Russia's crude exports hit a one-month high, driven by a surge in weekly flows that coincided with a sharp drop in refinery runs. The increase came before President Donald Trump's threat of secondary tariffs on buyers of Russian oil if Moscow fails to make a swift peace with Ukraine.

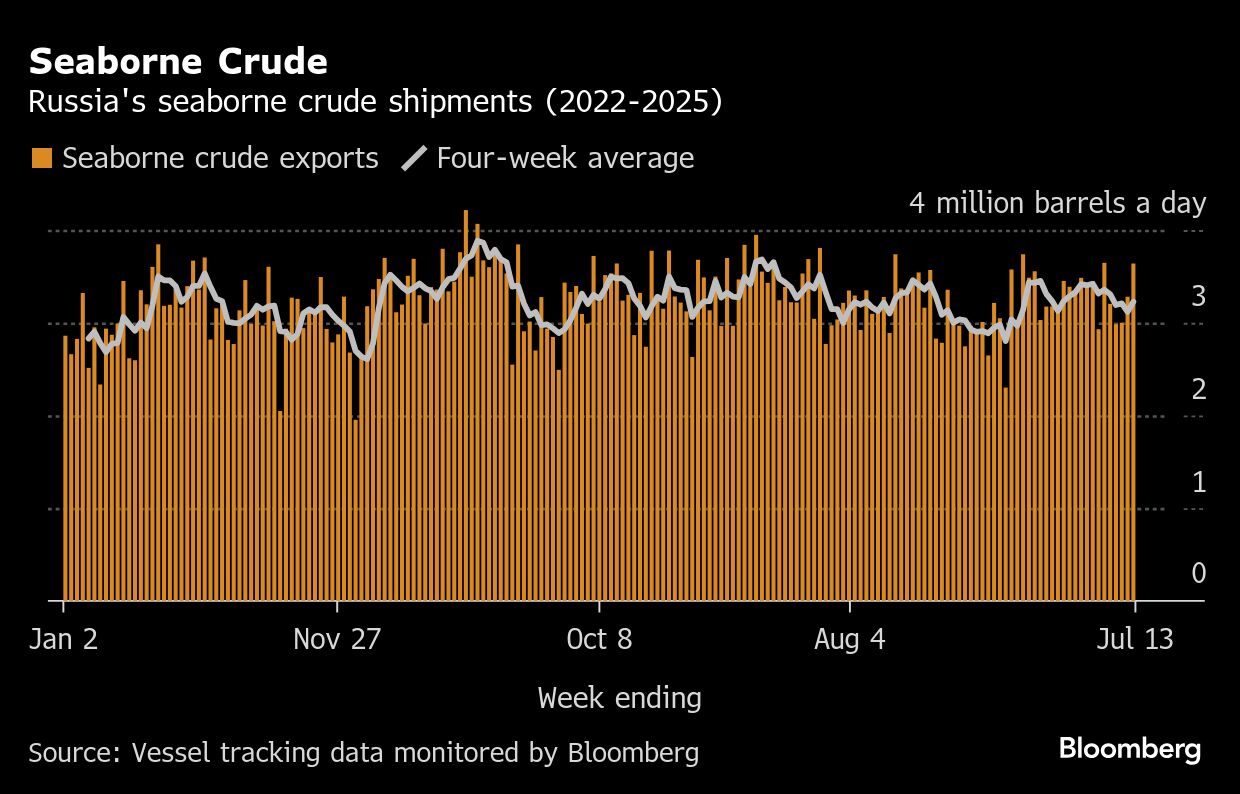

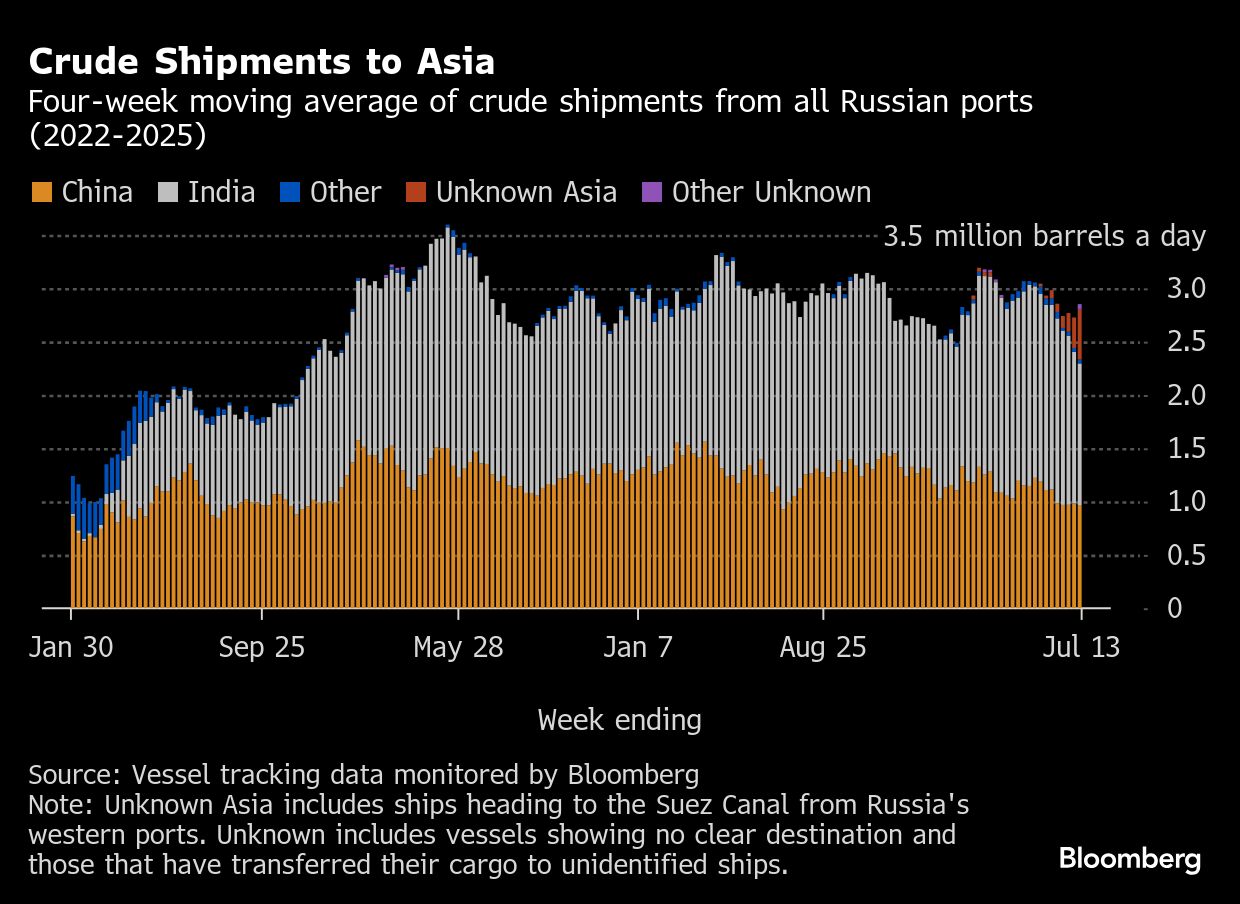

Seaborne crude cargoes averaged 3.23 million barrels a day in the four weeks to July 13, up by 3% from the period to July 6, tanker-tracking data compiled by Bloomberg show. On this measure, flows reversed the previous week's drop and rose to the highest since the period ending June 15 and are just above their year-to-date average.

Russian refineries processed a little over 5 million barrels a day of crude during the first nine days of July, down by about 300,000 from a month earlier, with several large plants undertaking seasonal maintenance. That's likely to have freed up more crude for export. The country's oil production is also edging higher as part of the OPEC+ group's easing of output cuts. Volumes rose by about 40,000 barrels a day in June.

Going forward, buyers of Russian crude face potential unspecified tariffs on their exports to the US if President Vladimir Putin continues the war with Ukraine. Trump made similar threats in March, which came to nothing. Whether he has really lost patience with the Russian leader is unclear, but his latest threats have been shrugged off by traders. If they are implemented, they would be the first serious move to curtail Russian oil shipments, rather than prices, since its troops invaded Ukraine in 2022.

Russia also faces the prospect of further action from the European Union. The bloc is moving closer to changing the price cap above which cargoes cannot be carried on EU ships or use services provided from member states. Under the proposed plans, the cap would be set at 15% below market rates based on a 10-week average and would be revised every three months.

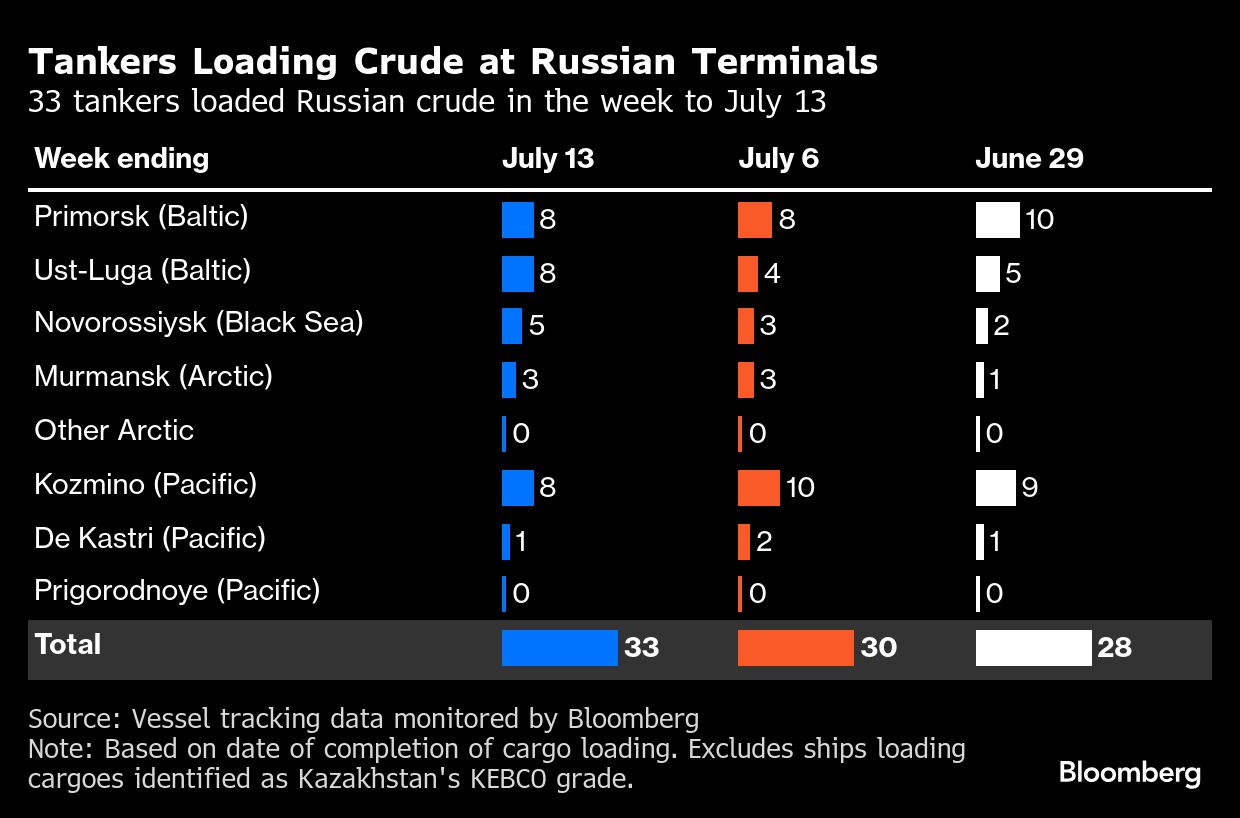

The volatile weekly shipments jumped by the most in five weeks, adding about 360,000 barrels a day to reach the highest since the first week of June. The Baltic terminals of Primorsk and Ust-Luga handled the most tankers since September in the week to July 13, with eight crude tankers leaving each of the ports during the week.

The four-week average smooths out the big swings in weekly numbers, giving a clearer picture of underlying trends in crude flows.

Crude Shipments

A total of 33 tankers loaded 25.47 million barrels of Russian crude in the week to July 13, vessel-tracking data and port-agent reports show. The volume was up from 22.96 million barrels on 30 ships the previous week.

Crude flows in the period to July 13 stood at about 3.23 million barrels a day on a four-week average basis, up by 110,000 barrels a day from the period to July 6. Using more volatile weekly figures, shipments rose by about 360,000 barrels to 3.64 million barrels a day, their highest in just over a month.

The increase in weekly flows was driven by a jump in shipments from the Baltic port of Ust-Luga, which reached the highest since September, and from Novorossiysk in the Black Sea. Those gains were partly offset by lower flows from the Pacific.

There was one shipment of Kazakhstan's KEBCO crude during the week from Novorossiysk.

Export Value

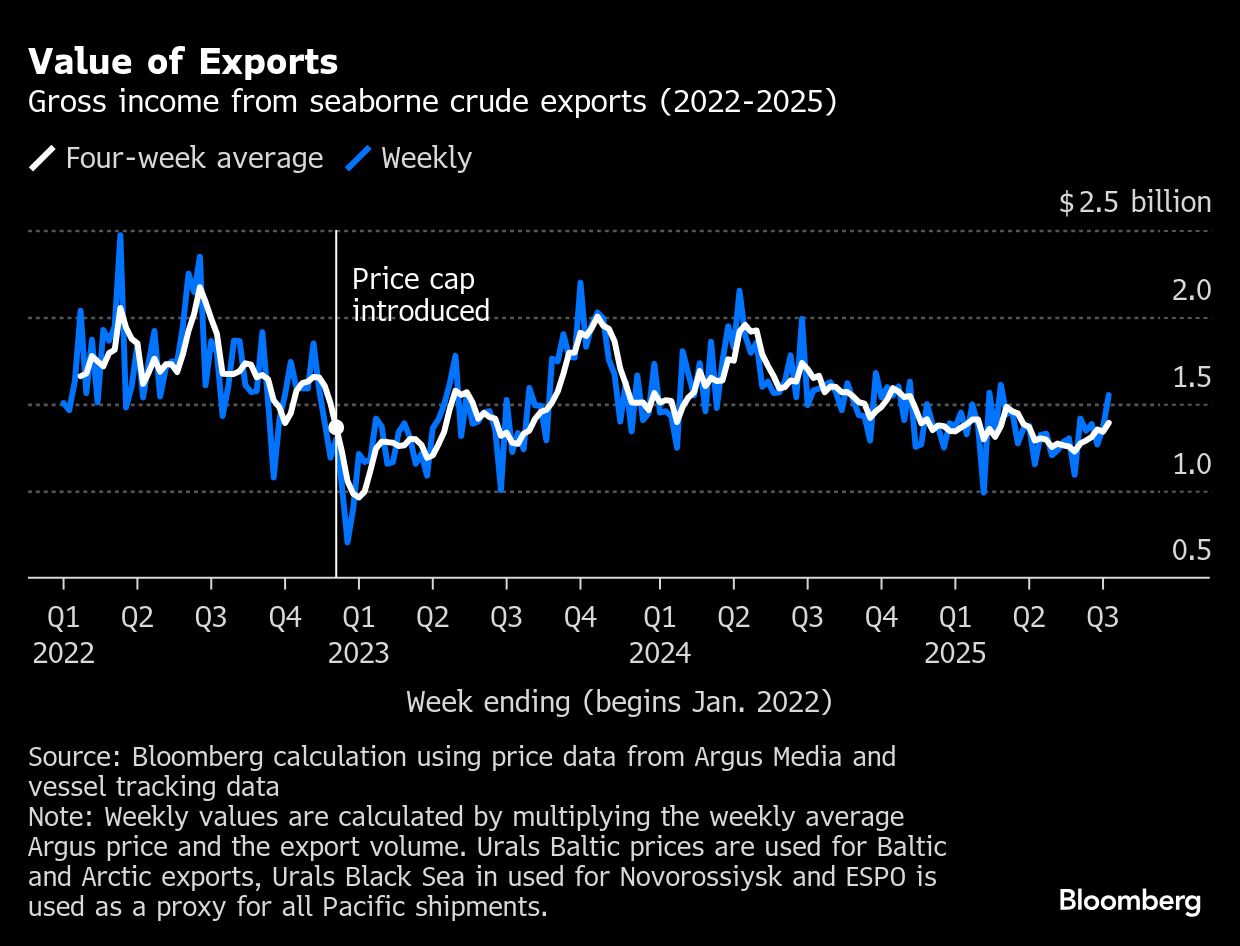

The gross value of Moscow's exports rose by about $190 million, or 14%, to $1.55 billion in the week to July 13. The increase in flows was boosted by higher average prices.

Weekly average export prices of Russian crude rose for the first time in three weeks.

Urals crude from the Baltic and Black Sea rose by about $2.30 a barrel to average close to $59.50 a barrel during the week, while the price of key Pacific grade ESPO increased by $2.10 to average $64.90 a barrel. Delivered prices in India were up by $2.40 at $69.70 a barrel, all according to numbers from Argus Media.

On a four-week average basis, the export price of Russia's crude shipments rose for a seventh week, with Urals from both the Baltic and the Black Sea and Pacific ESPO all rising by about $0.30-$0.40 a barrel.

Using this measure, the value of exports jumped by 4% in the period to July 13 to average about $1.39 billion a week, the highest since March.

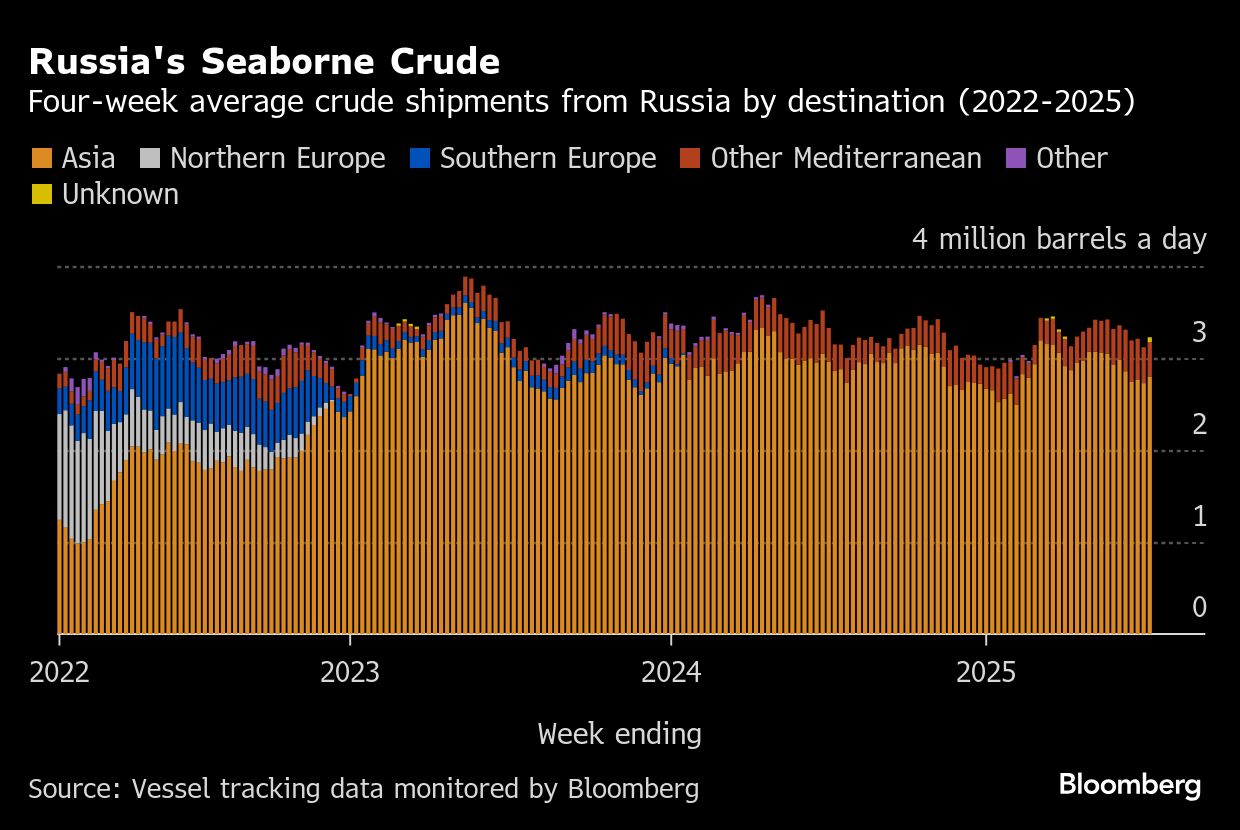

Flows by Destination

Observed shipments to Russia's Asian customers, including those showing no final destination, rose to a four-week high of to 2.85 million barrels a day in the 28 days to July 13, from 2.73 million barrels a day in the four weeks to July 6.

The figures include about 470,000 barrels a day on ships from Western ports showing their destination as Port Said or the Suez Canal, or those from Pacific ports with no clear delivery point, and a further 50,000 barrels a day on tankers yet to signal a destination.

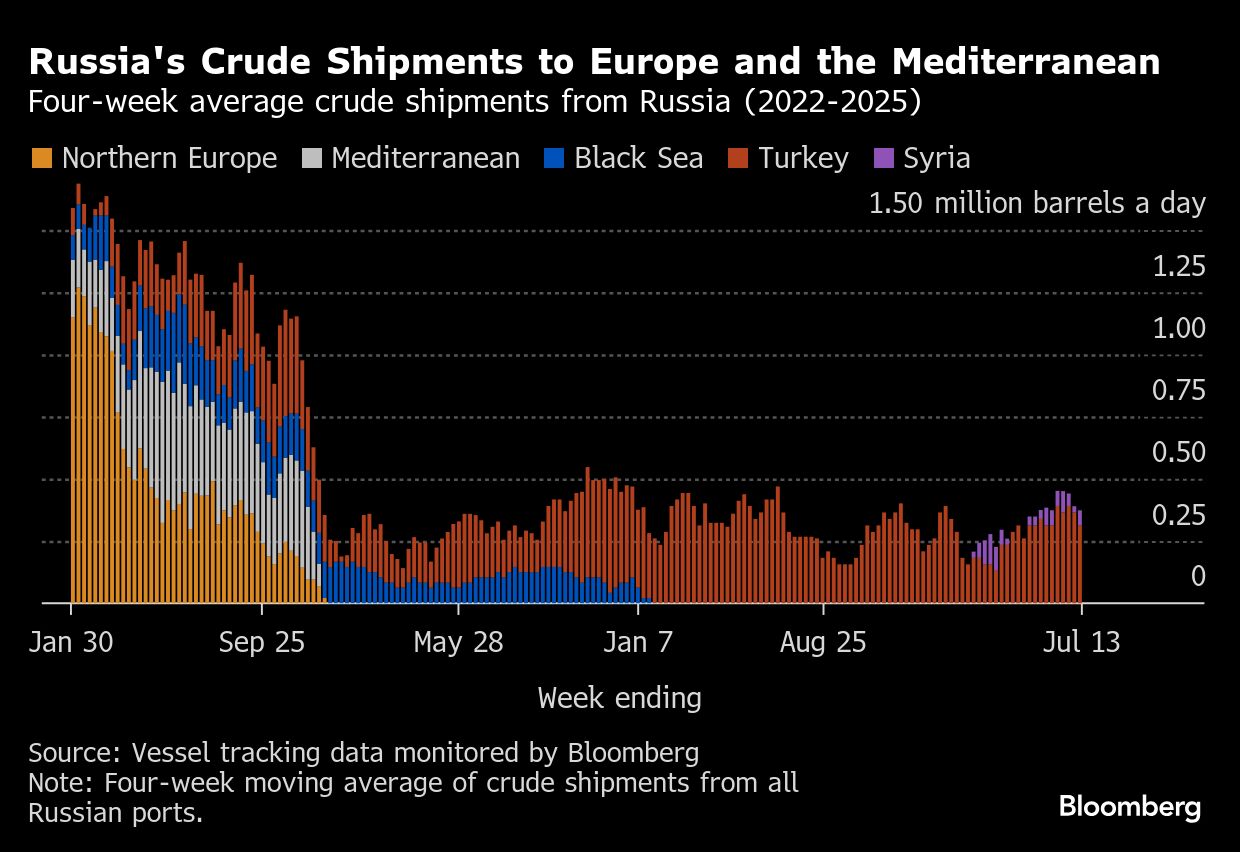

Flows to Turkey in the four weeks to July 13 averaged about 310,000 barrels a day, down about 50,000 barrels a day from the previous week. Shipments to Syria averaged about 60,000 barrels a day.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.