A largely benign US inflation report is bolstering the case for traders wagering that the Federal Reserve will soon cut interest rates, with some seeing an increased possibility of an outsize reduction.

Bets that the Fed will start bringing down borrowing costs next month gained momentum, with interest-rates swaps lifting the odds of a cut in September to around 95%. Treasuries gained across the maturities, with the yield on the 10-year note falling six basis points to 4.23% early afternoon in New York.

“The market tone has shifted to easing mode,” said Angelo Manolatos, a rates strategist at Wells Fargo. “While the CPI report was far from a slam dunk for the Fed, it does keep the central bank on track to cut in coming months.”

Earlier Wednesday, Treasury Secretary Scott Bessent urged policymakers to use the September meeting to kick off a cutting cycle.

“We could go into a series of rate cuts here, starting with a 50 basis point rate cut in September,” Bessent said in a television interview on Bloomberg Surveillance Wednesday. “We should probably be 150, 175 basis points lower.”

For weeks, investors have piled into swaps, options and outright Treasury longs to wager that subdued inflation and weakness in the labor market will allow the Fed to start cutting.

It's a view that has gained momentum from recent economic releases showing July consumer prices were largely in line with expectations while the US labor market showed surprise weakness in recent month.

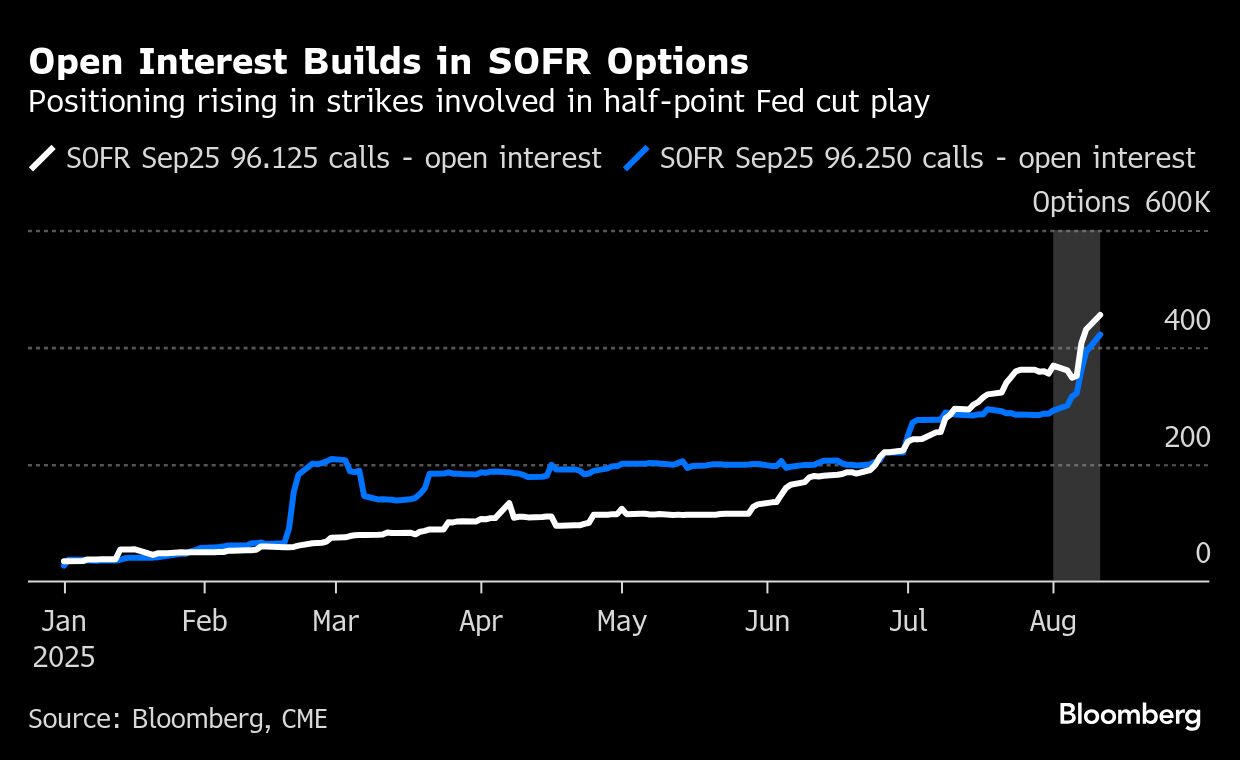

That's also helped fuel bets that the Fed will reduce rates by more than 25 basis points in September. Traders added some $2 million in premium on Tuesday to a position in the Secured Overnight Financing Rate (SOFR) that would benefit from such a move.

The inflation report “was a bit stronger than we have seen over the prior few months, but lower than many have feared,” said Rick Rieder, chief investment officer of global fixed income at BlackRock, in a note. “As a result, we expect the Fed to begin cutting rates in September, and it could be justified cutting the Funds rate by 50 basis points.”

Tuesday's report was far from an all-clear for the Fed. Though a tepid rise in the costs of goods tempered concerns about tariff-driven price pressures, underlying US inflation accelerated in July by the most since the start of the year.

With more than a month remaining until the central bank's September 16-17 meeting, Treasury bulls will also need to weather another major inflation report as well as key employment data.

“September is not a done deal,” Claudia Sahm, chief economist at New Century Advisors, said on Bloomberg TV. “We do not have the data that puts this one in the bag yet.”

For now, however, bets on a dovish Fed are taking the spotlight. The options trade linked to SOFR September contracts — where premium now stands at roughly $5 million — could pay off as much as $40 million should they price in a 50 basis point rate cut for that month, Bloomberg calculations showed.

Meanwhile in the cash market, investors unwound long positions in the build-up to the inflation data, shown by a survey of JPMorgan Treasury clients covering the week up to Aug. 11.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.