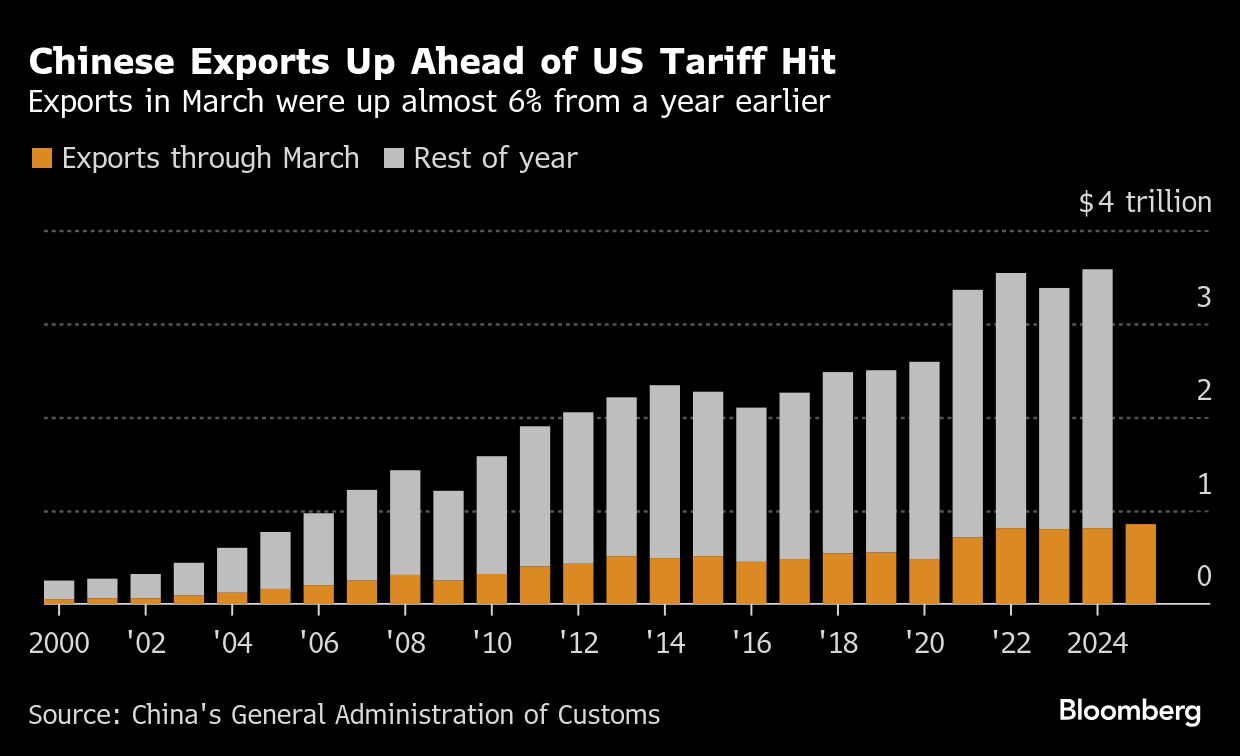

China's exports rebounded in March ahead of the massive tariff hikes imposed against it by the US this month, with near-record shipments flowing to Southeast Asia.

Exports in dollar terms far exceeded forecasts and soared 12.4% from a year earlier, the customs authority said Monday, reversing a decline of 3% in February. The value of sales abroad was higher than every estimate in a Bloomberg survey of analysts, whose median was 4.6%.

Imports shrank 4.3%, leaving a trade surplus of $103 billion last month.

The export surge supported the economy in the first quarter, but that boost may dissipate after the US threw global trade into chaos. The Trump administration put tariffs of higher than 100% on many Chinese exports, provoking a retaliation by Beijing.

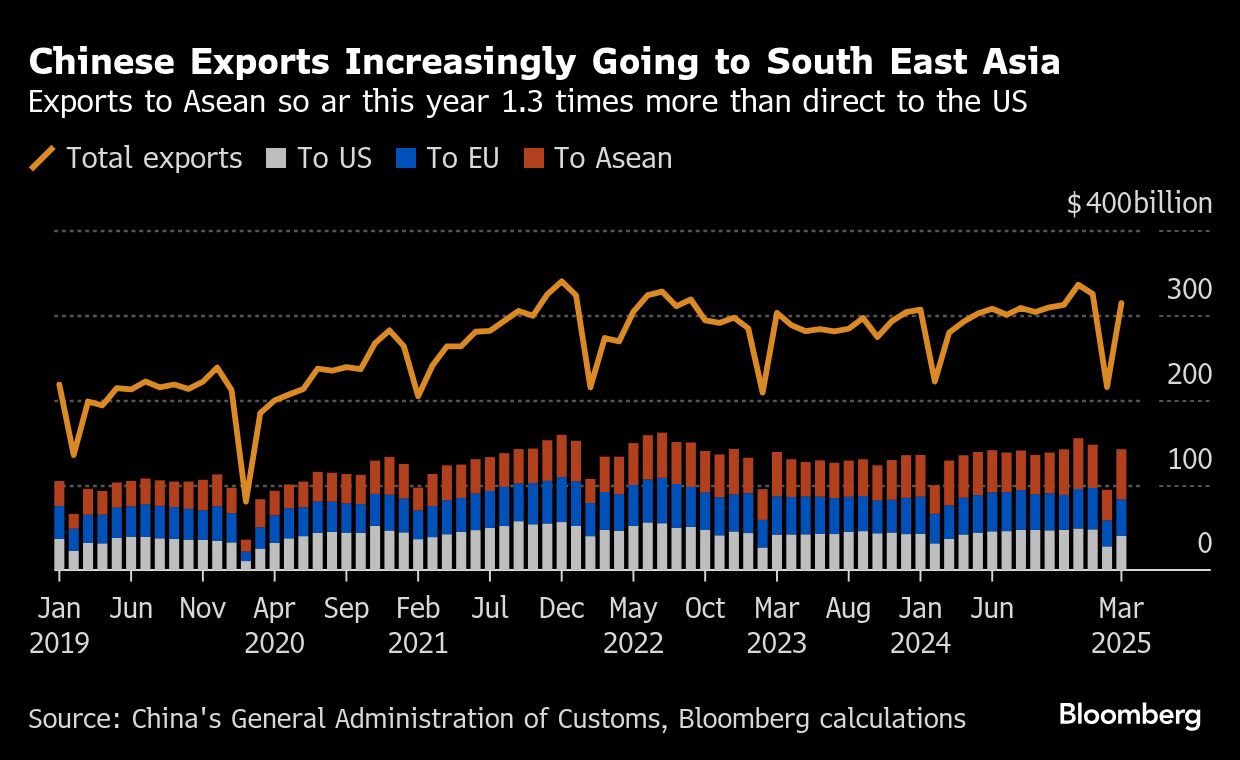

In March, many companies were likely frontloading orders to get ahead of tariffs. What's more, the latest figures suggest companies are diverting shipments to countries across Southeast Asia, with China's exports to the region reaching the second-highest ever.

Exports to Vietnam and Thailand soared to records, while sales to the US grew more than 44% from February to exceed $40 billion last month. Exports to the US almost 9% in March from a year ago, after dropping in February.

At the same time, the drop in imports reflects sluggish demand at home, a worry as China's export engine comes under pressure. China will report first-quarter economic growth on Wednesday, with gross domestic product forecast to expand 5.2%, according to a Bloomberg survey.

Newly-added US duties on Chinese goods this year hit 145% — well above the levels analysts have said would decimate bilateral trade — before the US decision to exempt certain consumer electronics from its so-called reciprocal tariffs.

Donald Trump downplayed his exemptions on Sunday, pledging still to apply tariffs to phones, computers and popular consumer electronics.

Chinese stocks were on track to gain for a fifth session, partly as the US tariff exemption offered investors some respite. The Hang Seng China Enterprises Index rose as much as 2.7%, while the CSI 300 Index for onshore shares climbed as much as 0.7%.

What Bloomberg Economics Says...

“China's trade data for March has yet to reflect the full impact of the trade war. US buyers may have rushed to ship in goods before higher tariffs started in April, pushing exports up sharply. Going the other way, domestic producers appear to have reduced purchases due to concerns about a potential drop in external demand and still-soft domestic consumption. Looking ahead, exports may face strong headwinds in April.” — David Qu.

The fallout of America's economic divorce with China will likely begin to be felt from this month, with little sign that the two sides are willing to back down and reduce their tariffs.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.