Close Federal Reserve watchers have a message for anyone who thinks the next leader of the US central bank will deliver lower borrowing costs on a silver platter: Don't count on it.

While it's an unlikely outcome, some investors have staked out positions in futures markets that will profit if interest rates drop immediately after Jerome Powell's term as chair ends in May 2026. The trade has been fueled by President Donald Trump's pledge to nominate “somebody that wants to cut rates.”

Those investors have targeted futures contracts linked to the Secured Overnight Financing Rate, or SOFR, which closely tracks the benchmark federal funds rate. They've sold off contracts that expire prior to Powell's exit and piled into contracts that expire just after the expected arrival of a Trump-appointed chair.

It's a trade that takes a chance on Trump getting his way, shrugging off how the central bank goes about setting rates.

A chair “can't act like a dictator,” said Mark Gertler, an economics professor at New York University who has co-authored papers with former Fed Chair Ben Bernanke and former Vice Chair Richard Clarida. “He can't call in the Marines or anything like that.”

Adjusting rates, Gertler pointed out, requires the support of a majority on the Federal Open Market Committee. Nineteen policymakers participate in FOMC meetings and 12 vote. In other words, the new chair will have to win over their colleagues with a reasonable case for cutting.

Contenders for the Fed chair job include former Fed Governor Kevin Warsh, Treasury Secretary Scott Bessent and National Economic Council Director Kevin Hassett, Bloomberg has reported. Current Fed Governor Christopher Waller is also an option, and former World Bank President David Malpass has also been floated.

Hassett on June 26 echoed Trump's call for lower rates, and Warsh similarly said borrowing costs should come down in an interview with Fox Business on Monday. Bessent last week said the Fed's previous economic models suggest they should have cut already.

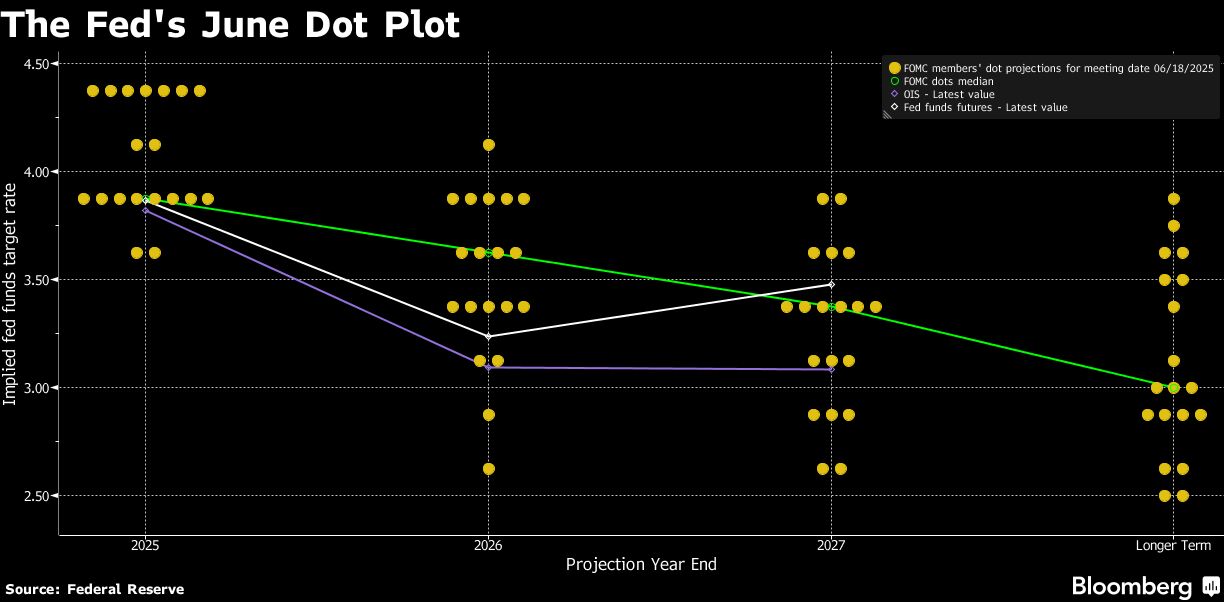

So far this year, Fed officials have agreed to hold borrowing costs steady in a range of 4.25% to 4.5%. But, as rate projections reveal, policymakers appear split over the outlook for cuts over the rest of the year, largely over differing views on how Trump's tariffs might affect inflation.

Ten policymakers — those more inclined to see the impact of tariffs on prices as temporary — expect two or three cuts by year's end. Two others see just one cut as appropriate and seven expect the benchmark rate to stay where it is. For next year, the range widens, with the upper boundary of the federal funds rate projected to finish 2026 anywhere from 2.75% to 4.25%.

The projections, being anonymous, can't be linked with certainty to individual policymakers.

Trump has responded with unrelenting demands for rate cuts. On Wednesday he posted his latest complaint on social media, saying rates were “AT LEAST 3 Points too high.”

“It's obviously a concern that the Fed will be less independent, certainly,” said Michael Feroli, chief US economist at JPMorgan Chase & Co. “Whether one person, even if that's the chair, can immediately get the committee to agree to a big change in policy, I think that might be more difficult.”

Lining Up Votes

Trump's pick to replace Powell won't be the only person inclined to support his call for cuts. Fed Governor Michelle Bowman — whom Trump placed on the board in 2018 and promoted to the central bank's top regulatory job last month — has so far this year supported holding rates steady, but recently said it might be appropriate to cut later this month. So, too, has Waller, another Trump appointee.

The president may use the vacancy created in January when Fed Governor Adriana Kugler's term expires to place his pick for chair on the Board of Governors. He'll then get one more opening to fill if Powell resigns from his underlying post as a governor. That's what outgoing chairs typically do, but Powell has declined to say whether he'll exit altogether.

But even if Powell departs, that doesn't add up to enough votes to make additional cuts. Whether others go along with lowering rates will depend more on what actually happens in the economy. And it could be difficult to peel away other policymakers one-by-one.

Dissents aren't especially rare, but in an institution that values broad-based agreement, especially when policy shifts, votes are rarely deeply split.

“At the end of the day it's a committee decision, and whoever the next chair is, he is going to have to build a consensus,” said Brett Ryan, US senior economist at Deutsche Bank Securities.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.