Russia is struggling to meet even the most cautious central bank estimate for growth this year, casting doubt on continued assurances from Governor Elvira Nabiullina that the economy isn't cooling excessively under high interest rates.

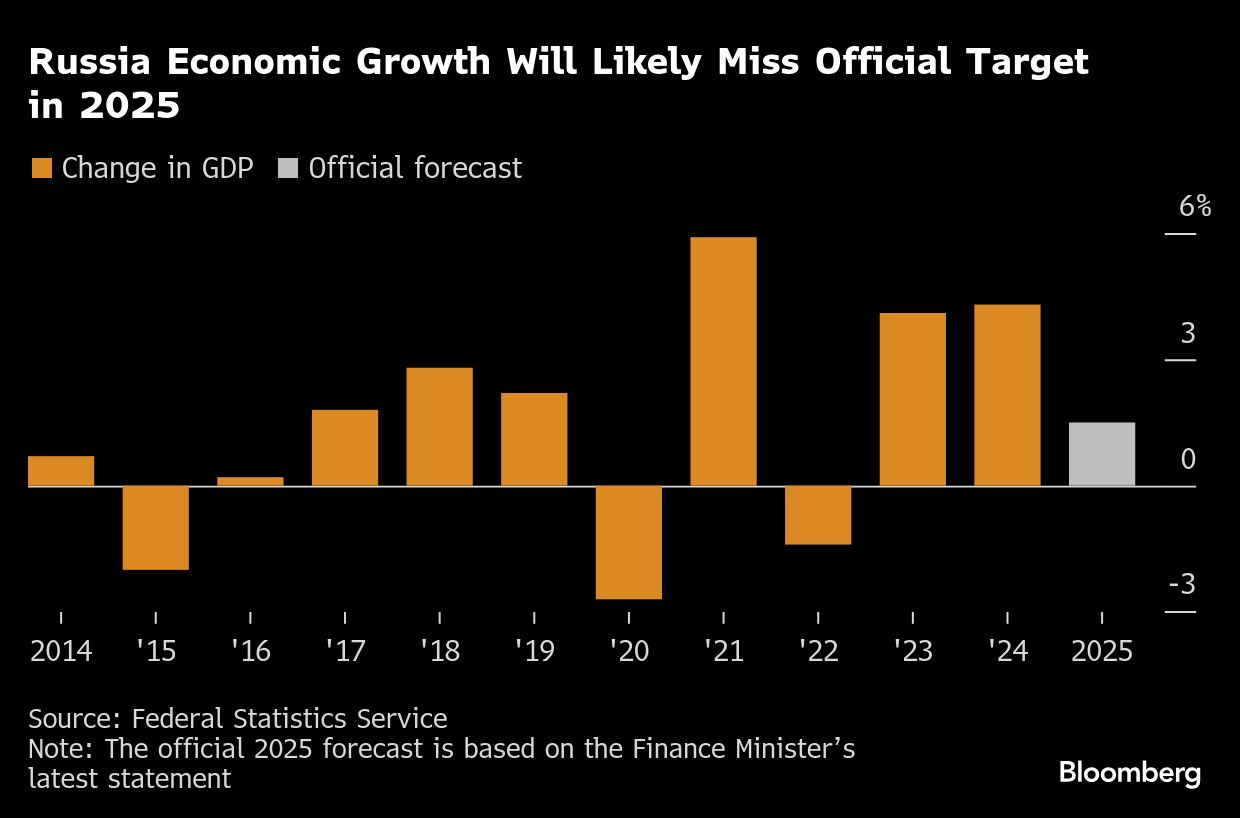

Gross domestic product expanded by just 1.1% over the first seven months of the year, according to data from the Economy Ministry published late Wednesday. That's barely above the lower bound of the central bank's 1%-2% growth forecast for 2025.

Current trends suggest that full-year growth may fail to meet even that conservative range, analysts say.

The central bank's expectations implicitly assume acceleration in the second half of the year, which is hard to reconcile with the growing effects of tight monetary policy, said Dmitry Polevoy, investment director at Moscow-based Astra Asset Management. He foresees full-year GDP growth of around 0.7% if the current pace continues.

Monetary policymakers have largely shrugged off business concerns over high borrowing costs, keeping the benchmark interest rate at a record level of 21% through the end of June while arguing the economy was merely exiting a period of overheating as expected.

Growth slowed in July, with GDP rising 0.4% compared to the previous year, down from 1% in June. Industrial production growth also decelerated to 0.7% from 1.9% as the manufacturing sector cooled. Seasonally adjusted industrial output fell for the second consecutive month, estimates Olga Belenkaya, an analyst at Finam Investment Company in Moscow.

The Bank of Russia cut its key rate by a total of 300 basis points over two meetings this summer, spurred by slowing inflation and worries the country's economy could tip into recession. Rate-setters adjusted downward their forecast for inflation, but kept the growth estimate unchanged.

Nabiullina has maintained that investment activity will remain robust this year despite the high cost of borrowing, while also allowing that state support for “priority sectors” — such as those supporting the military — was the main reason.

Independent business surveys tell a different story. “High interest rates and falling corporate profits are taking a significant toll on investment activity,” said Elena Astafyeva, commercial director at the TenderPro procurement platform in Moscow. TenderPro's survey results show a 13% drop in the number of business investment projects this year.

Read more: Russians Hoard Record $500 Billion in Banks Lured by High Rates

“Given the inertia in business activity indicators and a high base effect, economic growth could well turn negative by the end of the year,” said Oleg Kouzmin, an economist at Renaissance Capital. “The most likely outcome for full-year gross domestic product is below 1%,” he said.

Officials have been slower to tamp down their optimism. The Economy Ministry still officially forecasts 2.5% growth for the year. Finance Minister Anton Siluanov told President Vladimir Putin at a government meeting this week that a new, yet unpublished, estimate would put growth at no less than 1.5%.

“The main outcomes of July indicate a further slowing of the economy,” Belenkaya said. “At this pace, even the new estimate cited by Siluanov looks quite optimistic.”

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.