President Xi Jinping's government reached last year's 5% growth target, a well-telegraphed victory that came as little surprise. But a closer look at the numbers reveals a reliance on trade that's set to inflame US ties.

Hours before the official data arrived for China's fourth quarter, Scott Bessent — Donald Trump's pick for Treasury secretary — accused the Chinese of “attempting to export their way out” of what he called “a severe recession, if not depression.”

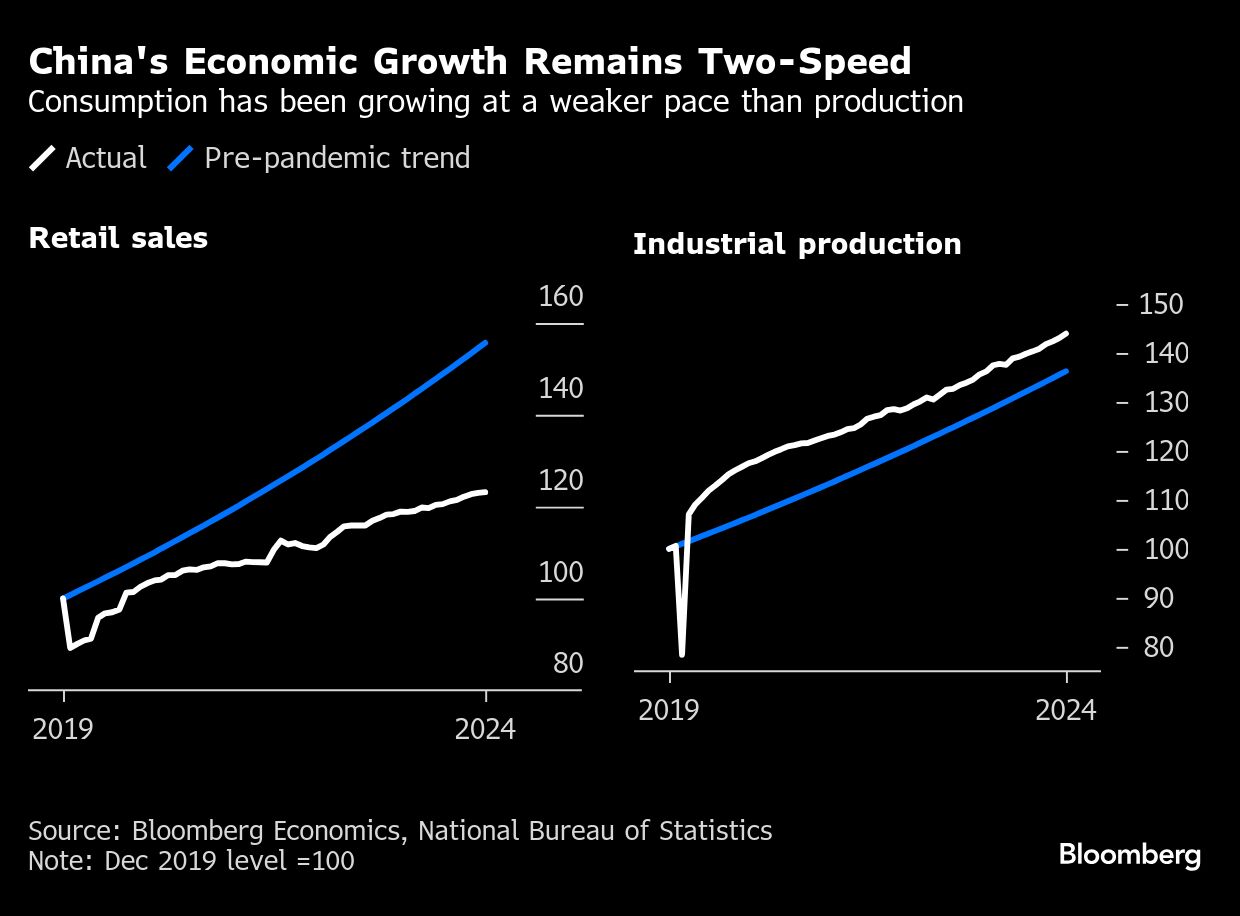

The snapshot that emerged on Friday from the National Bureau of Statistics showed China's two-track economy continued to be powered by trade while consumer spending remained muted. That will hardly quiet the voices egging on the US president-elect to embark on a new round of the trade war even at the risk of upending global commerce.

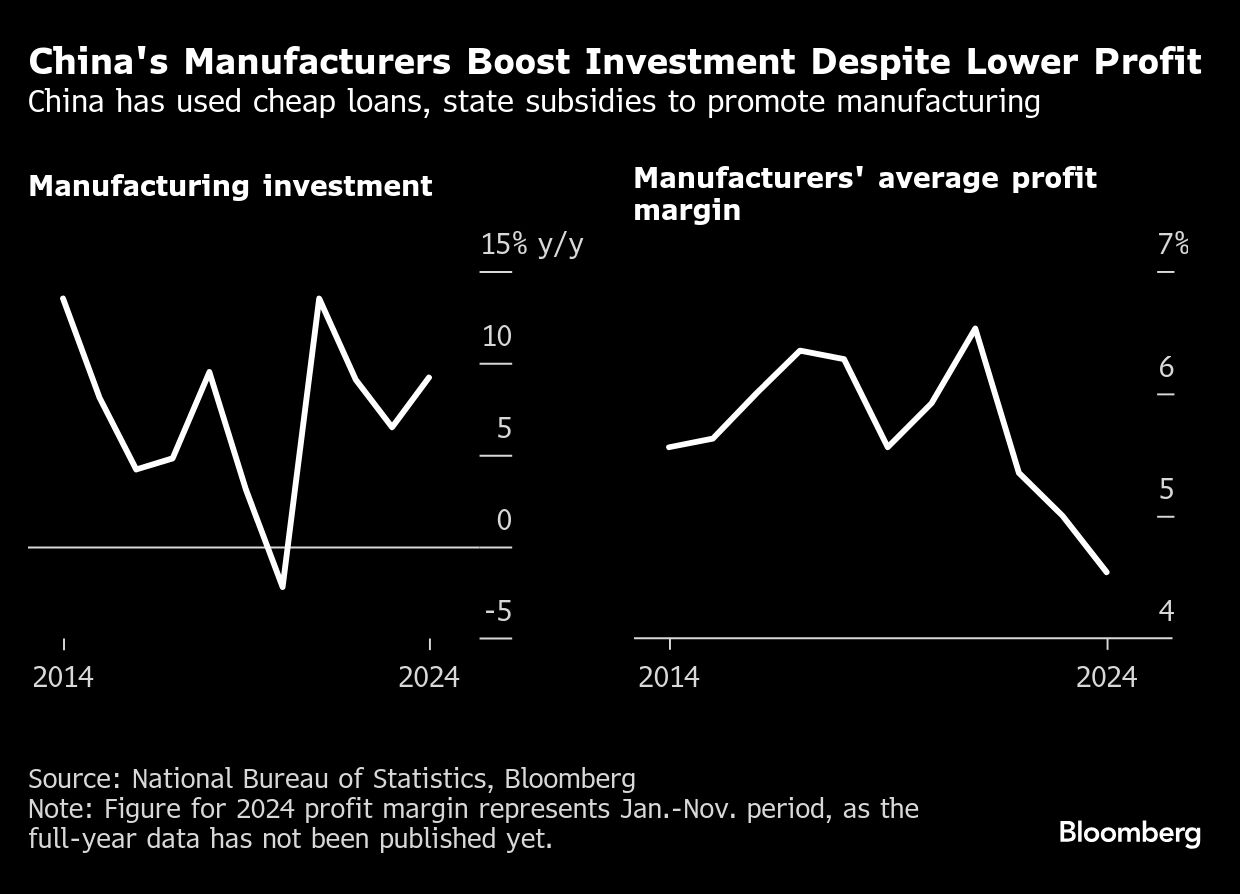

The Chinese economy that Trump's team will soon confront just ended last year having relied on its industrial heft and manufacturing dominance abroad to ride out a mid-year slowdown. Manufacturing investment climbed 9.2% from a year ago, the fastest pace in three years, even as the sector's profit margin plunged to the lowest for the first 11 months of the year since data began about a decade ago.

During the final three months of 2024, gross domestic product clocked the fastest growth in six quarters — enough for the statistics bureau to say “the economy rebounded remarkably.”

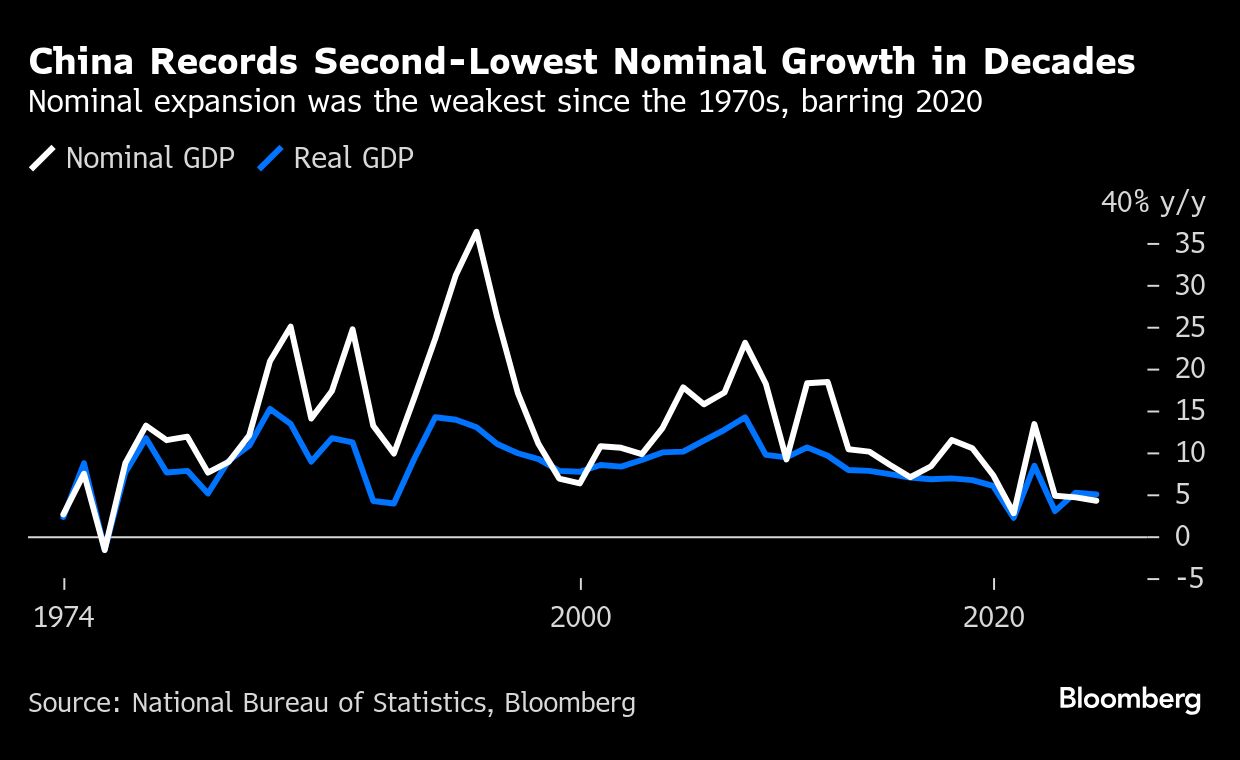

Behind the numbers, however, was a widening divergence between nominal and real expansion, a result of entrenched deflation that reflects the chronic weakness of China's domestic demand and remains the biggest flaw holding back the world's no. 2 economy.

Nominal GDP growth — unadjusted for price changes — slowed to 4.2% in 2024, the second-weakest pace since China began transitioning to a market economy in the late 1970s. In a world still awash in inflation, prices across China fell 0.8% last year and are expected to decline again in 2025 for the third straight year — the longest streak in decades.

“The biggest question for 2025 is whether China will have higher inflation, and that completely depends on how much stimulus will be rolled out,” said Larry Hu, head of China economics at Macquarie Group Ltd.

Weak nominal growth is a problem because it implies a sluggish expansion in workers' wages and company earnings, which in turn weighs on consumer spending and corporate investment. Together, they result in frail domestic demand that fails to absorb a stream of industrial output at home, sending prices down and exports soaring.

The result is a trade surplus that soared near an unprecedented $1 trillion last year, prompting a wave of protectionist countermeasures across the globe. It's an outcome so lopsided that Bessent decried China as “the most imbalanced economy in the history of the world” on Thursday during a US Senate hearing.

While some of Bessent's claims appear to be false — the economy is still expanding even by independent estimates, and prices across China fell far less than the figure he cited — it's undeniable that the country's leaders have acknowledged domestic demand is insufficient. Increasingly, they also allude to deflation as a concern, although they don't yet directly use that word.

But they have so far made limited efforts to reverse course, especially as exports surged on front-loaded orders ahead of Trump's inauguration.

The prospect of US tariff hikes under Trump means the same playbook may not work for Beijing if it wants to keep the economy chugging along in 2025. Xi discussed trade with the incoming US leader in a phone call Friday, with Trump describing the overall conversation as a “very good one.”

What Bloomberg Economics Says...

“China hit its full-year GDP expansion target but that cannot gloss over the weak growth momentum at the end of 2024. Production improved marginally in December, re-asserting itself as a growth driver. Investment – a typical lever for government support — further decelerated. The most noticeable weakness is seen in consumption, which continued to languish at a historically low pace.”

— Chang Shu, chief Asia economist, and David Qu, economist. For full analysis, click here

Senior officials signaled the focus of their stimulus will shift more toward consumption after long being preoccupied with investment. They also pledged to step up support to the economy via efforts including a bigger consumer product trade-in program, more government borrowing and spending, along with interest rate cuts.

What's in doubt is whether those measures are bold enough to rekindle confidence or fill a hole left by the shrinking property sector, whose travails wiped out an estimated $18 trillion in wealth from households.

“The fall in spending on property by roughly half since the peak in 2021 represents a huge drop in domestic demand, which cannot be easily replaced by more spending on consumer goods or government investment,” said Duncan Wrigley, chief China economist with Pantheon Macroeconomics.

A peek under the hood of the economy reveals China's economic lopsidedness is growing worse.

Industrial firms only utilized 75% of their capacity on average last year, the least since 2020. Household wages expanded 5.8% from a year ago in 2024, far behind gains of 9% seen before the pandemic. And the official data likely didn't fully capture labor market pains, with alternative data suggesting widespread pay cuts.

Another drag on growth was the slump in foreign companies investing in China, which last year hit the least in almost a decade. Non-financial foreign firms invested about 826 billion yuan ($113 billion) in China last year, the lowest total since 2016.

It's a mixed picture that helps explain why the economy feels colder for many observers than what the headline 5% growth figure would suggest. And what's more, long-standing suspicion toward the official growth figures is surfacing again.

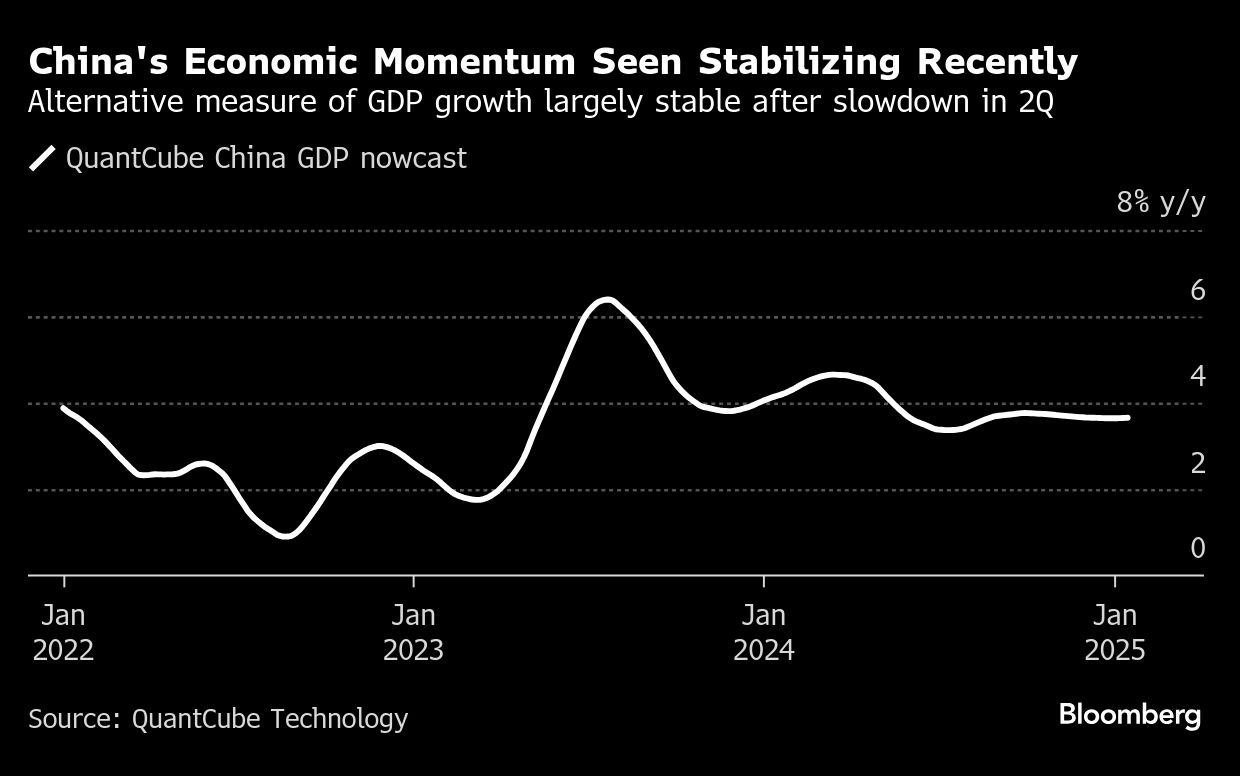

Pantheon Macroeconomics estimates China's GDP expanded only 4.3% in real terms last year. An assessment from Paris-based QuantCube, an alternative economic data provider, shows the economy grew around 4% at the end of 2024 and early this year, after rebounding from a trough in the second quarter.

Rhodium Group puts last year's expansion at 2.4% to 2.8%, due to its much lower evaluation of investment growth and household consumption than implied in the official figures.

TS Lombard said in a Jan. 17 note that the country's GDP expanded 4.9% in the fourth quarter and 4.6% for the full year. The research institute has upgraded its China growth forecast for 2025 to 4.7% from 4.5%.

For now, one thing is certain: Beijing will need to do more if it wants to get the Chinese consumer spending and avoid the full wrath of Trump's tariff tornado.

The economy is in need of “a major policy package that will lift everybody's expectation,” according to Helen Qiao, chief Greater China economist at Bank of America Global Research.

“They tried to do that in September, and the steam is a little bit lost by now,” Qiao said in an interview with Bloomberg TV. “So maybe there will be a time, by about March or April, that they need to do more.”

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.