Gold rose for a second day as investors weigh President Donald Trump's tax bill, which is expected to further expand US deficits.

Bullion gained as much as 1.7%, further paring its losses in the past two weeks, while US stocks edged lower and the dollar was near three-year lows. The US Senate passed the bill that combines $4.5 trillion in tax cuts with $1.2 trillion in spending reductions.

The US government pushing through the spending bill means that “fiscal risks are likely to come to the fore,” analysts at Commerzbank AG said in a note, potentially benefitting gold's haven asset appeal.

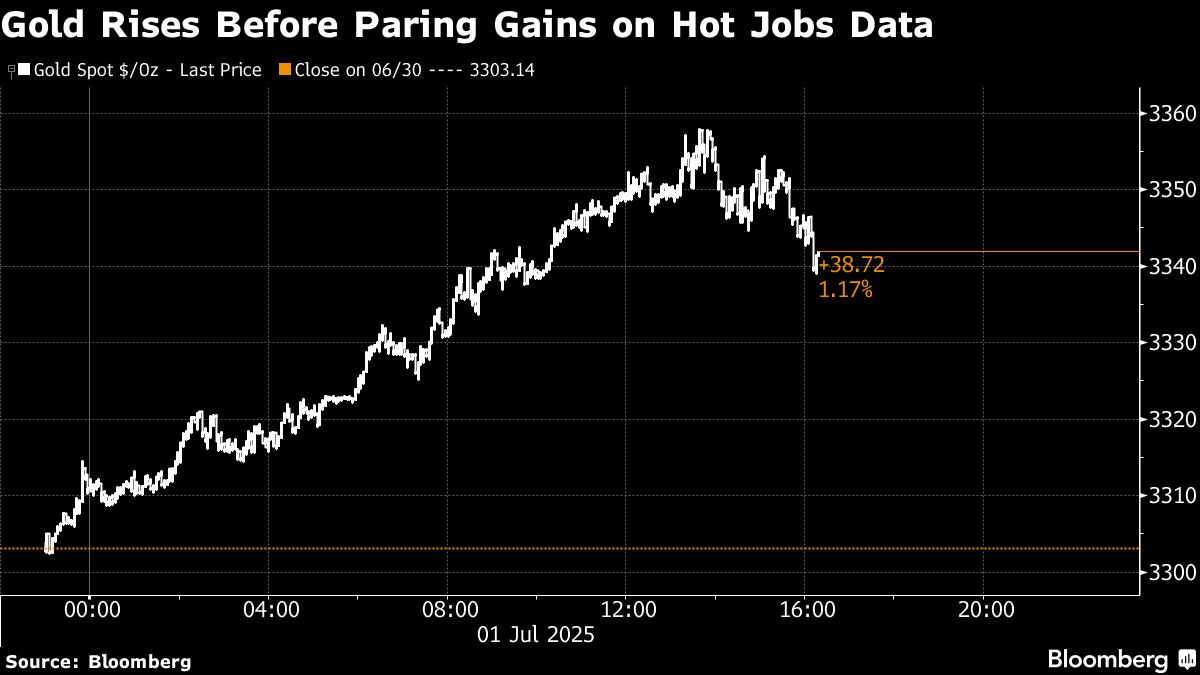

Gold's gains eased slightly after US jobs data came in hotter than expected, reducing the outlook for monetary easing that tends to benefit the non-interest bearing precious metal. The S&P 500 dipped after a rally that drove stocks to successive all-time highs.

Gold is up by more than a quarter this year, trading about $160 short of April's record, supported by elevated trade and geopolitical risks. Uncertainty over the long-term impact of Trump's tariff and fiscal agendas on the economy saw a gauge of the dollar drop almost 11% in the first six months of year, the worst performance since 1973. That makes gold cheaper for buyers in most other currencies.

“Gold, despite its recent losses, has the most potential to gain in the short term if the US dollar continues to decline,” Commonwealth Bank of Australia analyst Vivek Dhar said in a note.

Spot gold was up 1.2% to $3,342.65 an ounce at 12:40 p.m. in New York. The Bloomberg Dollar Spot Index was flat, after falling 0.5% Monday.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.