Bullion Market Association changed its rules to accept metal that would be delivered to a vault within 15 days, rather than the usual five-day window.

The LBMA doesn't see the need to take similar action now, because it views the current squeeze as the result of genuinely short supplies of silver, rather than due to logistical bottlenecks as occurred in 1998, according to a person familiar with its thinking.

For the past five years, silver demand has outstripped silver supply from mines and recycled metal — in large part thanks to a boom in the solar industry, which uses silver in its photovoltaic cells. Since 2021, demand has outstripped supply by a total of 678 million ounces, according to the Silver Institute, with photovoltaic demand more than doubling over the period. That compares to total inventories in London of around 1.1 billion ounces at the start of 2021.

The stress in the silver market has been building since the start of the year, as fears that silver would be ensnared by President Donald Trump's reciprocal tariffs prompted traders to attempt to front-run any possible levies by shipping more than 200 million ounces of metal into New York warehouses.

On top of the tariff drawdowns, more than 100 million ounces of silver flowed into global ETFs in the year through September, as a wave of investment demand for precious metals supercharged a rally that helped drive gold through $4,000 an ounce for the first time in history.

Together, the two trends drained London's reserves, leaving dangerously little metal available to underpin the roughly 250 million ounces of silver that change hands in the London market every day. Based on Metals Focus estimates, by early October the “free float” of metal not owned by ETFs in the London silver market had dropped to less than 150 million ounces.

When prices started spiking higher in early October, one question was on traders' minds: How long would it take to get the New York stock back? People familiar with the process say that in ideal circumstances it can take as little as four days to buy up spot silver on Comex, sift through the inventory for metal that is approved for delivery in the London market, load it on a commercial flight, and then unload it and move it into vaults in London.

But there can be snags at any point in the chain, with delays at customs sometimes running into weeks. One risk for traders is that they would enter contracts to sell silver in London, and then not be able to get the bullion there in time — leaving themselves exposed to the eye-watering cost of rolling their positions forward.

Still, Comex inventories have been drawn down by more than 20 million ounces in the past two weeks — the largest drop in more than 25 years — as traders rushed to solve the squeeze in London. It's been a boon for the logistics firms too, with many jacking up their own prices as the silver market soared, some market participants said.

But some traders were reluctant to put the trade on given the possibility that Trump might yet put tariffs on silver as part of an impending package of levies on critical minerals — which could once again send New York prices shooting higher. Throughout the past week, market conditions remained stressed as the global silver market waited to see when sufficient volumes would arrive to bring an end the squeeze.

In Toronto, TD Securities analyst Daniel Ghali had been warning for more than a year that the London market was setting itself up for a squeeze. A few days before the squeeze reached its apex, he'd sent out a note saying he thought the end was in sight, and advised clients to bet on lower prices.

He'd called the peak too early as prices kept ripping higher. But by Friday, the market was once again moving in his favor. Prices plunged more than 5% at the end of the day as signs of improving US-China relations sparked a heavy selloff across precious metal markets. He says there could be further pressure to come as a wave of silver starts to flood in — not just from New York but from as far afield as China.

The logistics were “a little bit more complex than we initially assumed,” Ghali said by phone. “We certainly did not expect the scale of the retail-buying bonanza across the globe that ensued, while the London market was getting squeezed.”

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.