US job growth remained solid in April, illustrating healthy labor demand entering a period when tariffs have a greater risk of tempering hiring decisions.

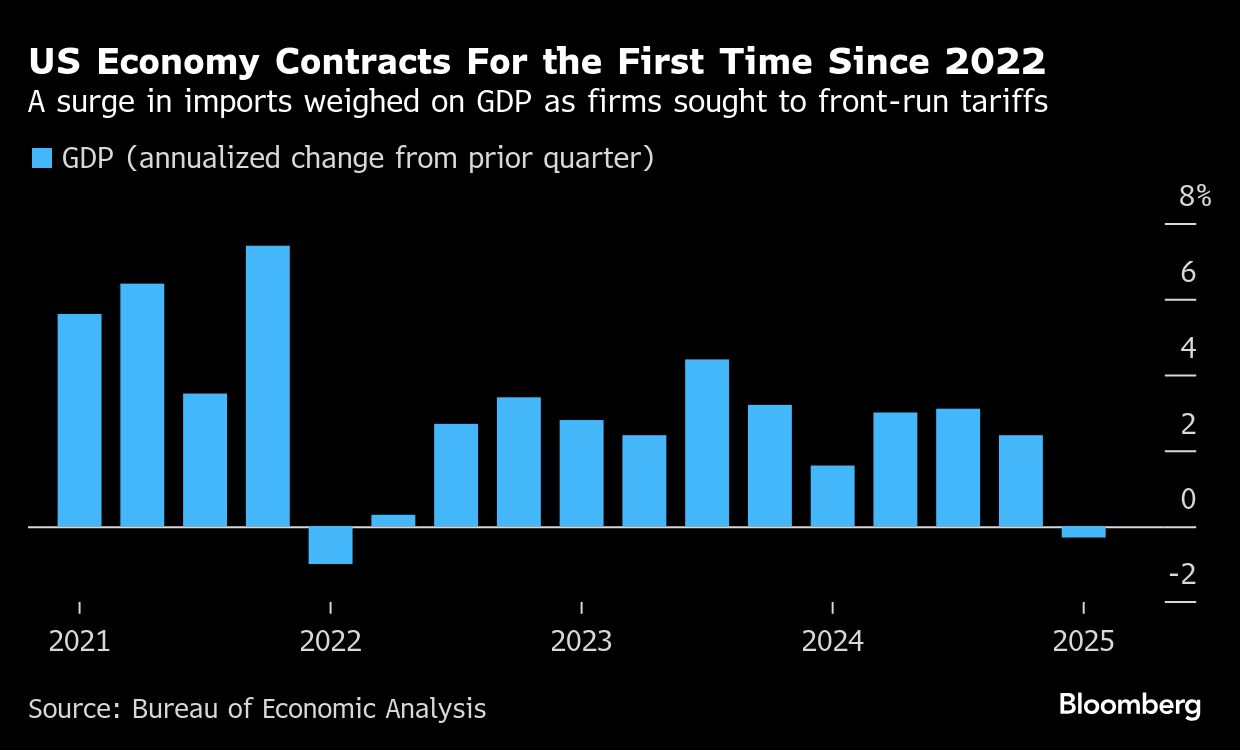

The stronger-than-expected advance in payrolls partly reflected stepped up hiring of transportation and warehousing workers needed to handle a recent flurry of imported goods. Net exports in the first quarter managed to subtract a record 5 percentage points from gross domestic product and caused the first economic contraction since 2022.

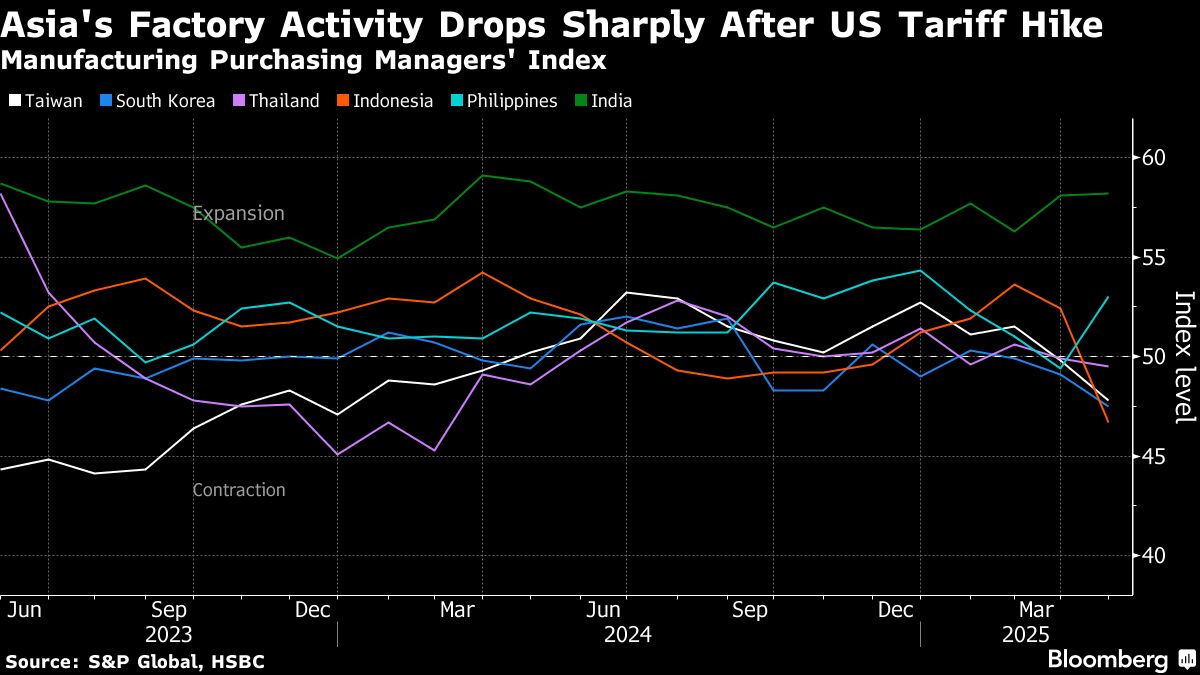

US trade policy is reverberating across the globe in the form of declining manufacturing activity, purchasing managers reports showed.

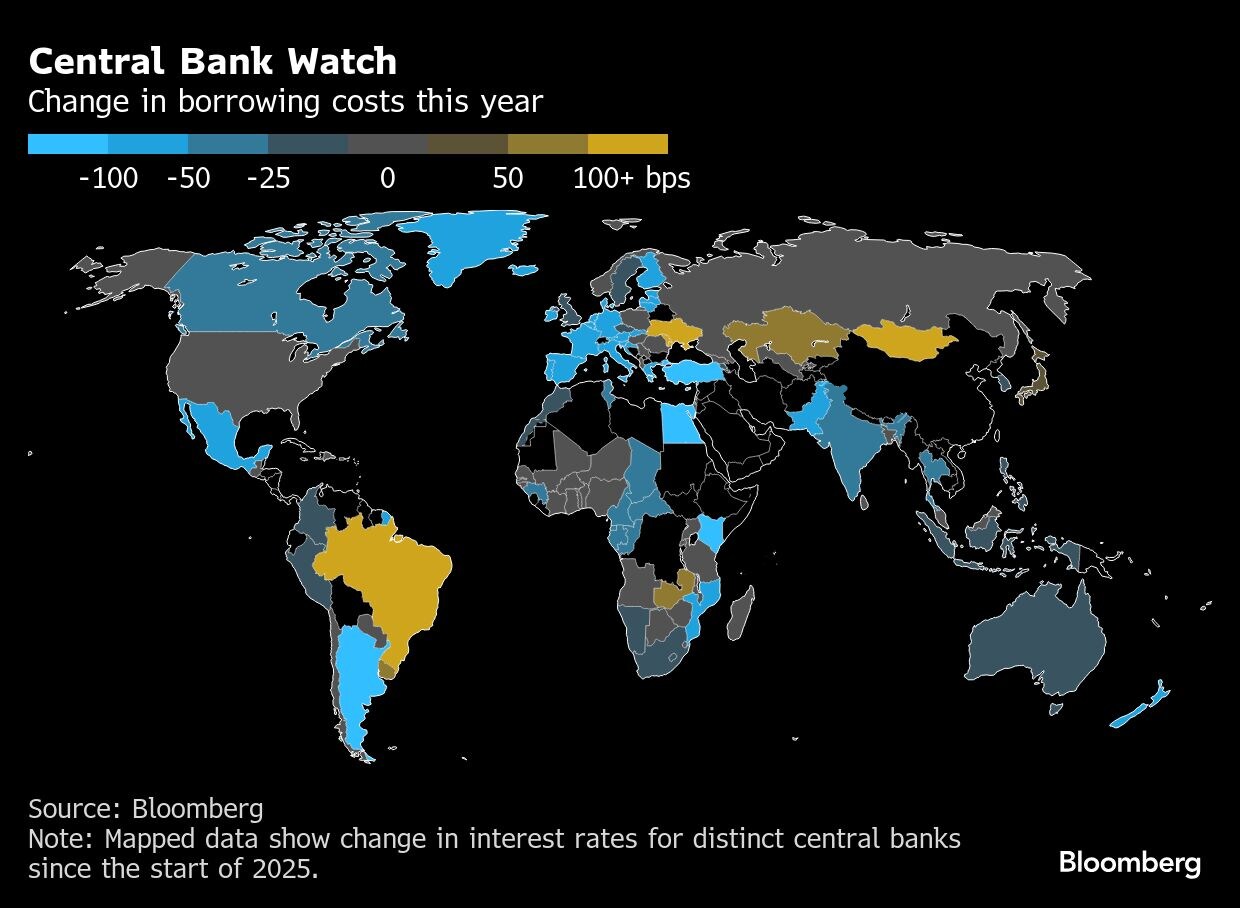

In Asia, the Bank of Japan held interest rates steady, while pushing back the timing for when it expects to reach its inflation target and slashing its growth forecasts as the global trade war darkens the economic outlook.

Here are some of the charts that appeared on Bloomberg this week on the latest developments in the global economy, markets and geopolitics:

US & Canada

US job growth was robust in April and the unemployment rate held steady despite deep uncertainty over President Donald Trump's trade policies, which economists expect will dent hiring plans over the coming months.

The US economy contracted at the start of the year for the first time since 2022 on a monumental pre-tariffs import surge, a first snapshot of the ripple effects from Trump's trade policy. Excluding trade and inventories, which can sometimes distort overall GDP, so-called final sales to private domestic purchasers increased at a 3% pace after rising an annualized 2.9% at the end of 2024.

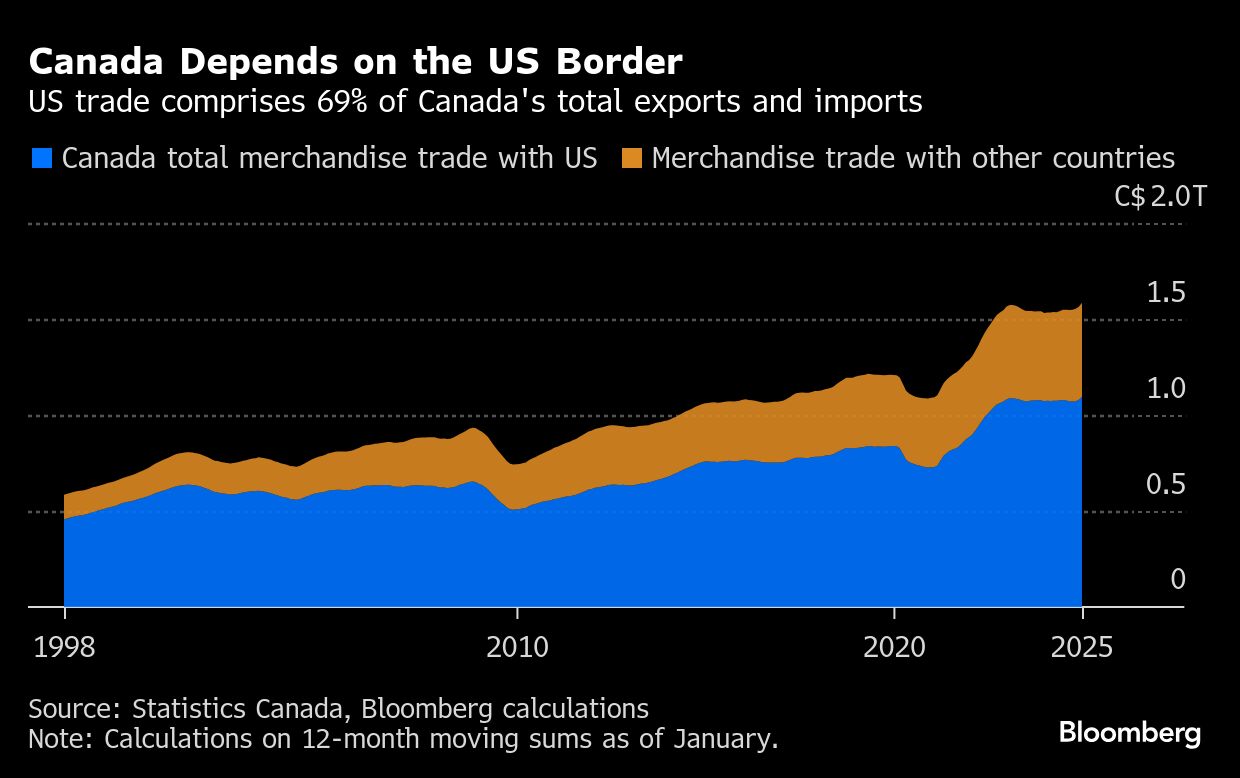

Canadian Prime Minister Mark Carney won election Monday by promising to manage a mercurial US president bent on waging a global trade war. Leaders around the world — desperate to defend their own beleaguered economies — will be watching to see if he knows how.

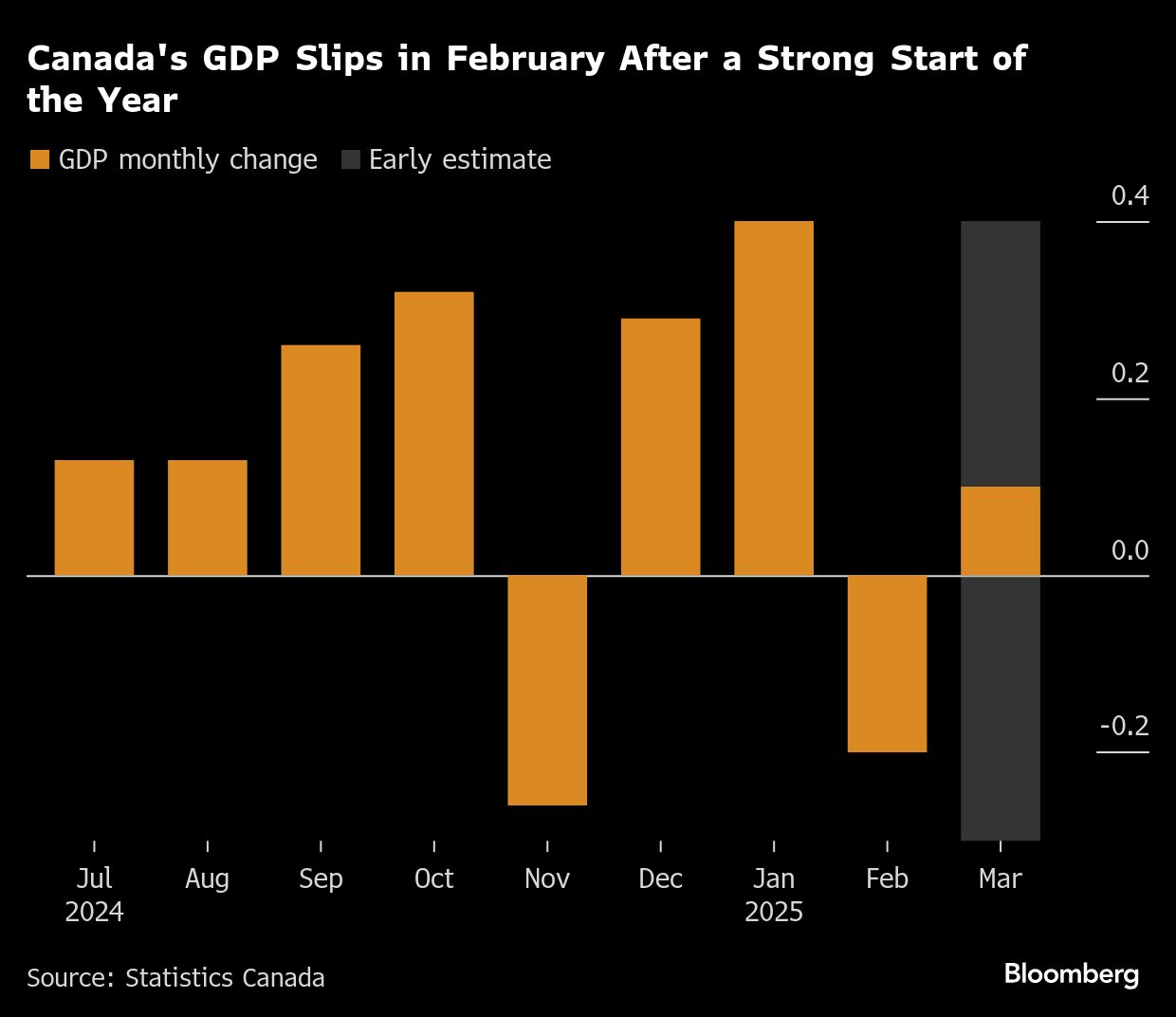

The Canadian economy appears to be taking a bigger hit from tariff uncertainty than expected, contracting in February and eking out slight growth in March.

Trump's tariff onslaught has roiled Washington and Wall Street for nearly a month. If the trade war persists, the next upheaval will hit much closer to home. By the middle of May, thousands of companies — big and small — will be needing to replenish inventories. Giant retailers such as Walmart Inc. and Target Corp. told Trump in a meeting last week that shoppers are likely to see empty shelves and higher prices.

Asia

The Bank of Japan pushed back the timing for when it expects to reach its inflation target and slashed its growth forecasts as the global trade war darkens the economic outlook. While emphasizing “extremely high” uncertainties ahead, the BOJ retained its commitment to raising borrowing costs if its economic outlook is realized, indicating policymakers will press ahead on lifting rates once the fog has cleared.

Manufacturing activity across most of Asia contracted in April, with companies struggling with weaker demand and pausing new orders in the face of US tariffs.

China has quietly started to exempt some US goods from tariffs that likely cover around $40 billion worth of imports, in what looks like an effort to soften the blow of the trade war on its own economy. It hasn't been officially confirmed, but at least half a dozen companies in China have been able to bring in goods from the list without paying tariffs, according to people familiar with the matter, who asked not to be identified discussing confidential information.

Europe

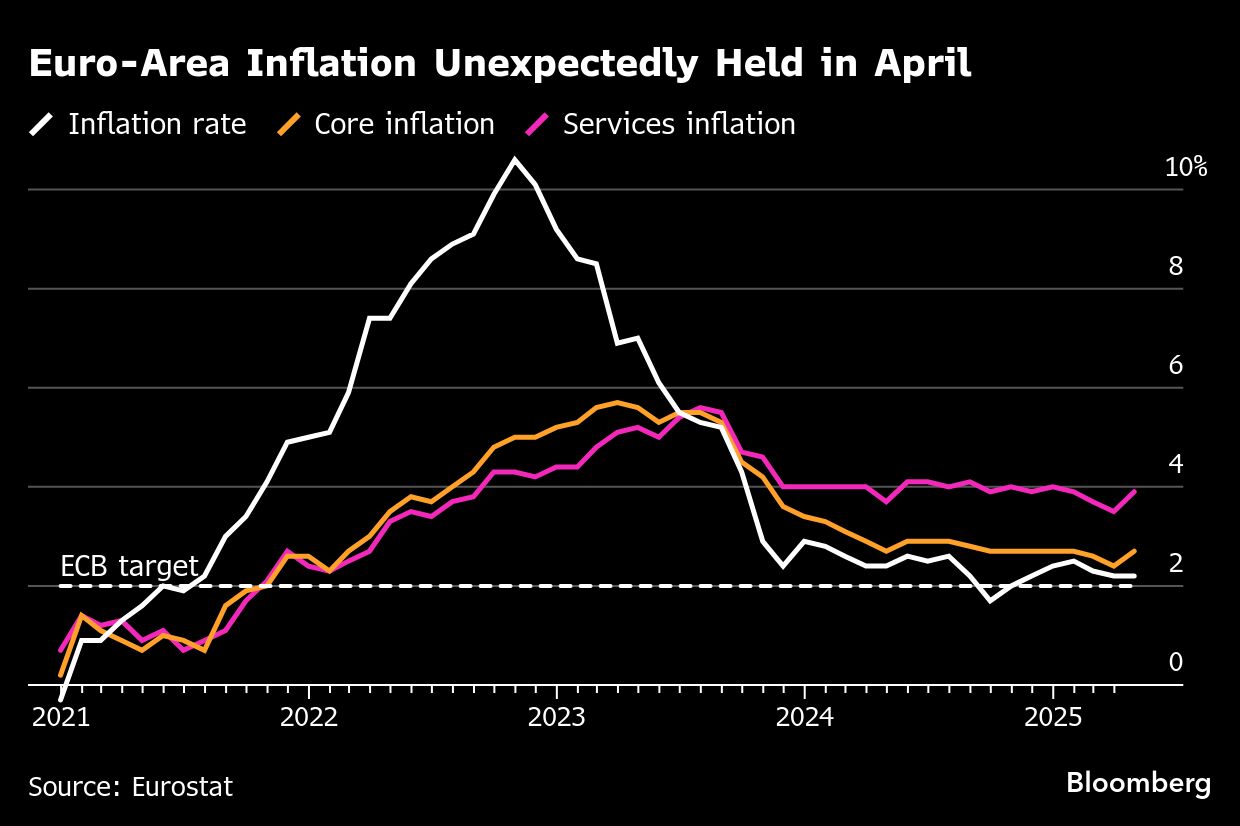

Euro-area inflation unexpectedly held steady and an underlying measure jumped in an awkward report for officials weighing how to respond to the economic hit from US tariffs. Closely-watched services inflation accelerated.

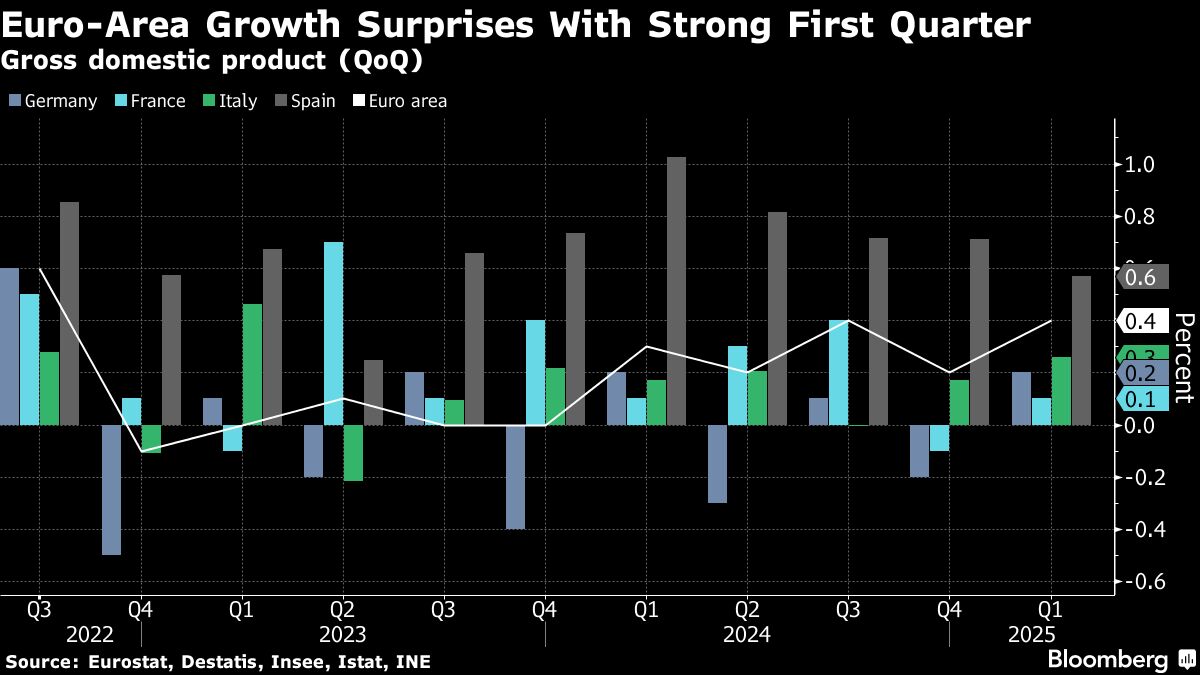

The euro-area economy grew more than expected at the start of the year, though is yet to feel the full force of US tariffs. First-quarter gross domestic product rose 0.4% from the previous three months — double the previous period's gain.

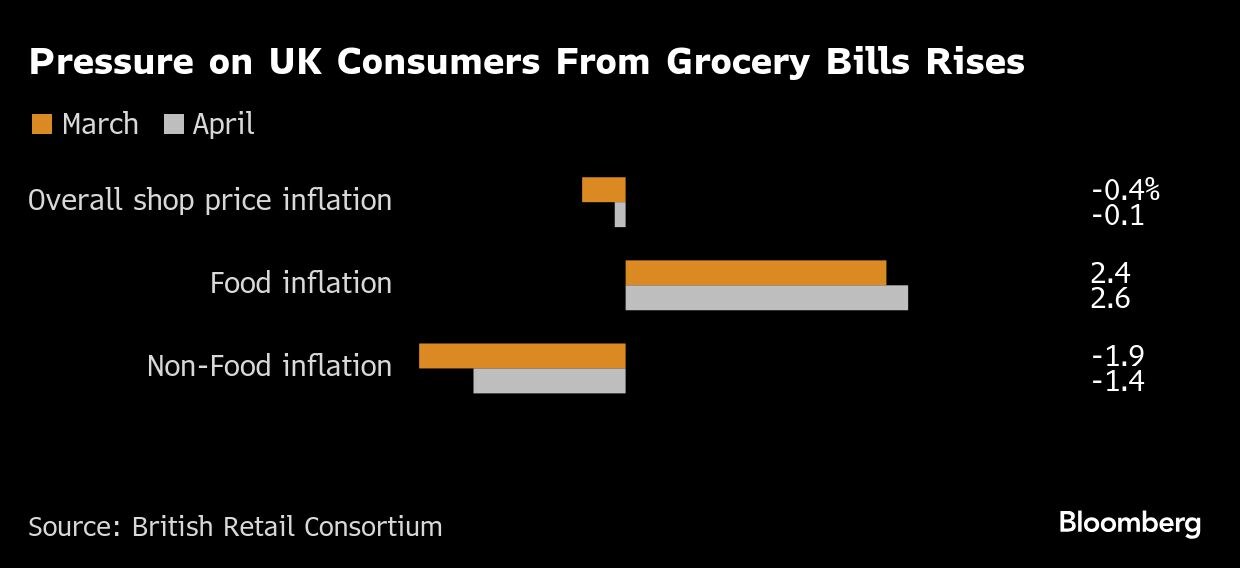

UK food prices posted their biggest rise in more than a year after supermarkets were hit by a double whammy of tax increases and a jump in the national minimum wage, a closely watched survey found.

Emerging Markets

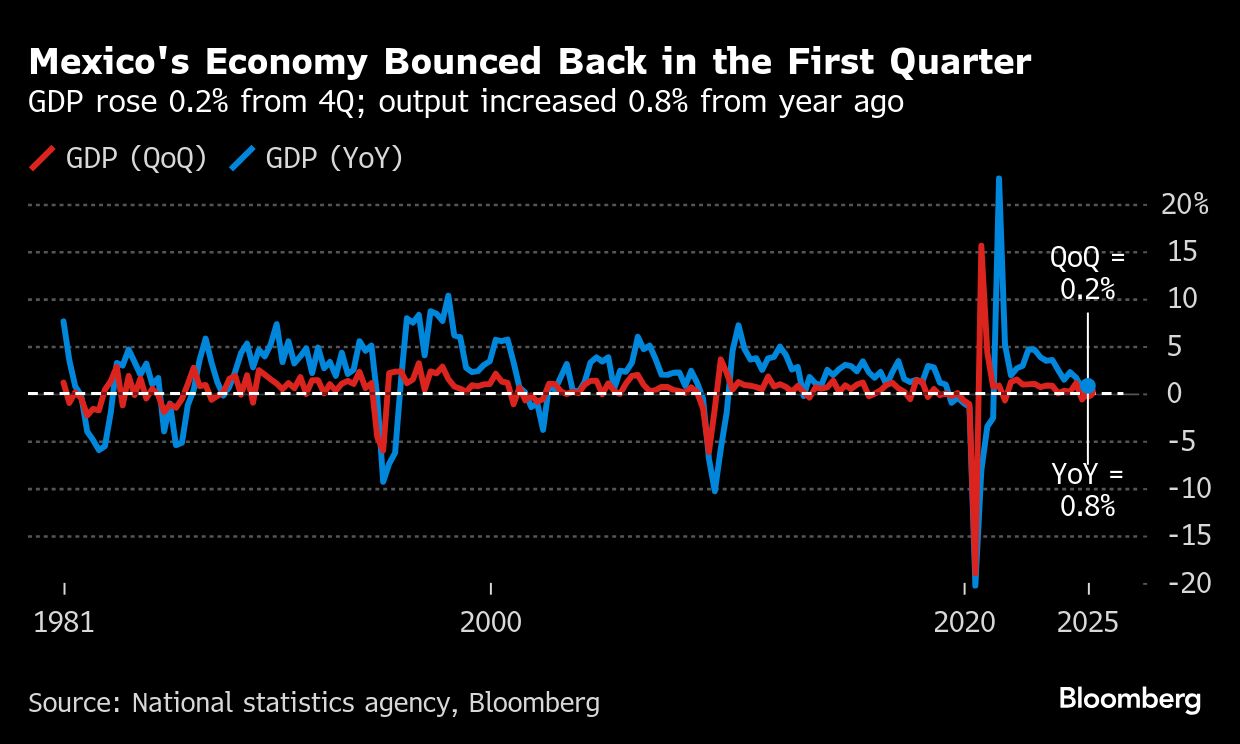

Mexico's economy expanded slightly in the first quarter on a jump in agricultural output, allowing President Claudia Sheinbaum to avoid recession as she steers the nation through an unpredictable US tariff policy. Quarterly growth was driven by an 8.1% surge in the agricultural sector, which bounced back from a plunge at the end of 2024. On the other hand, industry shrank 0.3% during the period and the services sector was flat.

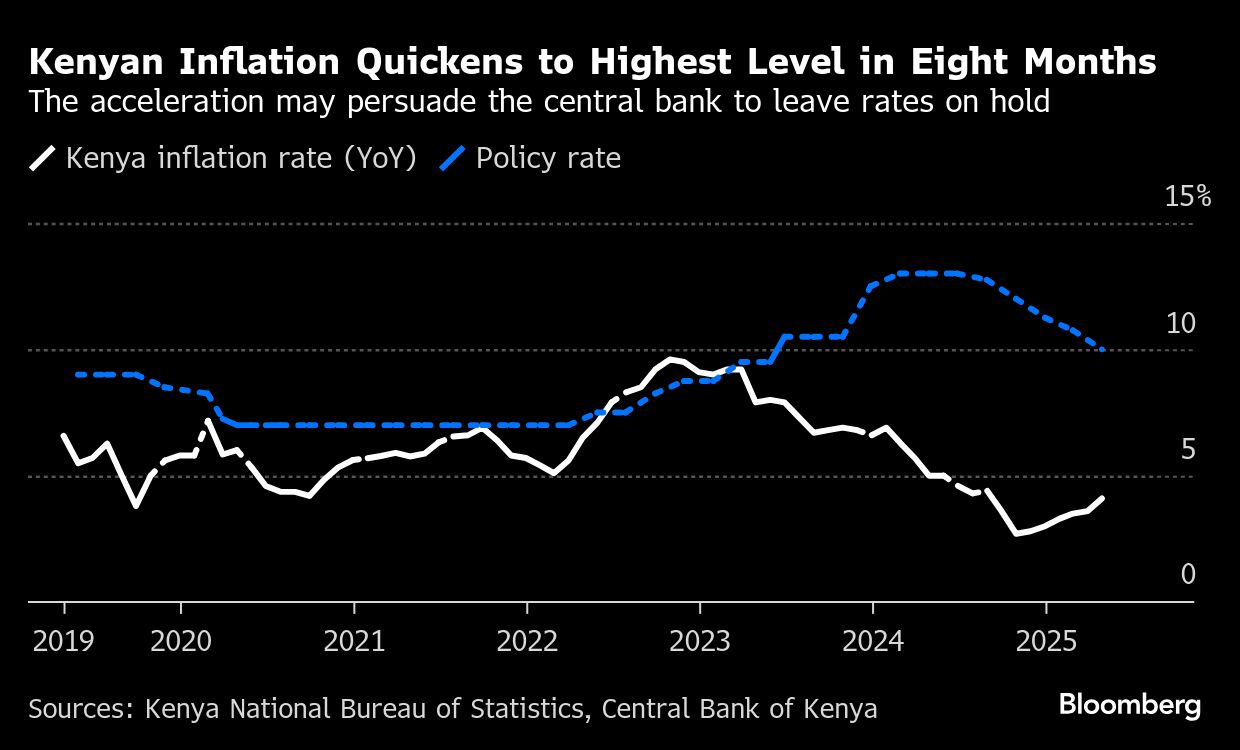

Kenya's annual inflation rate climbed to an eight-month high in April on the tight supply of food items including corn, potatoes and green vegetables. Inflation is seen hitting the higher band of the central bank's 2.5% to 7.5% target range in the third quarter, after staying below the 5% midpoint since June, according to central bank Governor Kamau Thugge.

World

In addition to the BOJ decision, Colombia's central bank unexpectedly cut its interest rates. Thailand also lowered rates, while Hungary, Chile, Guatemala, and Dominican Republic held.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.