When the Trump post hit — the real one, not the hoax — and the S&P 500 vaulted 7% in eight minutes Wednesday, Ed Al-Hussainy stepped away from his desk in Manhattan. The algos had taken over at that point, and the buy orders were pouring in at such a furious clip across all markets that “there was nothing to do.”

So he strolled over to the corner Walgreens, grabbed an 18-pack of beer — Modelo, to be precise, famous export of Mexico — and handed them out to his colleagues at Columbia Threadneedle to enjoy as they watched the frenzy. “For us,” Al-Hussainy said, “it was really a moment of calm.”

It didn't last long. By Thursday morning, he was staring once again at screens showing that stocks were sinking and, more importantly, Treasury yields were soaring even after President Donald Trump said it was their sudden surge that had prompted him to enact his 90-day reprieve. The bond market was buckling, and might not stop until the Treasury or Fed stepped in.

“I'm actually not worried about a recession,” Al-Hussainy said. “What I do worry about is a financial crisis.”

Take the market as a whole over the last week and you'd be forgiven for not noticing the battering American assets just took at the hands of Trump's trade war. The S&P 500 rose more than 5%, Treasuries stand where they stood in February, another big slug of money was ponied up by passive investors and Bitcoin ended the week higher.

That masks a fundamental shift that has taken hold among investors, traders and analysts. Serious questions now exist around the wisdom of owning American assets that until recently were the envy of a risk-obsessed world.

Amid the manic moves, key trading patterns even bear soft echoes with emerging markets. All told, fear is spreading that Trump's bid to rewrite the terms of global trade risks imperiling America's privileged status in the financial system.

“You honestly feel like you're seeing stuff wrong sometimes. You have to check the scaling on your graphs because prices are moving so quickly,” said Charlie McElligott, managing director of cross-asset strategy at Nomura Securities International Inc. “It's just a constant stream of bells and popups on the desks right now. Automated messages like risk limits and risk alerts. It's maximum overstimulation, maximum dopamine saturation.”

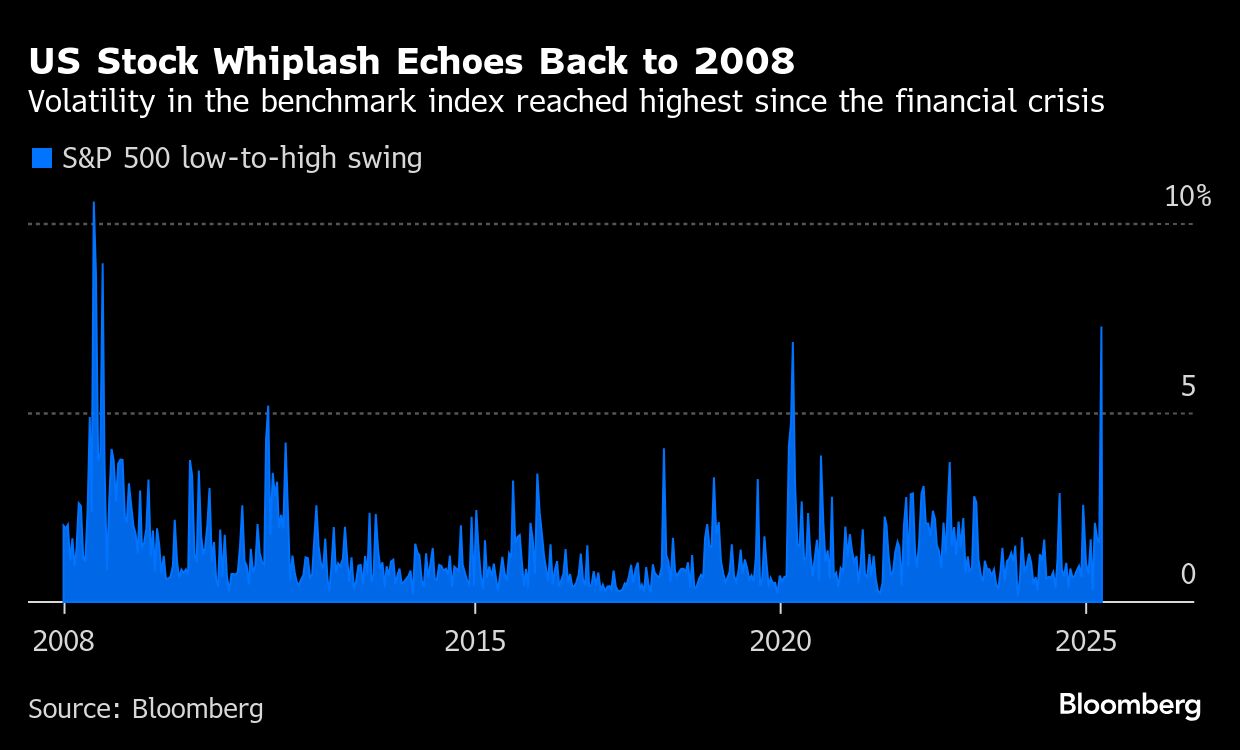

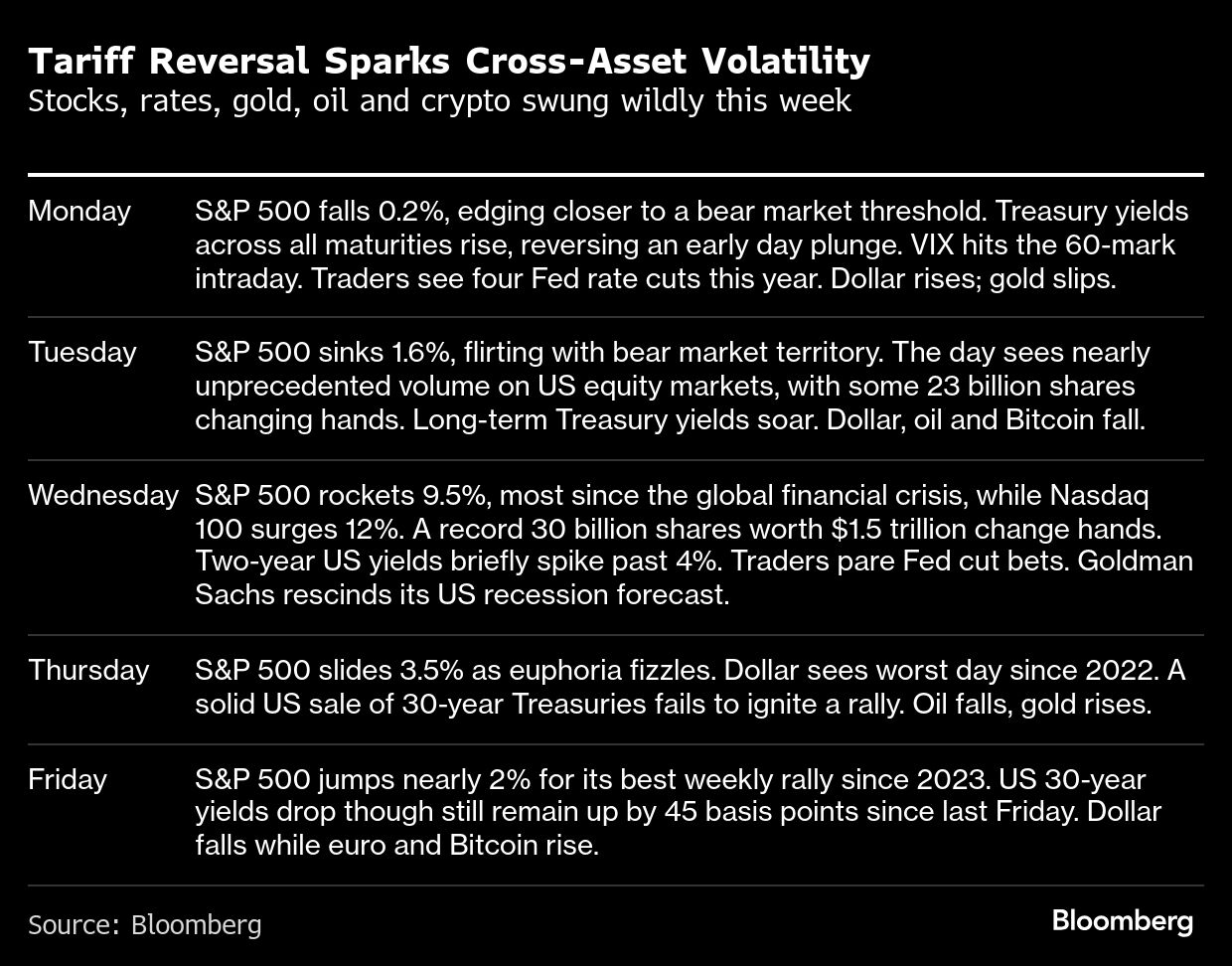

Even by the standards of Wall Street's long history, it was a brutal week to trade. Monday saw a fake social media post ignite the biggest intraday rally since 2020, before everything got rolled back. A day later the S&P 500 fell to the brink of a bear market when a White House official said the US would move forward with China tariffs as high as 104%. Bonds started to fall: 30-year Treasury yields spiked the most since 2022 as concern spread hedge funds were being stopped out of a decades-old trade premised on market stability.

Then came Wednesday, when Trump's pledge to pause ignited the biggest single-day equity rally since 2008 in a trading spasm that saw a record 30 billion shares change hands on US venues. Bonds continued to sell off, and while it was briefly possible to frame the move as a return to normalcy with investors selling out of havens, they haven't stopped since.

“It's at the point when you're getting kind of like the Sunday scaries every day,” said Matt Miskin at Manulife John Hancock Investments, who was presenting a quarterly outlook to 300 clients when the Trump relief rally hit and rendered months of planning in flux.

“When volatility acts like this, liquidity dries up and there are often times where things can move in ways that don't necessarily make sense,” said Miskin. “That's usually some big players that are seeing trades go against them and have to move.”

A bond trader at Tudor Investment Corp., Alexander Phillips, lost about $140 million in April amid the tariff-sown volatility, people familiar with the situation told Bloomberg News. He remains at the firm, working to recoup the losses. The firm manages $16 billion.

Swings in Treasuries and the dollar have led some to question the famed safe-haven status of the US government.

“We have to consider the possibility that fixed income is hugely disrupted in a way that changes everything,” said Phillip Toews, CEO of Toews Asset Management and author of The Behavioral Portfolio. “The headlines plus the markets are just basically mouth-gaping.”

Boston Fed President Susan Collins said on Friday that the central bank “would absolutely be prepared” to help stabilize financial markets if conditions become disorderly, according to the Financial Times. “Markets are continuing to function well” and “we're not seeing liquidity concerns overall,” she said.

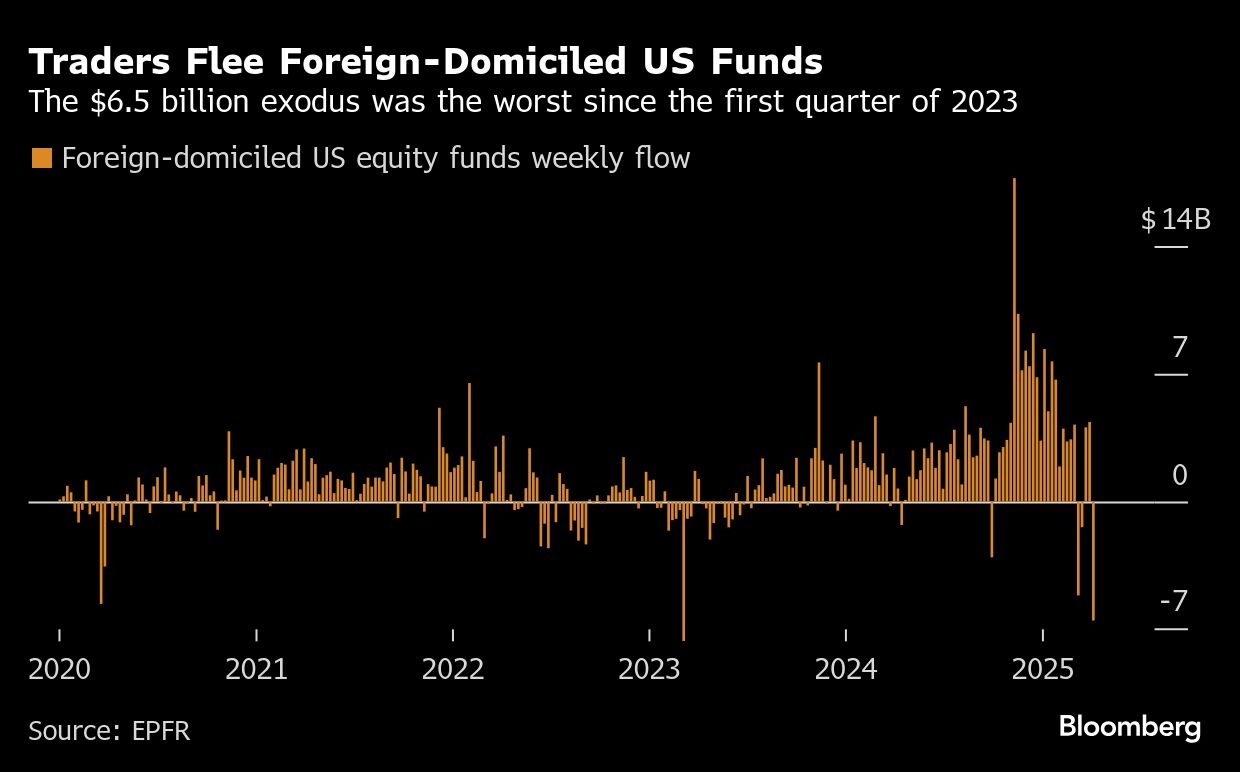

To be sure, measuring demand for US assets isn't an exact science, and prices don't always reflect where cash is flowing. Funds that buy Treasuries saw a record $18.8 billion on inflows in the week through Wednesday, according to EPFR Global data cited by Bank of America. But foreign domiciled US-focused funds saw a $6.5 billion outflow, the second biggest since at least 2020, according to EPFR.

“Confidence outside the US on the quality and leadership of US assets across equity, fixed income and currency has been damaged,” said Nathan Thooft at Manulife Investment Management in Boston, which oversees $160 billion. “The question remains is this a temporary hit or a secular shift? We still believe the former. But that doesn't dismiss the fact there are large asset owners who are looking for substitutes and diversification for safe haven assets.”

That could be a driving force behind dollar weakness. Havens such as the yen, Swiss franc and gold have been in the ascendency against the greenback while the euro rose to its strongest in three years. Options traders have turned bearish on the dollar for the first time in five years.

A country's currency and bonds selling off in tandem is a classic trait of an emerging market, reckons Al-Hussainy, Columbia Threadneedle's rates strategist.

“I have spent the last many, many years making fun of my colleagues in the UK after Brexit because the gilt market, the government bond market there, actually does function a lot more like an EM market,” he said. “This week was the first time they were able to make fun of me.”

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.