Russia is shipping less oil to the world.

In the first seven months of 2025, Moscow exported 4% less crude than it did in the comparable period of 2024, with an even sharper drop from the same timespan in 2023, ship-tracking by Bloomberg shows.

Russia's energy ministry didn't immediately respond to a request for comments on the data. However, Moscow has been compensating for previously pumping above its target under an OPEC+ initiative to restrict supply — so the curbs may relate to that. Whether that's why will become clearer in October, when the nation will in theory be allowed to produce significantly more.

The exports are important because they're what the country actually sells to global markets. Russia also made oil production data classified shortly after its invasion of Ukraine, making shipments the most visible part of the country's oil supply.

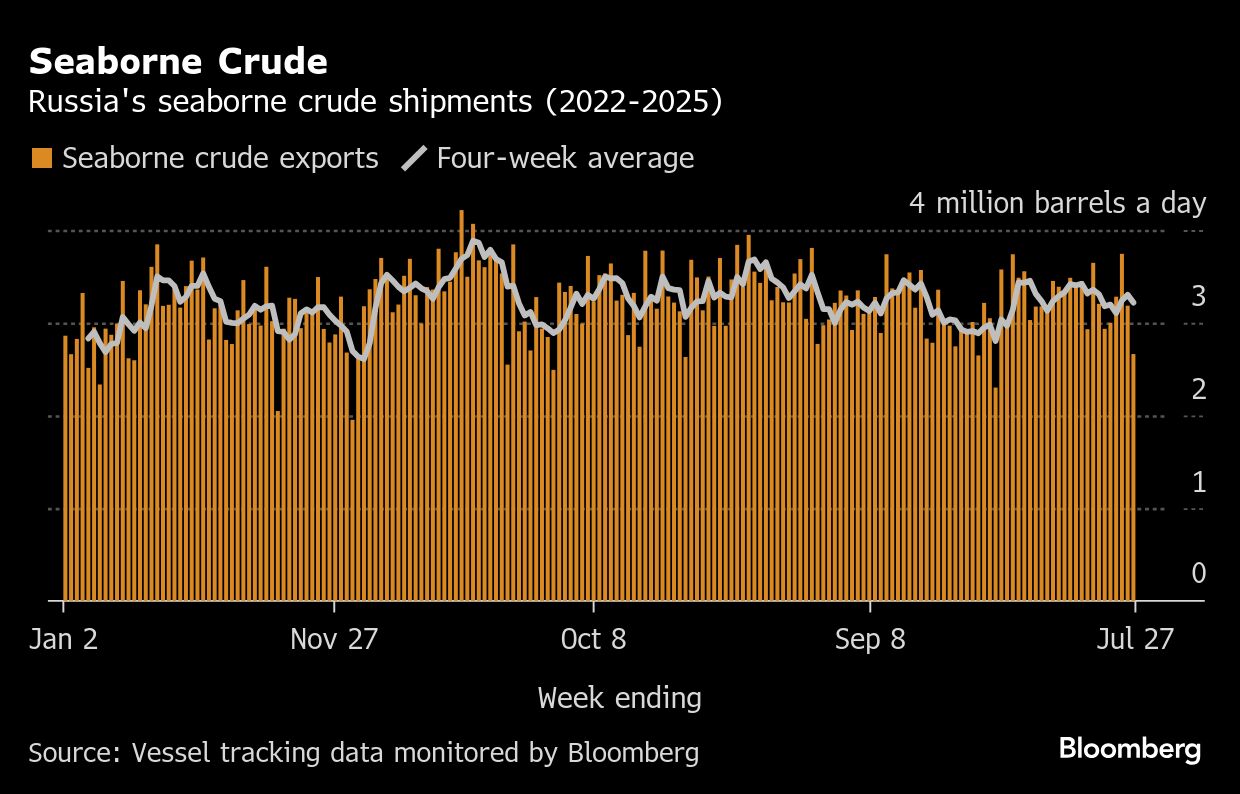

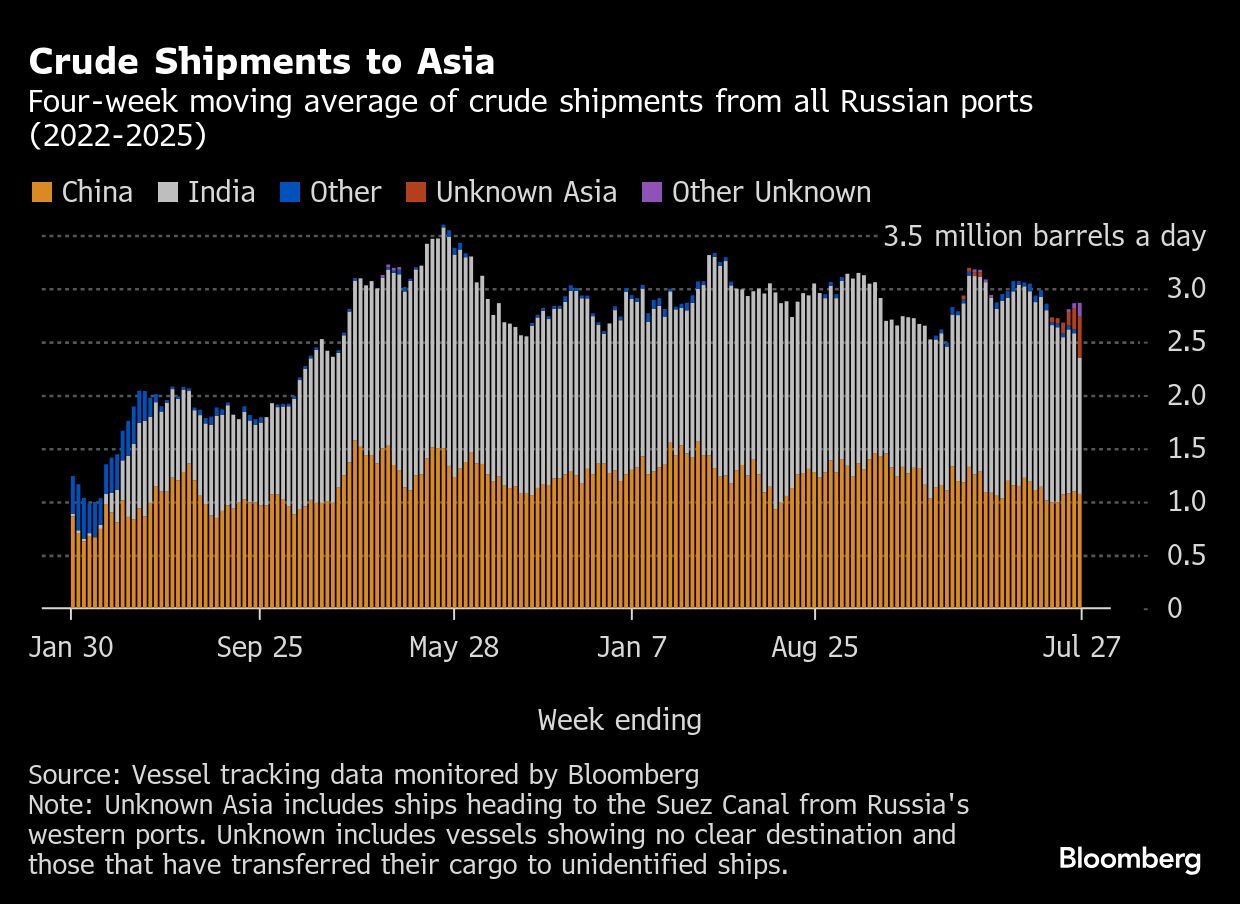

In the latest numbers, four-week average crude shipments gave up all of the previous week's gains following a second sharp drop in flows during the seven days to July 27. Seaborne cargoes averaged 3.22 million barrels a day in the four weeks to July 27, down by about 3% from the period to July 20, tanker-tracking data compiled by Bloomberg show.

Year-to-date flows are about 140,000 barrels a day down on the same period last year — a total of almost 30 million barrels. They're 7% lower compared with the same period in 2023. And it's not just exports that are lower. Crude processing at refineries is also down slightly year-on-year.

The flow of Russia's oil could face a new hit if US President Donald Trump follows through with a threat to impose secondary tariffs on all exports to the US from buyers of the country's oil. A previous deadline of early-September for President Vladimir Putin to reach a ceasefire agreement with Ukraine has been cut to 10-12 days, as Trump says he is losing patience with the Russian leader. Russia brushed aside the move.

The volatile weekly shipments fell sharply, shedding another 520,000 barrels a day and falling to their lowest in more than six months. Cargoes from the Baltic last week fell to the lowest since December 2022, with a four-day gap in the loading program for Ust-Luga and a slowdown in loading at Primorsk. It's possible that the deceleration in Baltic shipments reflects delays in clearance-to-dock resulting from President Vladimir Putin's tightening of rules for ships entering Russian ports after a series of explosions on oil tankers in Russia or vessels that had earlier called at its ports. However, there was no sign of a backlog of vessels that might be expected to accompany such delays.

Crude Shipments

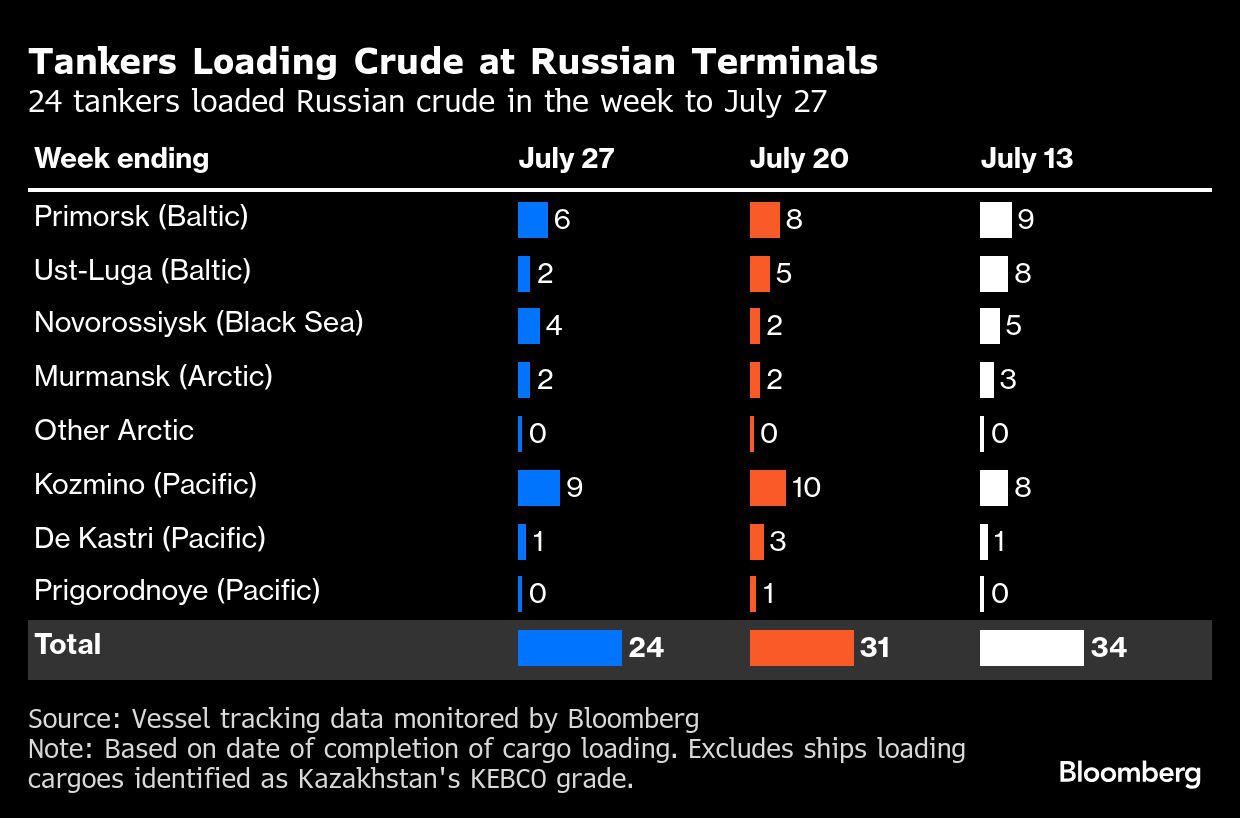

A total of 24 tankers loaded 18.63 million barrels of Russian crude in the week to July 27, vessel-tracking data and port-agent reports show. The volume was down from 22.28 million barrels on 31 ships the previous week.

Crude flows in the period to July 27 stood at about 3.22 million barrels a day on a four-week average basis, down by 80,000 barrels a day from the period to July 20. The four-week average smooths out the big swings in weekly numbers, giving a clearer picture of underlying trends in crude flows. Using more volatile weekly figures, shipments fell by about 520,000 barrels to 2.66 million barrels a day.

The drop in weekly flows was driven by a sharp decline in volumes of Urals crude from the Baltic and lower streams from the Pacific, which appears to have been driven by delays in transferring cargoes from shuttle tankers used by the Sakhalin 1 project. Those declines were partly offset by higher flows from the Black Sea.

There was one shipment of Kazakhstan's KEBCO crude during the week from Novorossiysk and one from Ust-Luga.

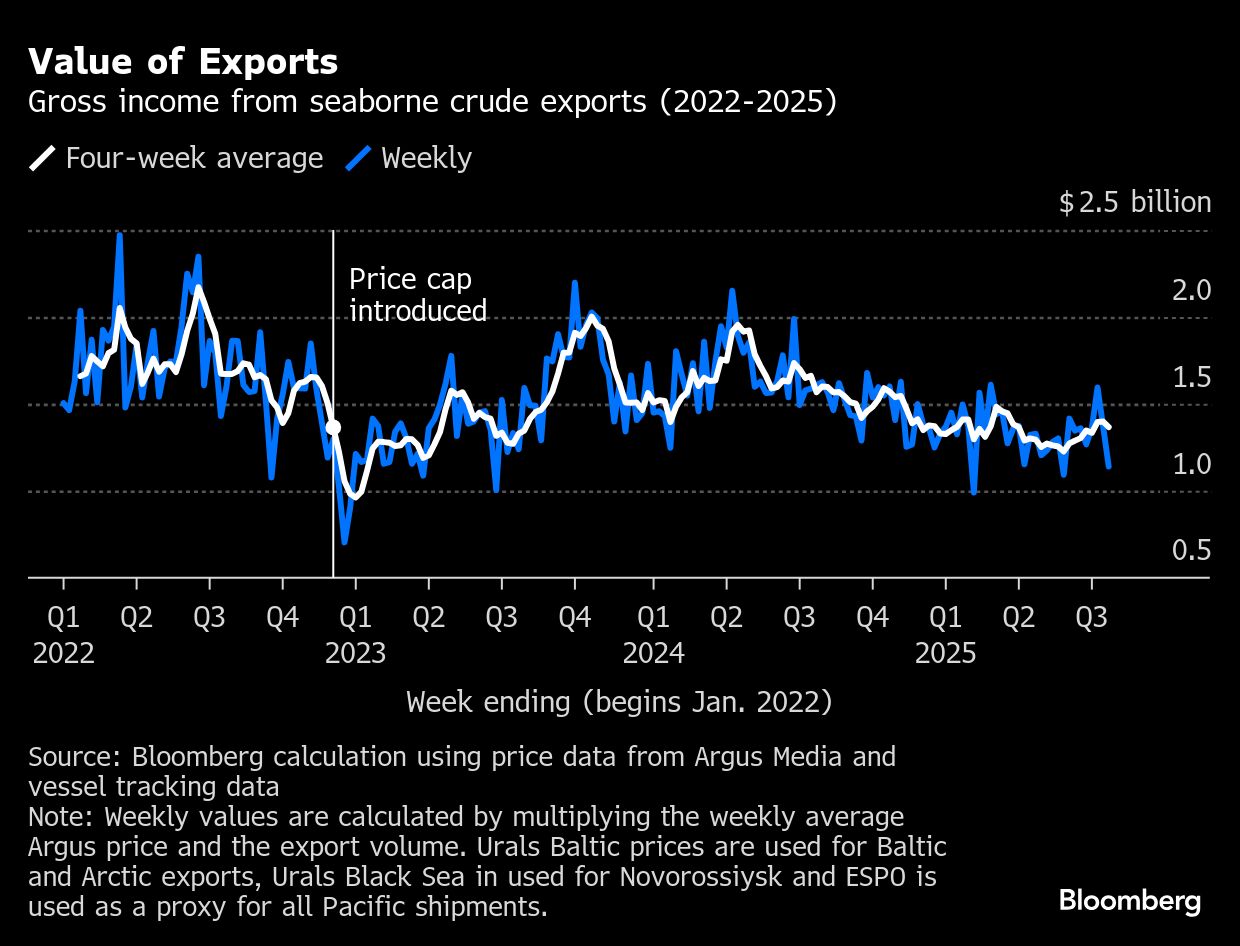

Export Value

The gross value of Moscow's exports fell by about $230 million, or 17%, to $1.14 billion in the week to July 27. The drop in flows was accompanied by lower average prices for Russia's flagship Urals crude.

Urals from the Baltic and Black Sea fell by about $0.50 a barrel to average close to $58.60 a barrel during the week. In contrast, the price of key Pacific grade ESPO rose by $0.40 to average $65.14 a barrel. Delivered prices in India were down by $0.90 at $68.10 a barrel, all according to numbers from Argus Media.

On a four-week average basis, the export price of Russia's Urals from both the Baltic and the Black Sea was unchanged, averaging about $58.60 a barrel, while Pacific ESPO was up by about $0.30 a barrel.

Using this measure, the value of exports fell by about 2% in the period to July 27, averaging about $1.37 billion a week.

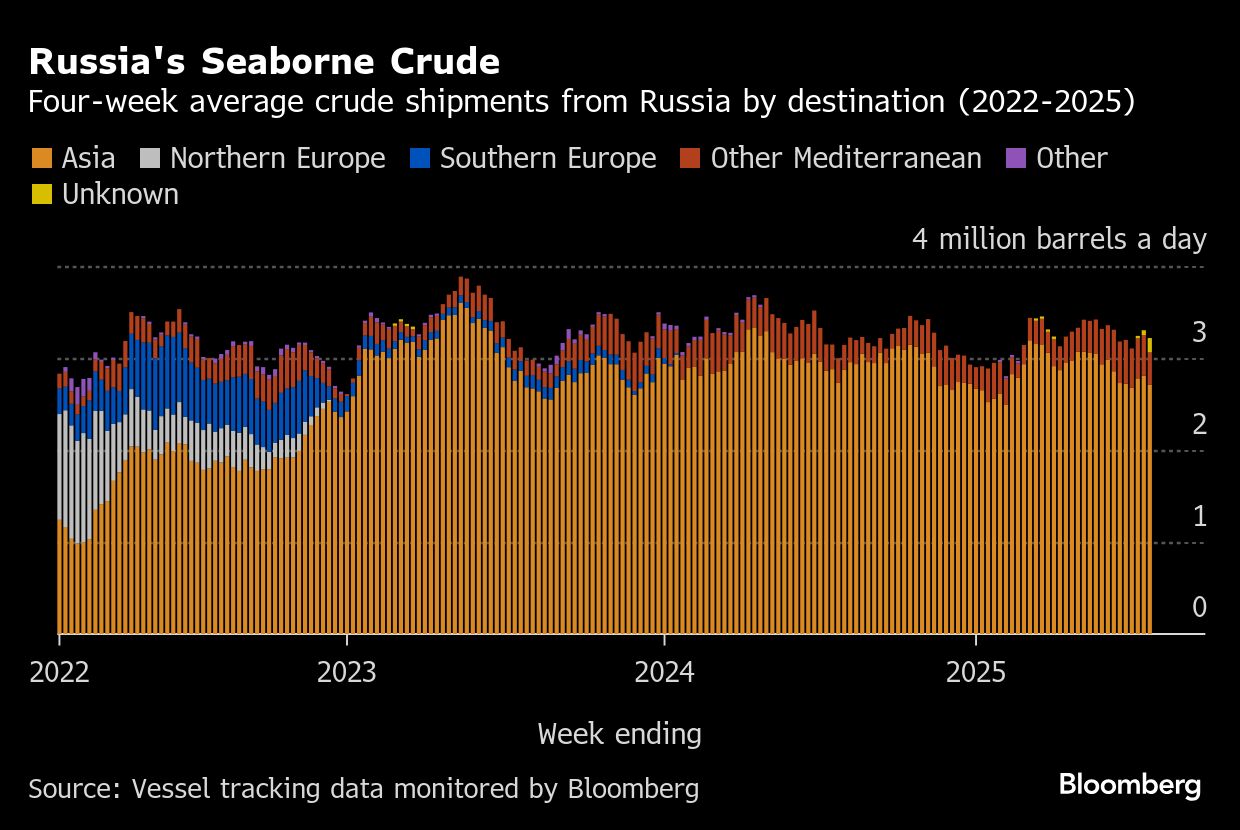

Flows by Destination

Observed shipments to Russia's Asian customers, including those showing no final destination, were unchanged at 2.86 million barrels a day in the 28 days to July 27.

The figures include about 380,000 barrels a day on ships from Western ports showing their destination as Port Said or the Suez Canal, or those from Pacific ports with no clear delivery point, and a further 130,000 barrels a day on tankers yet to signal a destination.

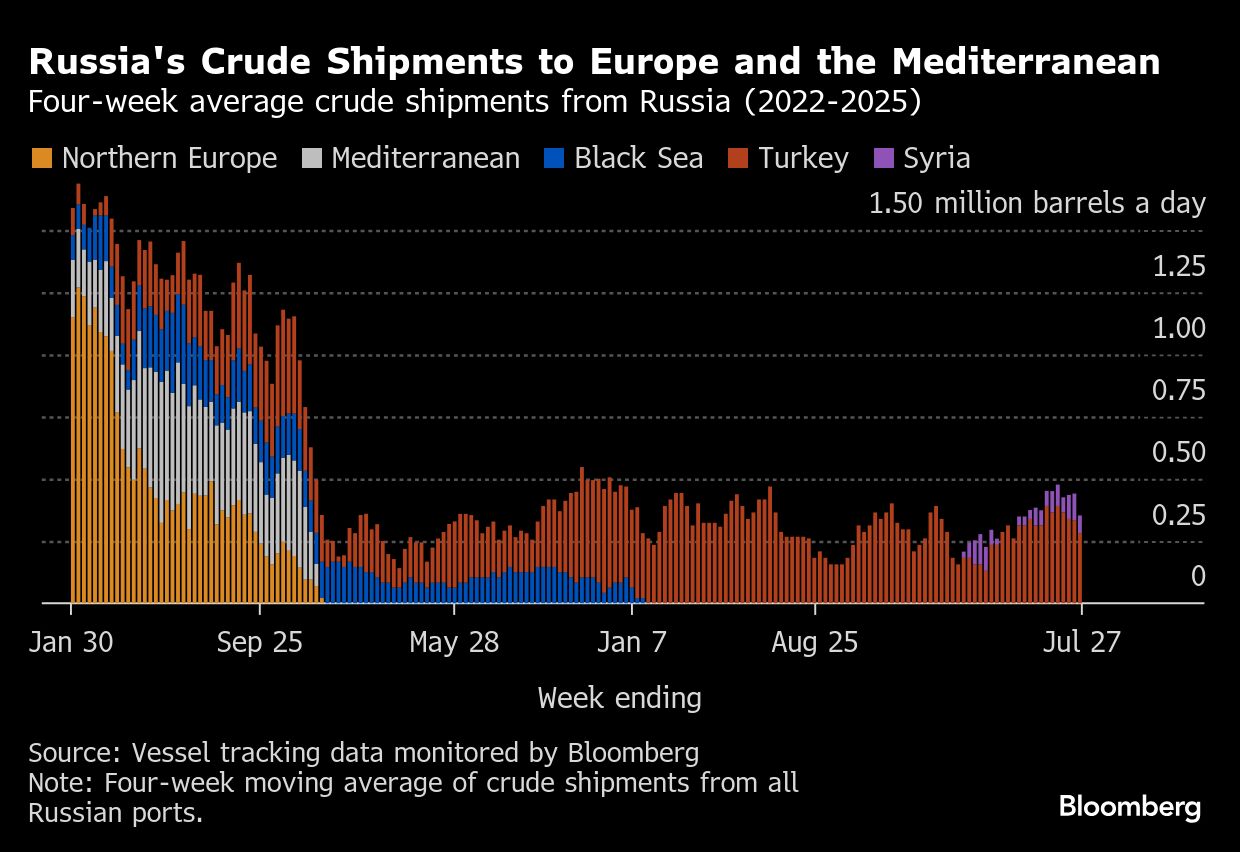

Flows to Turkey in the four weeks to July 27 averaged about 280,000 barrels a day, the lowest in 12 weeks. Shipments to Syria averaged about 70,000 barrels a day.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.