India’s Monetary Policy Easing Wasn’t Very Impactful, Study Says

RBI’s policy responses to support the economy through the pandemic failed to reduce government’s borrowing costs by a lot: IGIDR

(Bloomberg) -- The Indian central bank’s conventional as well as unconventional policy responses to support the economy through the pandemic failed to reduce the government’s borrowing costs by a lot, says a new study.

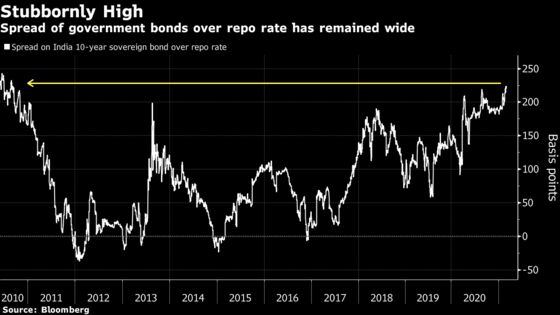

Policy actions by the Reserve Bank of India have had only a modest impact on the ‘term premium’ –- an indicator of the market’s expectations of future interest rates, according to the research authored by Rajeswari Sengupta of the RBI-funded Indira Gandhi Institute of Development Research in Mumbai, and Harsh Vardhan of the SP Jain Institute of Management and Research. There were limits to which monetary policy alone could provide an economic stimulus during a crisis, they wrote in the ‘Ideas for India’ portal.

The RBI was at the forefront of providing stimulus to the economy last year, while the Narendra Modi-led government followed with modest fiscal steps. The central bank cut interest rates by 115 basis points and injected billions of dollars through unconventional monetary policy to lower borrowing costs.

Those actions by the RBI did not have any discernible impact on the behavior of the term premium -- the compensation investors demand for holding longer-term debt -- especially during the pandemic period, wrote the authors who used inter-bank call rates as well as one-year T-bills yield to measure the premium. At best, the RBI stopped a sharp spike such as the one witnessed after the global financial crisis, they said.

“This implies that concerns of large fiscal deficits, high inflationary expectations, and the resulting likelihood of high future interest rates could possibly have been the more important drivers of term premium,” Sengupta and Vardhan wrote.

Their view chimes with that of Jayanth R Varma, a member of the RBI’s Monetary Policy Committee, who said higher term premiums revealed a lack of market confidence in the central bank’s inflation estimates.

Sengupta and Vardhan also wrote:

- The RBI’s long-term repo auctions, or LTRO, for providing 1.6 trillion rupees ($22 billion) of cheap funds to lenders between last September and November fell short, given term premium was fairly stable at around 250 basis points afterwards

- The effect was the same for Operation Twist -- where the RBI buys long-dated bonds and sells shorter maturities to keep a handle on the yield curve and term premiums

- “When measured over call rate, the average decline in term premium before and after OT was just three basis points. On the other hand, when measured over the yield of 1-year T-bills the term premium increased by one basis point.”

©2021 Bloomberg L.P.