Amazon.com Inc.'s cloud unit posted the strongest growth rate in almost three years, reassuring investors who were concerned that the largest seller of rented computing power was losing ground to rivals.

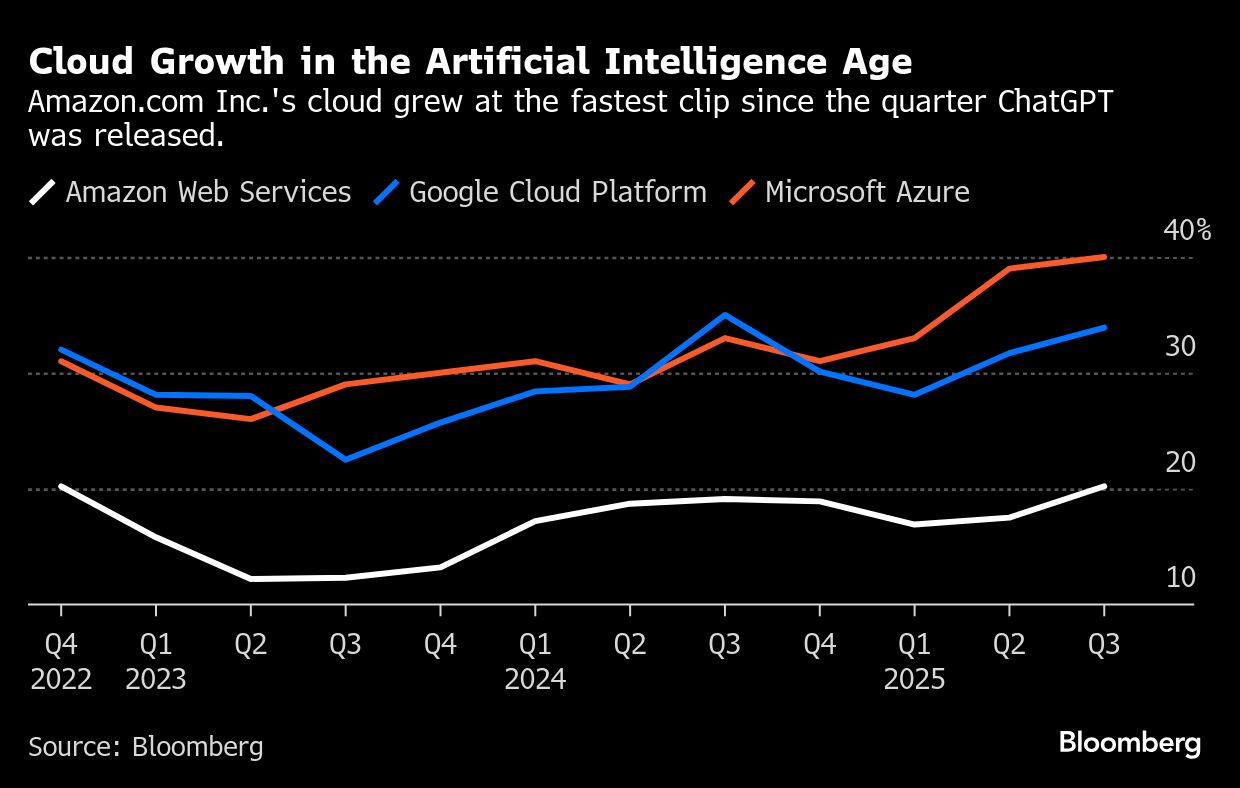

Amazon Web Services reported third-quarter revenue of $33 billion, an increase of 20% from the prior year and the biggest year-over-year rise since the end of 2022. Analysts, on average, estimated 18% growth.

Investor expectations for the cloud business were relatively low heading into Thursday's earnings report after the company in recent quarters cited constraints in getting new data centers online. Chief Executive Officer Andy Jassy and other executives had said they were optimistic about the business, though they stopped short of forecasting a reacceleration of growth.

The shares jumped about 13% in extended trading after closing at $222.86 in New York. The stock has lagged behind that of its industry peers this year, with investors worrying that the company has yet to benefit enough from its artificial intelligence products. In its most recent quarter, Microsoft Corp.'s Azure cloud business grew at almost twice the rate of AWS, while Alphabet Inc.'s Google Cloud posted 33.5% growth.

Jassy opened a conference call with analysts after the results were released by cheering the prospects for AWS and rattling off figures on the impact of AI on the company's businesses, most of which Amazon hadn't disclosed previously.

The company estimates that Rufus, the shopping chatbot embedded in its retail apps, will help deliver an additional $10 billion in annual sales. Connect, the company's call center product that is widely seen as its most successful software offering for office workers, is on track to pull in $1 billion in annualized revenue, Jassy said. Bedrock, the AWS marketplace for businesses to tap into AI models, could ultimately be as big a business as EC2, the computing service that is one of the cloud unit's primary money makers.

“We have momentum,” he said. “You can see it.”

During the quarter that ended Sept. 30, Amazon's total sales rose 13% to $180.2 billion, the company said in a statement. Analysts, on average, were anticipating $177.8 billion, according to data compiled by Bloomberg.

Under Jassy, Amazon has been working to improve the profitability of the retail business by stepping up automation and selling higher-margin ads and other services to online merchants. That work has receded from the headlines as investors focus on the company's battle in the market for AI.

The strong performance of Amazon's cloud business and its core retail business likely reassured investors worried that the company was spending too much money pursuing what some have suggested is an AI bubble, said Melissa Otto, analyst at S&P Global.

“We are seeing good evidence of the AWS business performing very well,” she said. “It doesn't feel bubbly to me. It just feels like a business firing on all cylinders.”

Like its biggest rivals, Amazon has invested heavily in data centers and chips to build and operate AI models capable of generating text or images and automating processes. Capital expenditures rose 61% to a record $34.2 billion in the quarter, Chief Financial Officer Brian Olsavsky said.

The power capacity of the AWS data center fleet has doubled since 2022, and Jassy said he expected it to double again by 2027. Last week, the unit suffered its biggest outage in years.

Though Amazon has sought to position its cloud business as a marketplace for a broad range of AI tools, for now, it has a lot riding on a single partner: Anthropic PBC, the maker of the Claude chatbot and software coding assistant.

Amazon is backing Anthropic with an investment of $8 billion, and built the startup a massive complex of data centers and custom AWS AI chips. That system, called Project Rainier, is up and running, the company said this week. Amazon said its Trainium2 chip was “fully subscribed” and represented a multibillion-dollar business.

Google recently announced a deal to provide Anthropic with some of its own chips.

In the third quarter, Amazon reported operating income of $17.4 billion, which included a $2.5 billion charge related to a legal settlement announced last month with the Federal Trade Commission over Prime subscriptions and $1.8 billion for estimated severance costs. The company said earlier this week that it would cut about 14,000 corporate workers and warned of further terminations in 2026.

Amazon projected that revenue in the holiday quarter would be $206 billion to $213 billion, meeting analysts' estimates. Operating profit will be $21 billion to $26 billion, also in line with expectations.

In the third quarter, sales generated by the online store business increased 10% to $67.4 billion. Advertising unit revenue jumped 24% to $17.7 billion. Third-party seller services from merchants who use Amazon's e-commerce site increased 12% to $42.5 billion.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.