- OPEC+ agreed to increase oil production by about 137,000 barrels a day from October

- The group plans to return up to 1.65 million barrels a day in monthly stages until September 2024

- OPEC+ accelerated production restoration to reclaim market share despite supply glut risks

OPEC+ agreed to a new round of production increases from next month, as the group extends a policy shift toward higher volumes after years of defending prices.

In a meeting that lasted 11 minutes, key alliance members approved adding about 137,000 barrels a day from October during a video call on Sunday as they accelerates the unwinding of its next tier of supply cuts. The group said in a statement it will return all or part of 1.65 million a day, without giving a period or increments, depending on market conditions. Delegates said it will be added in monthly stages until September next year.

The Organization of the Petroleum Exporting Countries and its partners stunned oil markets in recent months by reviving 2.2 million barrels of halted production a year ahead of schedule in a bid to reclaim market share, even despite widespread expectations of an approaching supply glut. That restoration has only just been completed.

Crude prices have fallen 12% this year, pressured by increased output from OPEC+ countries and elsewhere, and as US President Donald Trump's trade war weighs on demand. Yet the market has overall proven surprisingly resilient to the alliance's strategy shift, giving Saudi Arabia and its allies added confidence to return even more barrels.

The group hopes that a further increase in sales volumes will offset any hit to revenues from lower prices, one delegate said, signaling a reversal of the strategy that OPEC+ has espoused since its creation almost a decade ago.

Read More: Saudi Arabia Wants OPEC+ to Speed Up Next Oil Supply Boost

Further production increases are likely to please Trump, who has repeatedly called for lower oil prices to help tame inflation and as he pressures Russia to end its war against Ukraine. Saudi Arabia's Crown Prince Mohammed bin Salman is scheduled to visit Washington in November to meet the US president.

Lower Volumes

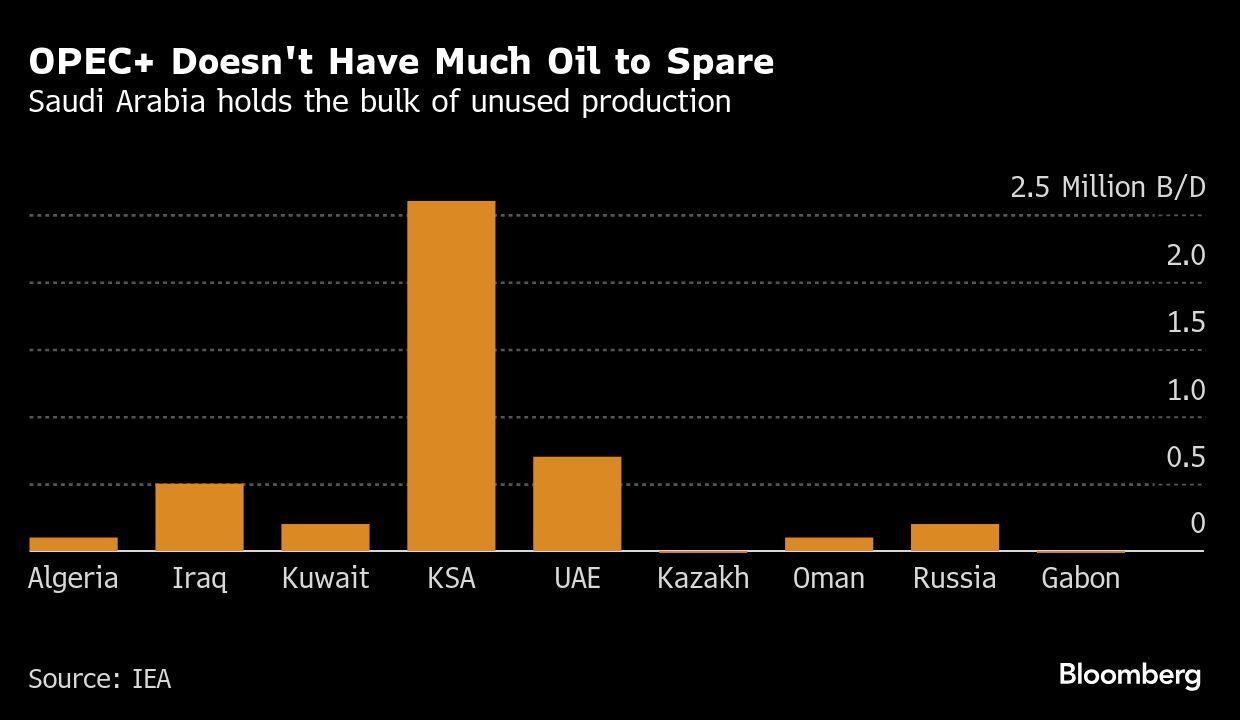

However, the actual volume is likely to be lower than announced, as some members of the group face pressure to compensate for earlier oversupply and forgo their share of production hikes, while several countries lack spare capacity.

The decision is likely to put a renewed spotlight on the unused production levels available in different OPEC+ members, as countries that can't pump more won't fully benefit from the increased quotas, while they face the added pressure of lower prices.

The group's decision comes against the backdrop of mounting warnings that the oil market is headed for a significant oversupply as the summer driving season ends in the northern hemisphere.

The International Energy Agency in Paris forecasts a record supply glut next year amid faltering consumption in China, which has powered demand growth for decades, and swelling output across the Americas — from the US and Canada to Brazil and Guyana. Goldman Sachs Group Inc. predicts Brent may slump to the low $50s in 2026.

Before this latest move, OPEC+ had agreed to restore 2.2 million barrels a day in a series of accelerated hikes between April and September — a year earlier than previously scheduled.

Officials from the group have previously given a range of explanations for opening the taps, from attempting to discipline overproducing members such as Kazakhstan to placating Trump's demands for lower prices and reclaiming sales volumes ceded to rivals like US shale drillers.

For global oil markets in the longer term, the OPEC+ move serves to erode a longstanding safety net of idle production that could be brought back to cushion unforeseen supply shocks.

And Sunday's decision would represent yet another unexpected twist by Saudi Energy Minister Prince Abdulaziz bin Salman, who has established a history of springing surprises in order to wrong-foot speculators.

At the start of the week, the majority of crude traders and analysts surveyed by Bloomberg News predicted that the eight key OPEC+ nations would hold production steady at Sunday's gathering, before reports emerged that the group would consider an increase.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.