The Bank of Japan kept its key policy rate unchanged and signaled growing unease over the potential impact on the global economy from escalating trade tensions.

Governor Kazuo Ueda's board voted to keep the policy rate at 0.5% Wednesday at the end of a two-day gathering, according to its statement. The result was in line with the expectations of all 52 economists surveyed by Bloomberg. The central bank added a reference to the evolving situation regarding trade and other policies to its list of risks to the outlook.

After initial fluctuations, the yen was trading slightly weaker against the dollar compared to right before the release. Bond yields didn't immediately move on the decision.

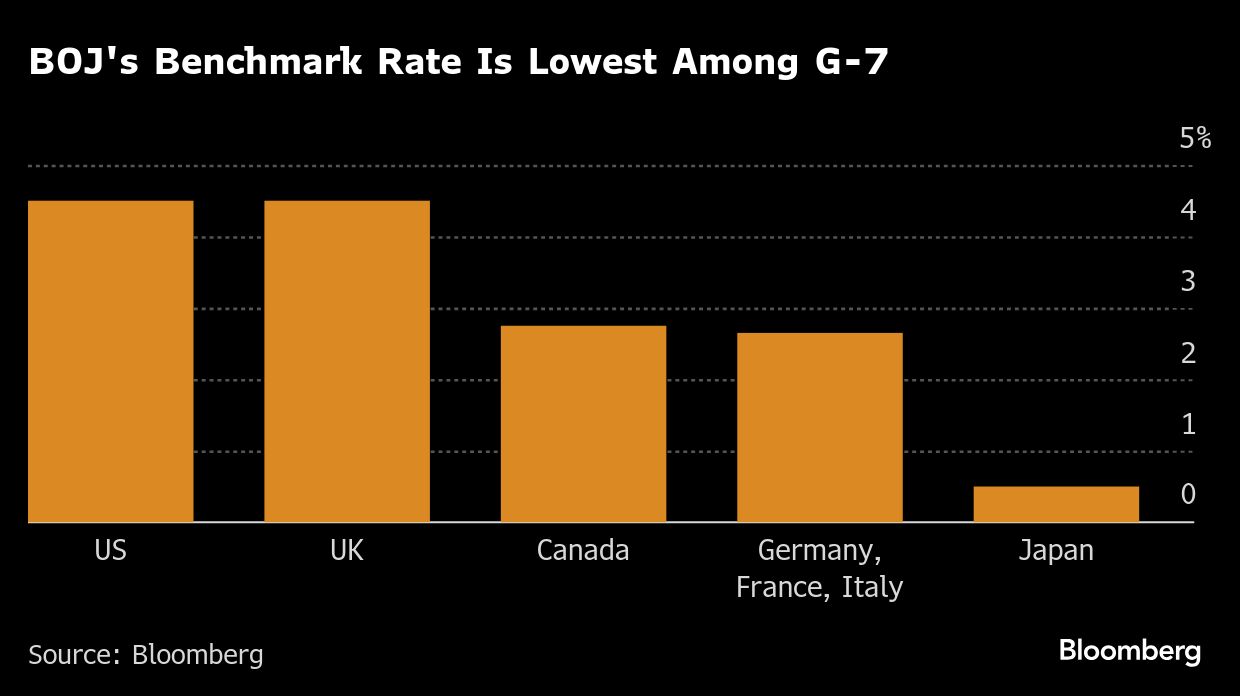

The stand-pat decision comes as domestic economic signals suggest further scope for raising interest rates in Japan even as the international landscape darkens and central banks elsewhere in the world mull the timing of rate cuts.

“There is a very high level of uncertainty about US policy, and I think there will be companies that may hold back on capital investment and production plans against this background,” said Harumi Taguchi, principal economist at S&P Global Market Intelligence. “As for the domestic situation, wage talks are producing high results and prices are continuing to rise, so I think things are progressing as the BOJ has forecast.”

Japan's biggest umbrella group for labor unions said last week that early results from annual wage talks were the most robust in 34 years, in a positive sign for personal spending. Meantime, the nation's overall inflation rate sped up to 4% in January, the highest among Group of Seven economies.

The outlook for the global economy has taken a turn for the worse as President Donald Trump forges ahead with his tariff campaign. Ueda said last week he was “very much” concerned about the global economy in light of trade tensions. The OECD Monday cut its world growth forecast to 3.1% for 2025 to account for disruptions to global commerce.

The BOJ's additional reference to risks from trade policies indicates growing concerns over the potential impacts from rising tides of protectionism around the world. The change may cool speculation in the market about the risk of a rate hike when the board delivers its next decision on May 1.

For now the BOJ has some time for watching developments after last hiking the rate two months ago. With inflation trends staying more or less in line with the bank's projections, most economists expect the bank to wait until June or July to raise its policy rate.

BOJ officials were leaning toward keeping rates unchanged so they can take time to assess the impact of the January hike as well as weigh the tide of uncertainties sweeping through the global economy, people familiar with the matter told Bloomberg earlier this month.

This week's meeting marks the one-year anniversary of Ueda's decision to end the massive monetary easing program by ditching the world's last negative interest rate regime.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.