(Bloomberg) -- The European Central Bank lowered interest rates for a third consecutive meeting, signaling more reductions next year as inflation nears 2% and the economy struggles.

The deposit rate was cut by a quarter-point to 3% — as predicted by all but one analyst in a Bloomberg survey. That brings total easing since June to 100 basis points.

Indicating its shifting stance, the ECB's statement dropped wording saying policy will remain “sufficiently restrictive” for as long as necessary.

“The Governing Council is determined to ensure that inflation stabilizes sustainably at its 2% medium-term target,” the ECB said Thursday. “It will follow a data-dependent and meeting-by-meeting approach to determining the appropriate monetary-policy stance.”

The euro fell 0.2% to a session low $1.0470, with investors focusing on the omitted reference to keeping rates “restrictive.” Traders are betting on about 125 basis points more of easing next year, broadly in line with pricing before the announcement.

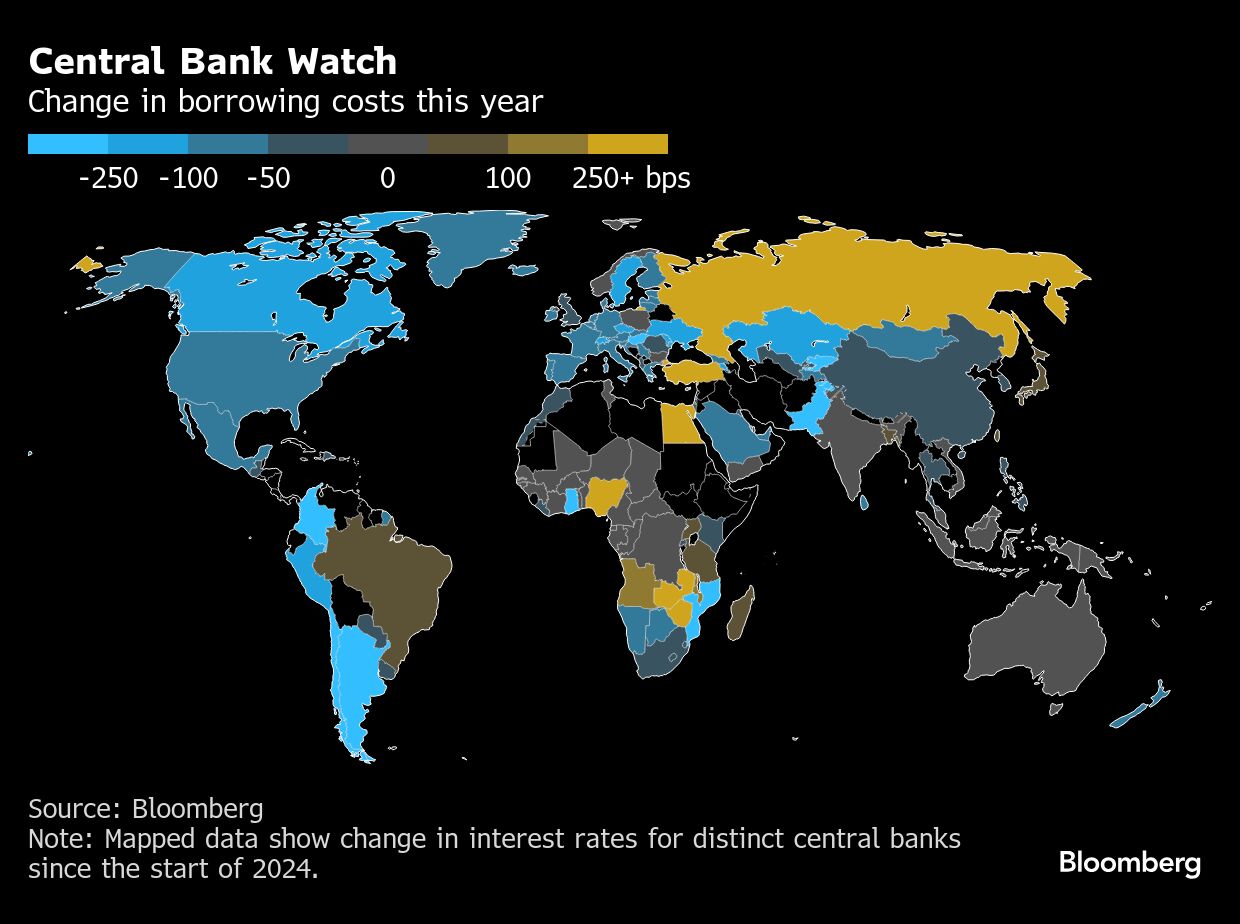

Despite no firm commitment, back-to-back decreases in borrowing costs are widely expected to continue through mid-2025 as Europe's already sluggish economy endures political upheaval in Germany and France, plus a potential jolt to global trade from Donald Trump's return to the US presidency.

The fear is that sub-par growth drags inflation — currently 2.3% — below target, recalling the pre-Covid era when the focus was more on perking up prices than restraining them.

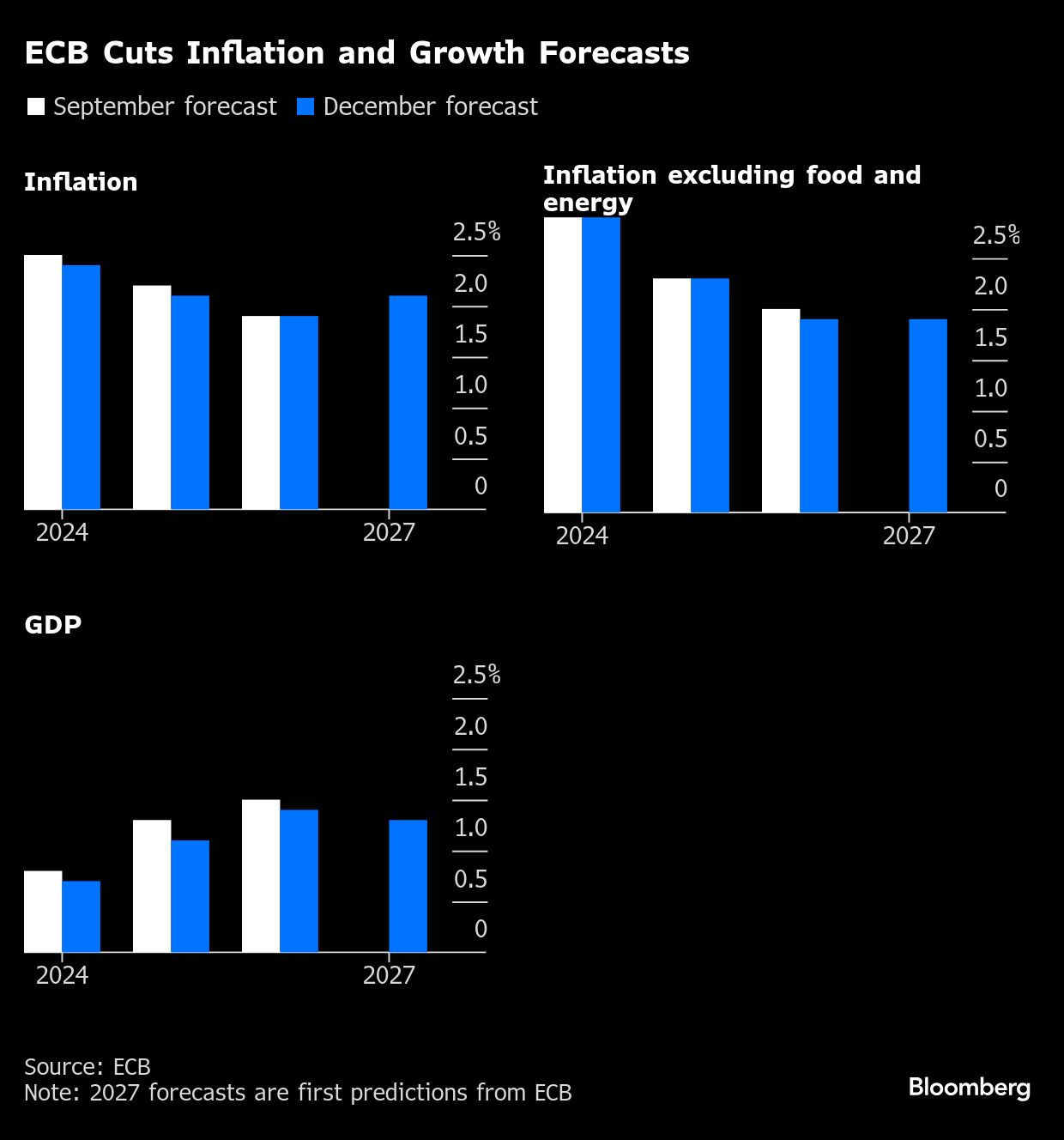

New quarterly projections from the ECB, published Thursday, reflect the fragile backdrop, revising down the outlook for economic expansion and inflation next year.

Dangers to growth remain tilted to the downside, according to President Christine Lagarde, who pointed to waning momentum in the 20-nation euro zone.

“The economy should strengthen over time, although more slowly than previously expected,” she told a press conference in Frankfurt. “The risk of greater friction in global trade could weigh on euro-area growth by dampening exports and weakening the global economy.”

Lagarde isn't the only central-bank chief overseeing rate decreases. Earlier Thursday, the Swiss National Bank followed Wednesday's decision by the Bank of Canada to cut by 50 basis points. The Federal Reserve, meanwhile, will probably do likewise next week after data Wednesday showed US inflation for November in line with expectations.

The run-up to this week's ECB meeting was dominated by concerns over Europe's outlook. While growth unexpectedly quickened in the third quarter, recent data signaled a deterioration, particularly in the services sector, which had for most of the year been offsetting long-running weakness among manufacturers.

That's ignited debate over how far the ECB should lower borrowing costs, and how effective such monetary easing would be at a time when many challenges facing the bloc — like labor shortages and higher energy costs — are structural.

What Bloomberg Economics Says...

“Our base case is that the ECB feels its way toward a neutral policy stance next year, with the pace of cuts slowing after 1Q25. However, as inflation continues to decelerate and threats to the economy persist, the risk is skewed toward back-to-back cuts all the way to 2%.”

—David Powell, senior euro-area economist. Click here for full REACT

Economists see rates settling at 2%, while investors reckon a more aggressive campaign will leave them at 1.75%. If markets are right, that would probably result in policy turning stimulative by falling below so-called neutral levels.

Italy's Fabio Panetta and France's Francois Villeroy de Galhau aren't ruling out venturing into expansionary territory. But Executive Board member Isabel Schnabel and Bundesbank President Joachim Nagel have warned against pushing too far.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.