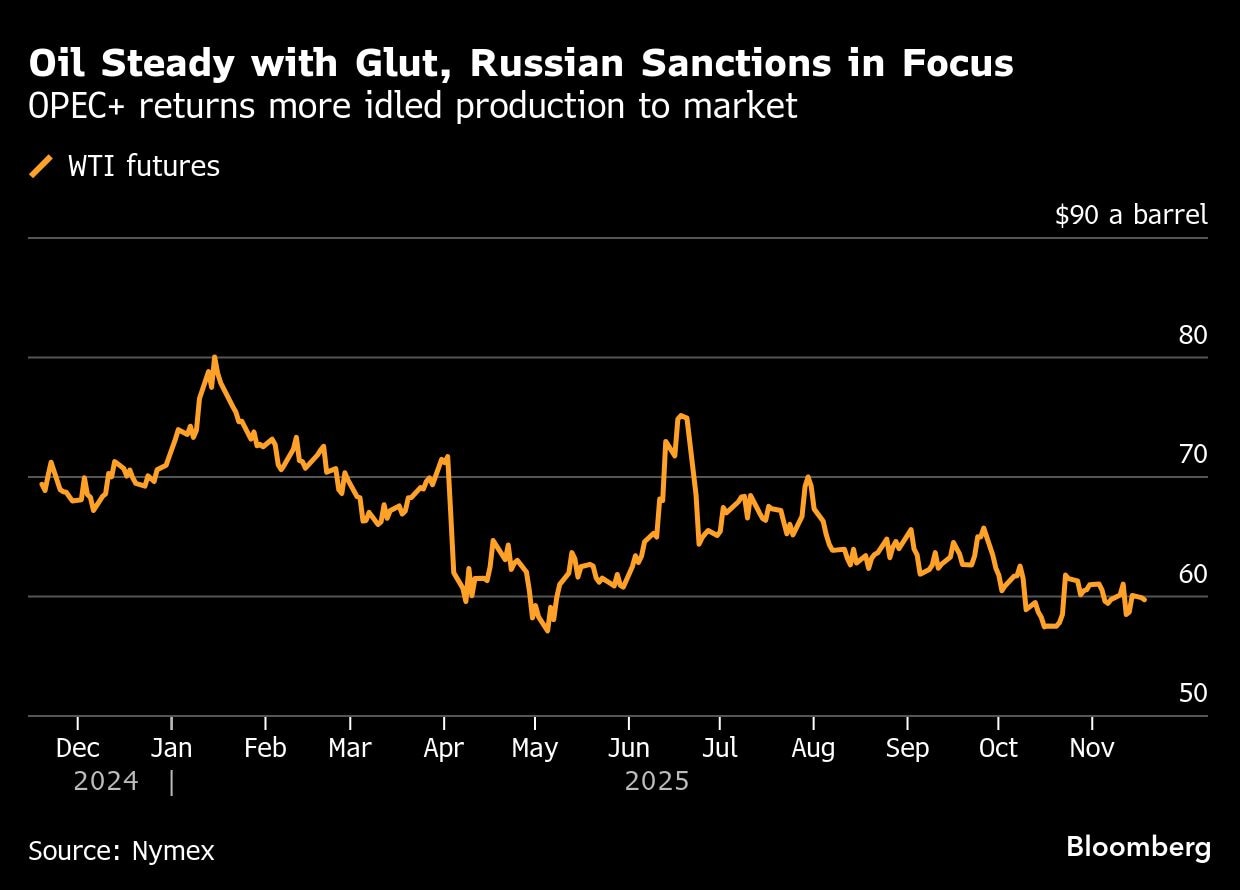

Oil steadied as investors weighed the impact from an emerging surplus against US sanctions on Russia that have upended some crude flows.

West Texas Intermediate traded below $60 a barrel after a modest loss in the previous session. Brent closed near $64. The price of Russia's flagship crude has plunged to the lowest level in more than two years, just days before US sanctions hit major producers Rosneft PJSC and Lukoil PJSC.

Benchmark futures are down this year as expectations for a glut weigh on the outlook, with the International Energy Agency forecasting a record surplus in 2026. The oversupply is being driven by the return of idled output from OPEC and its allies, and more production from outside of the group.

Canada's oil sands output is climbing as the newly expanded Trans Mountain pipeline brings more crude to Asian markets after years of capacity constraints. Production rose to a record high in June and is set to grow even further to 6 million barrels a day by 2030, according to the Bank of Montreal.

Still, there are other geopolitical risks simmering that could put a floor under prices, including attacks in Sudan that have crimped exports, and Iran's seizure of an oil tanker last week near the vital Strait of Hormuz. The market is also weighing the potential fallout from US pressure on Venezuela.

The US plans to designate a Venezuelan drug cartel it alleges is led by President Nicolas Maduro as a foreign terrorist organization, and President Donald Trump has said he isn't ruling out US troops going into the oil-rich country.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.