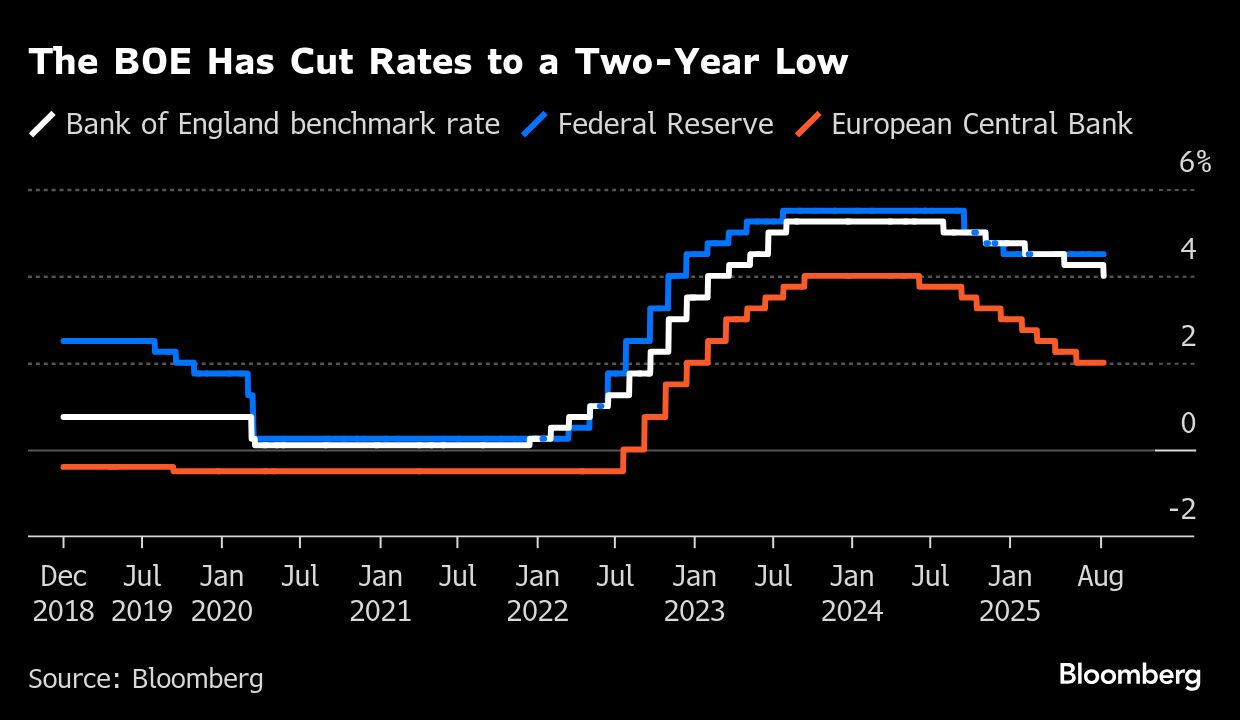

The Bank of England cut interest rates to the lowest in over two years in a closer-than-expected decision that pitted the prospect of inflation hitting 4% against a weakening jobs market.

Five members of the Monetary Policy Committee voted for the quarter-point reduction to 4%, while four backed no change. That followed an earlier three-way split that failed to reach a majority. It was the first time in the 28-year history of the panel that two rounds of voting were needed to reach a presentable outcome on rates.

The pound jumped against the dollar after the decision, climbing 0.5% to $1.3428. Gilts fell, sending the two-year yield six basis points higher to 3.88% as money markets reduced wagers on the extent of interest rate cuts from the BOE next year.

“It was a finely balanced decision,” Governor Andrew Bailey said in a written statement. “Interest rates are still on a downward path but any future rate cuts will need to be made gradually and carefully.”

Before the decision, economists had predicted less support for no change. The fragmented vote illustrates the extent of disagreement at the UK central bank about how to respond to signs of fraying economic growth juxtaposed against an unsettling resurgence in inflation.

In contrast, the US Federal Reserve has so far shirked from rate cuts this year to gauge prospective price pressures, incurring derision from President Donald Trump.

The BOE stuck with overall guidance steering markets toward more “gradual and careful” easing, warning of emerging slack in the economy and cooling demand for workers. Tax data suggest the UK economy has lost 185,000 jobs since the Labour government announced plans to increase employers' payroll taxes and the minimum wage.

However, the MPC also said that upside risks to inflation have “moved slightly higher since May,” and pointed to rising food bills in particular. Officials now expect inflation to hit 4% in September, up from the previously predicted peak of 3.7%, and the panel “remains alert” to second-round effects.

Subdued Growth

While the forecast for economic growth in 2025 was also upgraded slightly to 1.25% following a strong first quarter, they said the underlying picture “remained subdued.”

Officials also noted that policy was becoming less of a drag on the economy, and linked future cuts to further progress on bringing inflation down in the medium term.

“The timing and pace of future reductions in the restrictiveness of policy will depend on the extent to which underlying disinflationary pressures continue to ease,” the minutes said. “The restrictiveness of monetary policy has fallen as Bank Rate has been reduced.”

Ahead of the decision, markets were leaning toward one more reduction by the end of the year, followed by another to bring the level to around 3.5%.

Thursday's outcome marked the fifth reduction since the BOE started cutting rates a year ago, and continues a wary once-a-quarter pace of easing.

One previous MPC decision in 1998 required the governor's casting vote to resolve disagreement, but the extent of the split this time round required a more imaginative approach of two rounds. That highlights just how difficult officials are finding it to make judgments on the economy.

Alan Taylor, an external policymaker, initially backed a half-point reduction before joining those supporting a quarter-point in order to secure a majority.

Deputy Governor Clare Lombardelli, Chief Economist Huw Pill along with externals Catherine Mann and Megan Greene were those who opposed another cut.

The BOE's analysis also warned of signs of strain in long-dated bonds ahead of its annual decision on the pace of so-called quantitative tightening in September.

That study on the impact of QT is likely to entrench expectations for a reduction in the speed of balance sheet run-off from around £100 billion ($133 billion) a year currently.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.