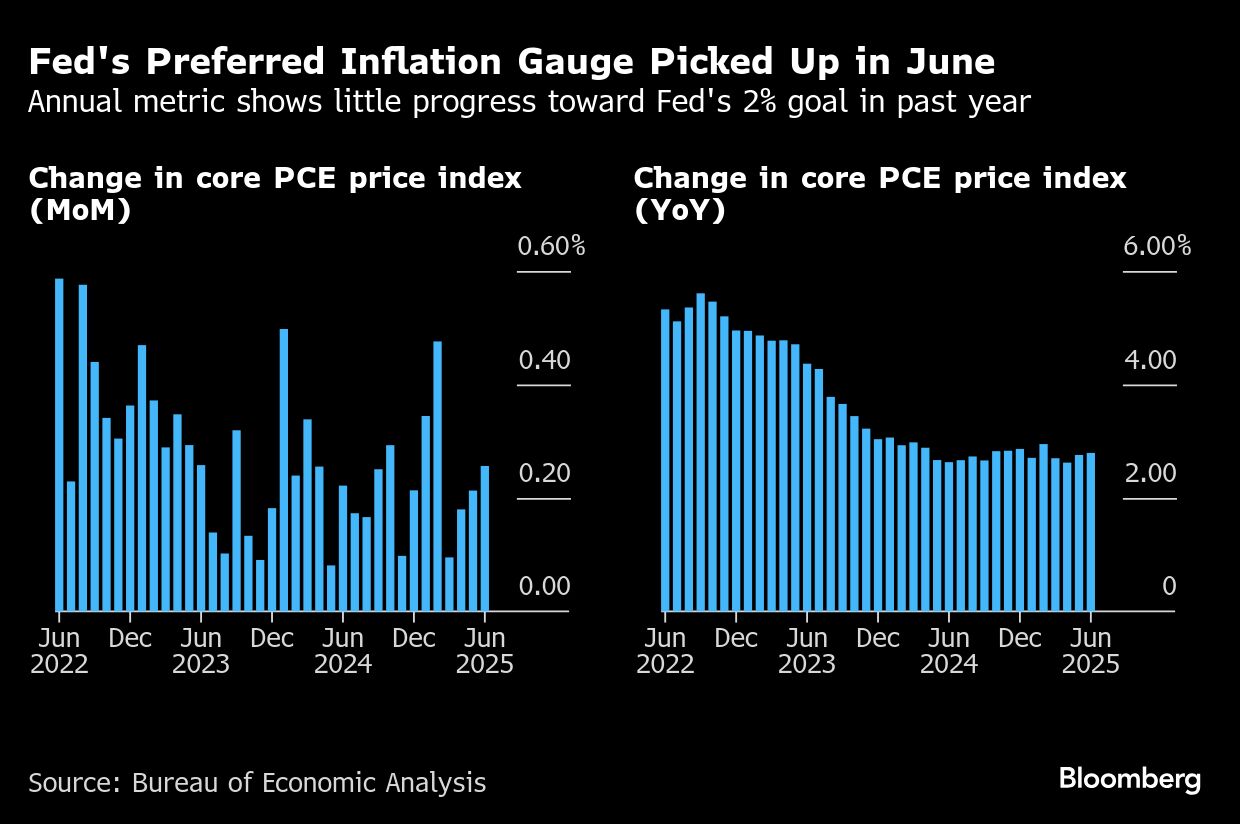

The Federal Reserve's preferred measure of underlying inflation increased in June at one of the fastest paces this year while consumer spending barely rose, underscoring the dueling forces dividing policymakers over the path of interest rates.

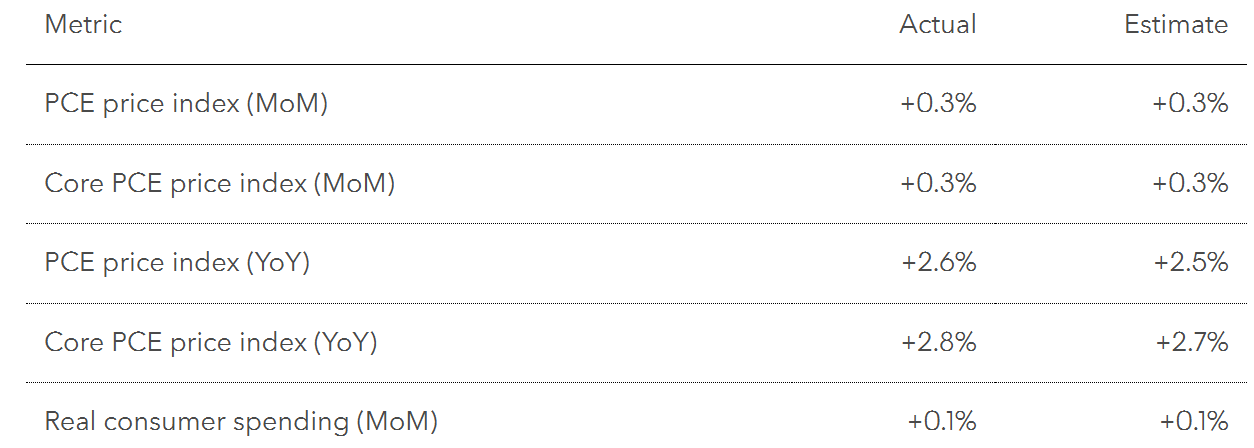

The so-called core personal consumption expenditures price index, which excludes food and energy items, rose 0.3% from May, according to Bureau of Economic Analysis data out Thursday. It advanced 2.8% on an annual basis, a pickup from June 2024 that underscores limited progress on taming inflation in the past year.

The data also showed inflation-adjusted consumer spending edged up last month after declining in May.

The data illustrate the tug and pull in the economy that has Fed officials split over the course of monetary policy.

On the one hand, progress on inflation has essentially stalled and central bankers fear that President Donald Trump's tariffs — some of which are already being passed on to consumers — will exert greater pressure on prices. On the other, a retrenchment in consumer spending due to a softening labor market risks a broader slowdown in the economy.

The Fed kept borrowing costs unchanged for a fifth straight meeting on Wednesday, though two governors dissented in favor of a quarter-point cut. Chair Jerome Powell was staunch in his defense of a solid labor market and upside risks to inflation that support keeping rates steady for now.

“Weaker consumer spending and an upturn in goods prices due to tariffs could further complicate Fed policy,” Sal Guatieri, senior economist at BMO Capital Markets, said in a note. “We will need to see either calmer inflation figures or weaker growth/softer job conditions to spur a rate cut on September 17.”

The S&P 500 rose, Treasury yields declined and the dollar advanced after the report.

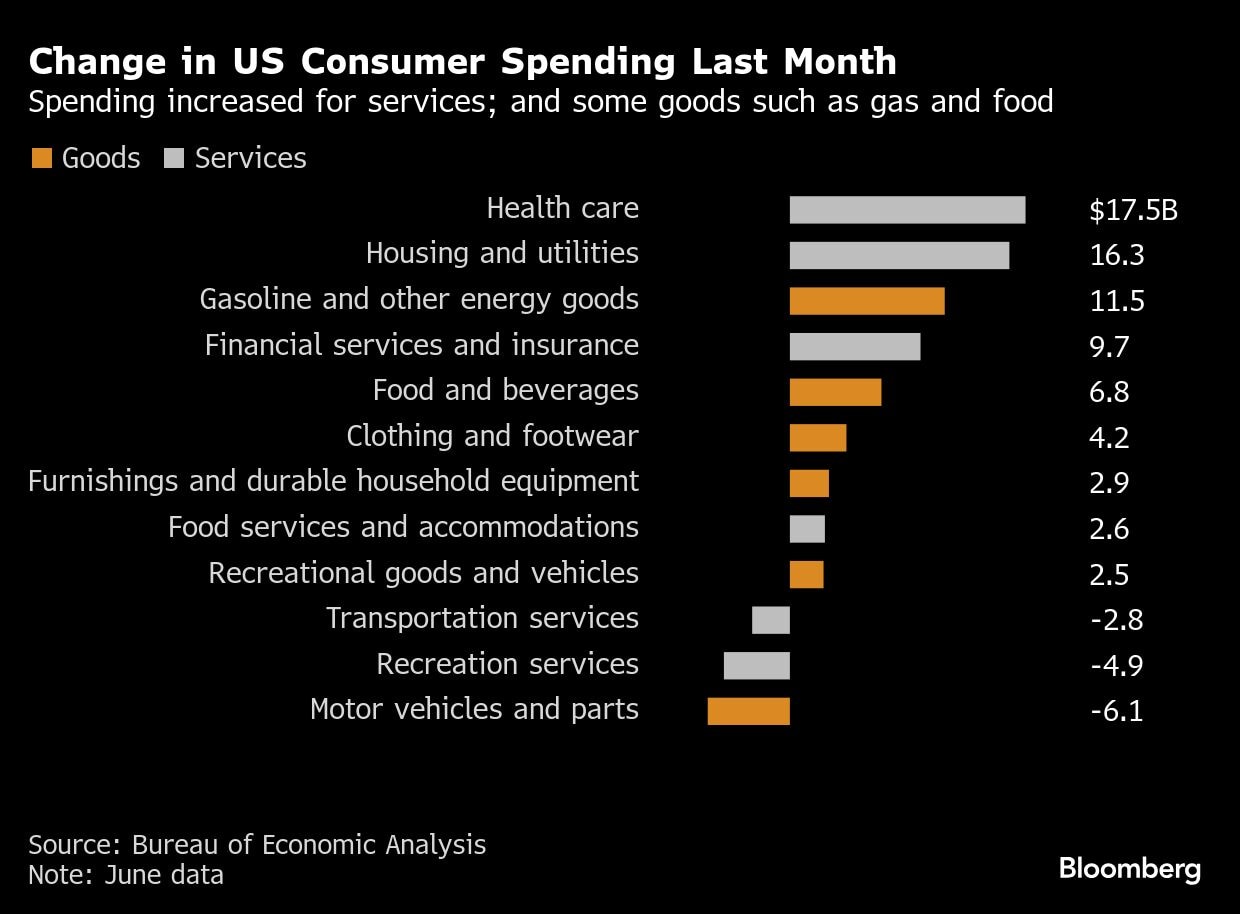

The figures round out the softest consecutive quarters of growth in consumer spending since the pandemic. The gain in June spending reflected a rebound in outlays for non-durable goods. Purchases of durable goods fell for a third month — the longest stretch since 2021 — and outlays for services were tame, indicating weak discretionary spending.

What Bloomberg Economics Says...

“Consumers are becoming more discerning in their spending habits — spending relatively more on necessities — as firms test how much of the tariff cost they can pass along.”— Stuart Paul and Estelle OuTo read the full note, click here

Underlying the weakness in spending is a cooling labor market. Real disposable income was flat after declining in May, while wages and salaries barely rose. The July jobs report due Friday is expected to show a continued moderation in hiring and a slight pickup in unemployment. The saving rate held at 4.5%.

Separate data Thursday showed initial applications for unemployment insurance were little changed last week. Another report showed labor cost growth rose 3.6% from a year ago, matching the lowest since 2021, reassuring Fed officials that the job market isn't a source of inflationary pressure.

Inflation in June was driven by a pickup in prices for goods, including household furnishings, sports equipment and clothes that indicates some pass-through of import duties to consumers. Last month's consumer price index also showed costs of commonly imported goods like toys and appliances rose firmly.

A key metric of services inflation that excludes energy and housing rose 0.2% for a second month.

The PCE inflation figures were largely known coming into this report, thanks to inputs from the CPI data, as well as details from the producer price index and quarterly figures in Wednesday's report on gross domestic product. Looking ahead, economists say there could be more upward pressure on inflation as Trump is expected to outline a new round of tariffs on Friday and a stock-market rally keeps a key PCE input elevated.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.

.jpg?im=FeatureCrop,algorithm=dnn,width=350)