(Bloomberg) -- Big tech may be driving the stock market, but after a blow-out first quarter, big oil would like a word.

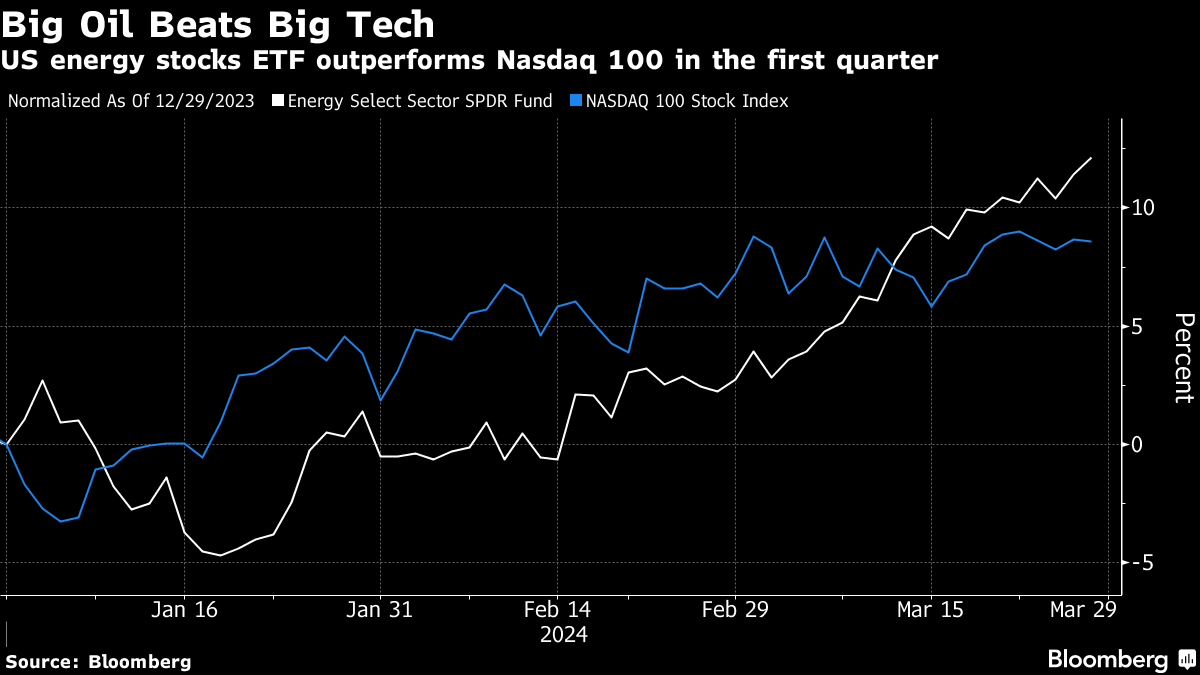

After finishing 2023 in the red as the broader market soared, energy stocks have started 2024 with a sharp rally that has them beating tech indexes this year. Specifically, the closely watched Energy Select Sector exchange-traded fund, or XLE, is up more than 13% since the start of January while the Nasdaq 100 Index has gained just 8.7%. Rising oil is helping, as West Texas Intermediate crude broke above $80 a barrel in mid-March for the first time since November and held there.

“Most investors coming into 2024 weren't expecting anything out of energy,” Roth analyst Leo Mariani said by phone. But the stocks “roared back like a lion with an awesome March.”

Energy led the the S&P 500's 11 market sectors last month, rising more than 10% compared with the next closest group, utilities, at 6.3%, and the 3.1% gain in the broader index. Following that performance, energy investors are now looking to the April 3 OPEC oil-market monitoring meeting for clues on crude's direction, which could add fuel the rally or cause it to stall.

“Right now, investor sentiment could go either way,” Pickering Energy Partners Chief Executive Officer Dan Pickering said. He likened energy's first-quarter to the beginning of a binge-worthy TV show. “A number of people 1.5 episodes in, trying to commit to whether they binge this season — and Q2 may be the point where you say, I'm staying up all night.”

What OPEC Says

Some of that will depend on what OPEC+ members say this week, particularly if they signal plans to hold the line on previously announced voluntary cuts through the first half.

“I think at this point, the market is expecting OPEC to maintain restraint,” Hennessey Funds portfolio manager Ben Cook said by phone. He likened the OPEC meeting to a Federal Reserve decision, where the outcome may be expected, but the messaging is equally important.

Russia's decision to cut production could push Brent crude to $100 a barrel this year, JPMorgan analysts led by Natasha Kaneva wrote. It's currently trading in the high $80s and could reach the $90s by May, they wrote.

Amid that bullishness, some investors are snapping up shares in mid-sized oil producers, which offer more torque to the rising commodity price. Diamondback Energy Inc., for example, is up 28% this year and climbed every day but two in March while posting 15-day winning streak, the longest for any S&P 500 stock this year.

“You're going to see the most rapid pickup in earnings estimates will not be on the largest producers because they have lower costs,” said Cole Smead, president of Smead Capital Management. “It will be on the smaller producers.” Some of the stocks he's buying are Apa Corp. and Ovintiv Inc., as well Canadian producers such as MEG Energy Corp. and Strathcona Resources Ltd.

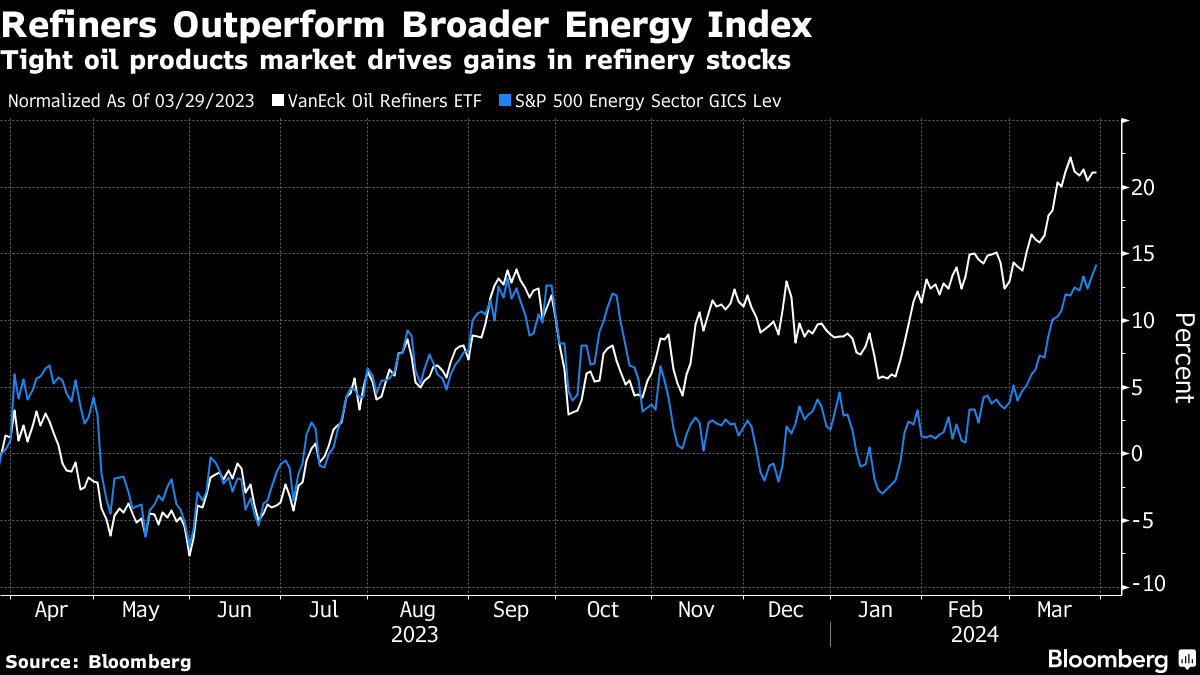

Refining stocks have been hot for even longer than oil companies. The VanEck Oil Refiners ETF is up up over 15% in the last five months, outperforming integrated companies such as Exxon Mobil Corp. and Chevron Corp. as well as gains in crude.

Refining Bets

The refined products market has been tight, and capacity has only gotten more precious as Ukrainian military strikes knock out Russian facilities. That's why some investors see the refining business as a way to play the rally in energy from here.

“We have spare capacity in crude, but refining capacity is what's really being constrained by the Red Sea and by what's happening with Russia,” said Rebecca Babin, senior energy trader at CIBC Private Wealth Group. “So the story behind the scenes is really in the products.”

To be sure, Wall Street widely expects energy stocks to post declining earnings this year, including an almost 27% drop in first-quarter profits thanks to lower year-over-year oil prices. That's by far the worst expected performance of any S&P 500 sector, according to data compiled by Bloomberg Intelligence.

However, some analysts are starting to flip those expectations. Morgan Stanley US equity strategist Mike Wilson, for instance, upgraded energy to overweight on a combination of rising oil prices, “inflecting earnings revisions, strong breadth and compelling valuations.” Energy valuations continue to trade at a historic discount to the S&P 500 and, with higher free cash flow yields, there is “a path to further outperformance,” he wrote in a note to clients on March 25.

Indeed, energy is also the cheapest sector in the market, which is helping draw new investors in, even as the rally remains somewhat lowkey so far.

“There's been a quiet rally in this sector that is catching a few people by surprise,” BMO Capital Markets analyst Jeremy McCrea said, adding that investors who were betting on an electric future are beginning to think that “maybe we're going to be using oil and gas for a bit longer than expected.”

--With assistance from Tom Contiliano.

More stories like this are available on bloomberg.com

©2024 Bloomberg L.P.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.