Huawei’s Clout Is So Strong It’s Helping Shape Global 5G Rules

Security officials are concerned China’s government and Huawei Technologies are taking a bigger role in the technical groups.

(Bloomberg) -- The future of the 5G technology that promises to revolutionize telecommunications runs through international bodies with esoteric names such as the 3rd Generation Partnership Project and the International Telecommunication Union.

The organizations set standards for the emerging technology. But security officials are concerned China’s government and Huawei Technologies Co. are taking a bigger role in the technical groups, lending a competitive edge to a company under indictment in the U.S.

As of September, Chinese firms and government research institutes accounted for the largest number of chairs or vice chairs in the International Telecommunication Union’s 5G-related standards-setting bodies, holding eight of the 39 available leadership positions, according to the U.S.-China Economic and Security Review Commission that advises Congress. By comparison, mobile provider Verizon Communications Inc. is now the only U.S. leadership representative, according to the commission.

“Having a socialist government basically in charge right now is incredibly problematic for U.S. goals, and 5G specifically,” Michael O’Rielly, a member of the U.S. Federal Communications Commission, said in an interview. “They have loaded up the voting to try to get their particular candidates on board, and their particular standards.”

Huawei, China’s largest technology company, has been the target of a broad crackdown by U.S. officials, who say the company’s telecommunications equipment could be used by China’s Communist Party for spying. U.S. prosecutors filed criminal charges Jan. 28 alleging Huawei stole trade secrets from an American rival and committed bank fraud by violating sanctions against doing business with Iran.

Huawei denies the charges and rejects suggestions it poses a security risk or is beholden to Beijing. It also asserts the innocence of Chief Financial Officer Meng Wanzhou, who was arrested on sanctions charges in Vancouver and faces extradition to the U.S.

On standards-setting, Huawei has worked with other companies, Andy Purdy, USA chief security officer for the company, said in an interview.

“Industry has been working hard with a lot of visibility as they’ve evolved from 4G to 5G to make sure there’s a very strong consensus standards-based approach,” Purdy said.

There’s no clear way for a nation to influence standards-setting in a way that would harm U.S. security, Doug Brake, director of broadband and spectrum policy at the Information Technology & Innovation Foundation, said in an interview.

“There’s been a lot of consternation over the past few years over Chinese participation in the standard-setting bodies,” Brake said. “You can’t really sneak something into the standard developed through 3GPP since it’s an open process. We should be encouraging China to participate in global standards.”

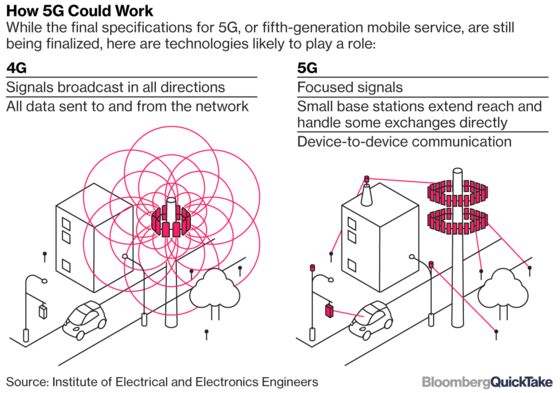

U.S. officials up to the White House level make no bones about the stakes as communications jumps from the current 4G, or fourth generation, technology to fifth-generation 5G that will feature always-on, ubiquitous connections with billions of sensors and controls. It will connect everything from banks and cars to factories and phones.

The U.S. gained from being a 4G leader, and “and we are working hard to maintain our advantage as we shift to and expand towards 5G," Michael Kratsios, deputy assistant to President Donald Trump for technology policy, said at a conference Jan. 29 in Washington. “The risk of losing American market leadership cannot be overstated.”

Standards are set by bodies such as the 3GPP -- the 3rd Generation Partnership Project, which unites seven telecommunications standards development organizations -- and the International Telecommunication Union, or ITU, a United Nations agency.

The ITU is headed by Houlin Zhao, the first Chinese official to be elected secretary-general of the group. Richard Li of Huawei is chairman of a group examining emerging technologies and 5G.

Patents, Too

“Huawei has been aggressive in standards-setting bodies” and in securing patents that other companies need to honor, Michael Wessel, a commissioner on the U.S.-China commission, said in an interview. “That creates vulnerabilities that have law enforcement as well as the intelligence community on guard.”

U.S.-based chipmakers Qualcomm Inc. and Intel Corp. are among companies competing to develop 5G technology, as are Huawei and fellow Chinese manufacturer ZTE Corp. Trouble for Huawei could benefit rivals in the 5G network gear market, including Sweden’s Ericsson AB and Finland’s Nokia OYJ, according to a Dec. 7 note note by Bloomberg Intelligence analysts Woo Jin Ho and John Butler.

“I’m really concerned about standard-setting,” the FCC’s O’Rielly said. “Skewed standards that lean toward Chinese companies should be incredibly problematic, because it’s at the expense of domestic and international partners that U.S. companies are involved with.”

Qualcomm Leads

The ITU assembles government representatives and companies. The 3GPP gathers company executives, and China has been active there, too. The number of Chinese representatives serving in chair or vice chair leadership positions rose from 9 of 53 available positions in 2012, to 11 of 58 available positions in 2017, according to the U.S.-China commission.

In these roles, Chinese companies can set the agenda and guide standards discussions, the commission said in a report. Still, Qualcomm leads the most important 5G standards-setting group after beating Huawei for the position in a 2017 vote.

“The Chinese go more with the goal of driving a standard that will advantage what they’re doing,” Wessel, of the U.S.-China commission, said.

U.S. officials cited fear of losing ground in the standards race last year as they squelched a hostile bid for Qualcomm from Broadcom Inc.

Qualcomm’s expertise and research spending drives U.S. leadership in standard-setting bodies, and weakening its position “would leave an opening for China to expand its influence on the 5G standard-setting process,” the U.S. Treasury Department said in a letter that signaled Trump administration hostility to the deal.

Skeptical of Threat

“China would likely compete robustly to fill any void left by Qualcomm as a result of this hostile takeover,” Deputy Assistant Secretary Aimen Mir said in the letter. “Given the well-known U.S. national security concerns about Huawei and other Chinese telecommunications companies, a shift to Chinese dominance in 5G would have substantial negative national security consequences for the United States.”

Qualcomm has about 15 percent of patents essential for 5G networks, and Chinese companies have about 10 percent, said Michael Murphree, an assistant professor of international business at the University of South Carolina.

“There’s a lot of money at stake” since manufacturers pay fees to patent-holders, Murphree said. If 5G “incorporates a large amount of Huawei patents -- then it doesn’t matter if you buy Huawei equipment or not, you still have to pay to use Huawei patents.”

Murphree was skeptical of the idea Huawei could pose a threat via standards accretion.

“Huawei is not at all going to control the standards as such,” Murphree said. “No single company or single country ever controls all the standards” that are forged by a mix of advanced-economy participants.

To contact the reporters on this story: Todd Shields in Washington at tshields3@bloomberg.net;Alyza Sebenius in Washington at asebenius@bloomberg.net

To contact the editors responsible for this story: Jon Morgan at jmorgan97@bloomberg.net, Elizabeth Wasserman

©2019 Bloomberg L.P.