- JPMorgan Private Bank favors shifting investments from China to Indian equities due to strong domestic support

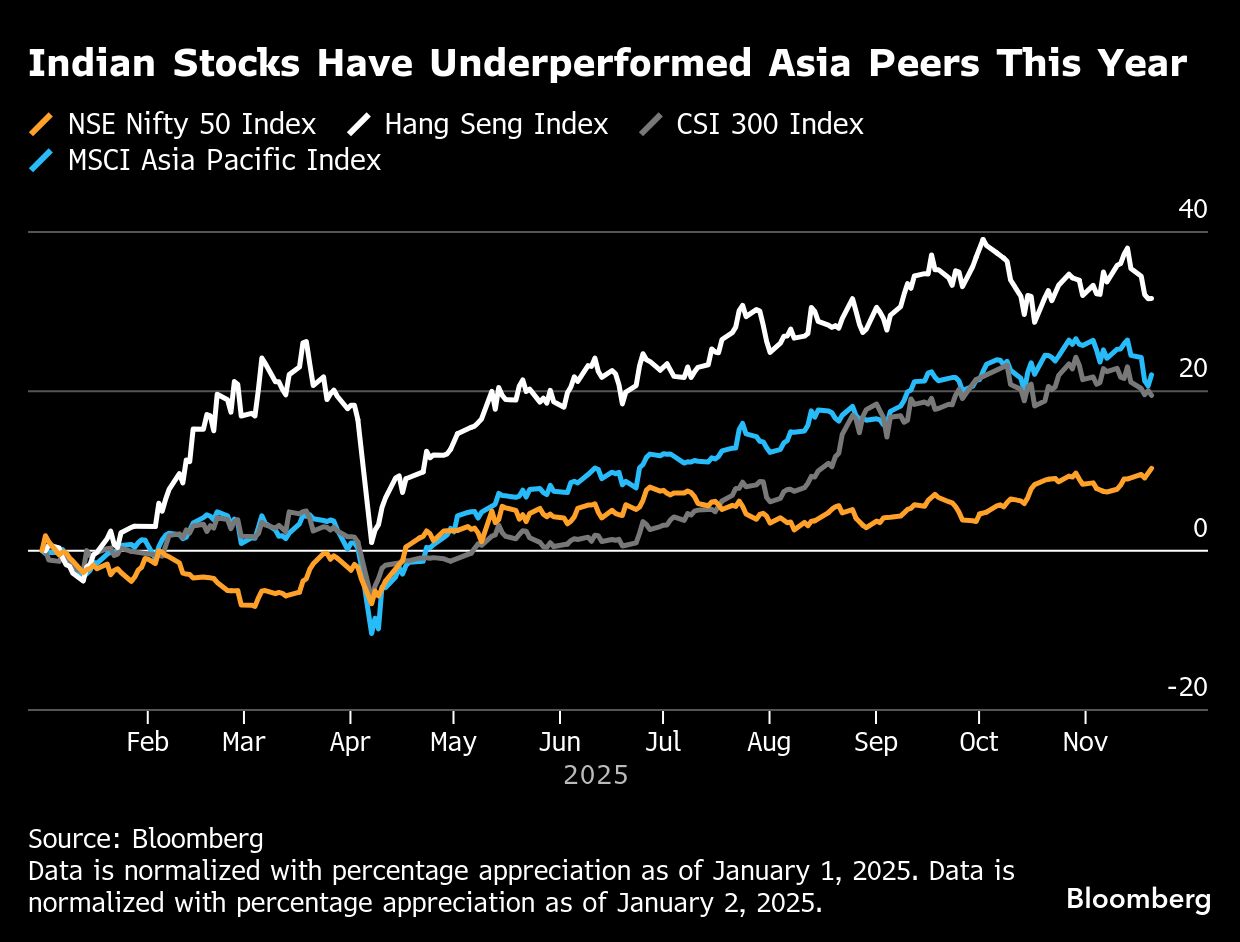

- Indian stocks have underperformed in 2025 despite a record high in the NSE Nifty 50 Index recently

- India’s GDP growth is projected at 6%-7% with earnings expected to rise in double digits

JPMorgan Private Bank said it favors rotating from Chinese equities into Indian stocks, arguing that the South Asian nation's strong domestic market and policy support offset its high valuations.

It is “a good time to switch into Indian equities since they have underperformed so much,” said Timothy Fung, head of Asia equity strategy at the bank in Hong Kong. With the Hang Seng index recently rising to four-year highs above 26,000, “we felt quite comfortable shifting our focus from China to India.”

China's market has rallied this year, fueled by excitement around DeepSeek and easing US-China relations. In contrast, India has lagged the region in 2025 by the widest margin in decades, though its benchmark NSE Nifty 50 Index briefly hit a record high on Thursday as global funds returned amid stronger corporate earnings. The Nifty fell 0.4% on Friday, outperforming its Asian peers that are reeling from a selloff in tech shares.

“With GDP growth projected at 6%-7% and earnings likely to rise in double digits, the case for rotating into India is gaining traction,” Fung said. “It's purely a valuation call,” he said, adding they would consider moving back into China if the Hang Seng falls to 24,000. The gauge closed little changed at 25,835.57 on Thursday.

Much of the optimism around India depends on the progress in trade talks with the US, especially as valuations remain elevated. The Nifty trades at about 21 times one-year forward earnings, well above the 12.5 times multiple for the Hang Seng.

Still, Fung is unfazed by India's premium, noting that “India has historically traded at levels above 20 times.”

Indian equities have shown unusual resilience in recent weeks, even as global markets wobbled. The Nifty is up almost 2% this month, compared with an around 4% drop in MSCI Inc.'s regional gauge, as investors position for a possible US-India trade deal.

India's trade minister said this week that a final agreement is expected soon after months of talks to cut 50% duties previously levied. Fung said that even with US tariffs in place, much of the country's growth is being fueled by local demand as production shifts from China. With Prime Minister Narendra Modi's party winning a crucial election victory in the state of Bihar, reforms are back on track, he added.

“India has been underperforming due to tariffs, and that gives a pretty good window to re-enter India as a trade,” Fung said. “Right now, the window is still open, and everyone is still underweighting India because they don't understand India like they understand the Chinese market.”

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.