Asian shares extended gains Tuesday, buoyed by upbeat US earnings and indications that tensions between Washington and Beijing were easing.

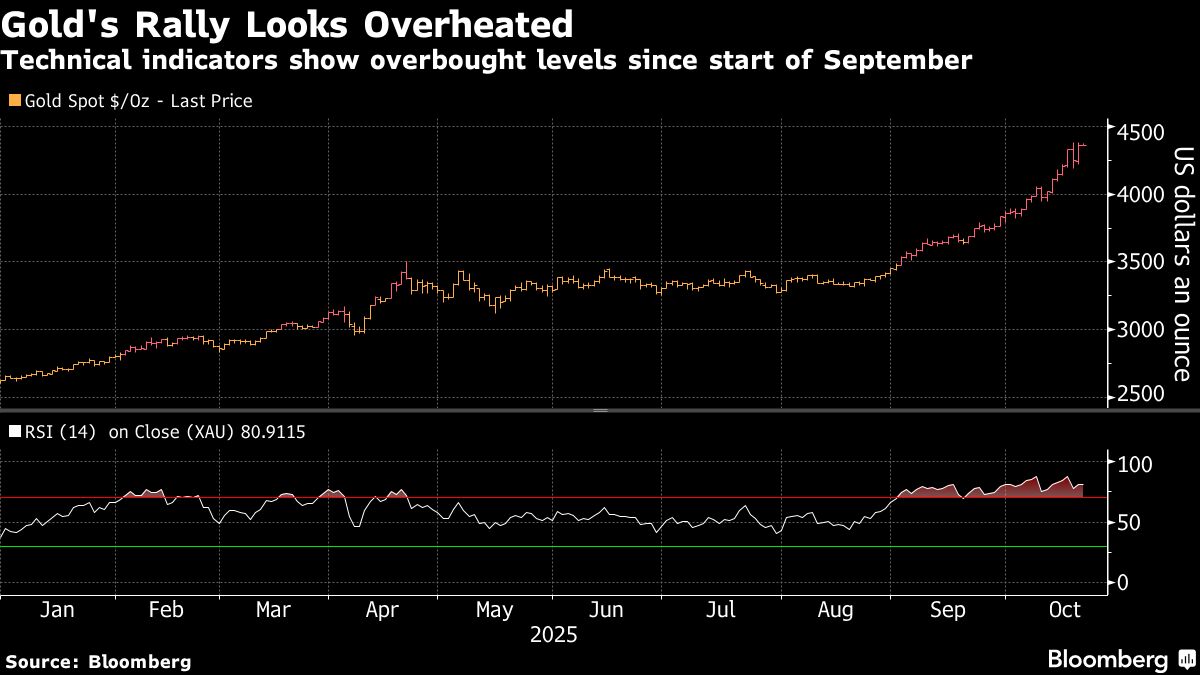

A regional stock gauge topped its record close as most major Asian benchmarks advanced. Chinese shares gained at the open, while Japanese equities strengthened amid expectations Sanae Takaichi will become the nation's first female prime minister. US equity futures rose after the S&P 500 and Nasdaq 100 each gained more than 1% Monday, while gold held near highs amid bubble concerns.

Asian markets are finding fresh momentum after the S&P 500 logged its biggest two-day gain since June on Monday, with about 85% of companies beating profit estimates so far. Strong third-quarter earnings helped temper worries over the US government shutdown, while hopes of progress in US-China trade talks lifted sentiment. President Donald Trump reiterated his threat to follow through on a tariff hike on Chinese goods “if there isn't a deal” by Nov. 1, but said he plans to meet President Xi Jinping next week.

“The strong start to the week on Wall Street has helped Asian markets to open higher today,” said Nick Twidale, chief market analyst at AT Global Markets in Sydney. “A softening in trade concerns has also helped overall sentiment, with investors taking a glass 75% full look at the market at the moment.”

Earlier this month, markets were roiled as Trump raised the prospect of a sky-high tariff rate, citing China's “hostile” export controls. Soybean futures rallied Monday, with growers holding out hope that Trump will make a deal with China to restart stalled American exports.

Separately, shares of critical mineral producers jumped in Sydney on Tuesday after Trump signed an agreement with Australian Prime Minister Anthony Albanese to boost America's access to rare earths and other key materials.

Read More: Trump Declares ‘Full Steam Ahead' on Aukus in Win for Australia

The Treasury 10-year yield traded below 4% and the dollar was steady early Tuesday as falling oil prices eased concern about the inflation backdrop before the release of consumer-price data.

After a delay caused by the US government shutdown, the Bureau of Labor Statistics is set to release September's consumer price index on Friday. The data, originally slated for Oct. 15, will give Federal Reserve officials a key reading on inflation ahead of their Oct. 30 policy meeting.

The data may take on greater importance due to the government shutdown-driven data drought, said Rick Gardner at RGA Investments. He still sees a Fed cut in October and noted that a key test will be Big Tech earnings, with investors looking for clarity on how spending on artificial intelligence is leading to profitability.

“We are seeing the typical seasonal volatility in October, but the recent swings have been relatively shallow by historical standards, as the buy-the-dip mentality appears to be in play,” Gardner said.

Some of the main moves in markets:

Stocks

S&P 500 futures were little changed as of 10:32 a.m. Tokyo time

Nikkei 225 futures (OSE) rose 1.1%

Japan's Topix rose 0.6%

Australia's S&P/ASX 200 rose 0.9%

Hong Kong's Hang Seng rose 1.1%

The Shanghai Composite rose 0.3%

Euro Stoxx 50 futures rose 0.2%

Currencies

The Bloomberg Dollar Spot Index was little changed

The euro was little changed at $1.1648

The Japanese yen was little changed at 150.72 per dollar

The offshore yuan was little changed at 7.1208 per dollar

The Australian dollar was little changed at $0.6516

Cryptocurrencies

Bitcoin fell 0.8% to $110,281.06

Ether fell 1% to $3,961.26

Bonds

The yield on 10-year Treasuries was little changed at 3.98%

Japan's 10-year yield declined one basis point to 1.660%

Australia's 10-year yield declined three basis points to 4.12%

Commodities

West Texas Intermediate crude fell 0.5% to $57.22 a barrel

Spot gold fell 0.2% to $4,347.44 an ounce

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.