US Mortgage Affordability Searches Hit Near-2008 Levels As Income Lags Behind

Typical mortgage payment has increased by 82% over this period, while median household incomes have grown by only 26%.

Over the past five years, housing costs have far outpaced income growth, raising questions about affordability and financial stress among homeowners. Recent estimates from John Burns Research and Consulting show that the typical mortgage payment has increased by 82% over this period, while median household incomes have grown by only 26%.

This imbalance means that mortgage payments now absorb a significantly larger share of household earnings.

Industry analysis suggests that a typical household would need to spend a record 47% of its income to afford the median-priced home for sale, a level that outstrips affordability metrics not seen in years.

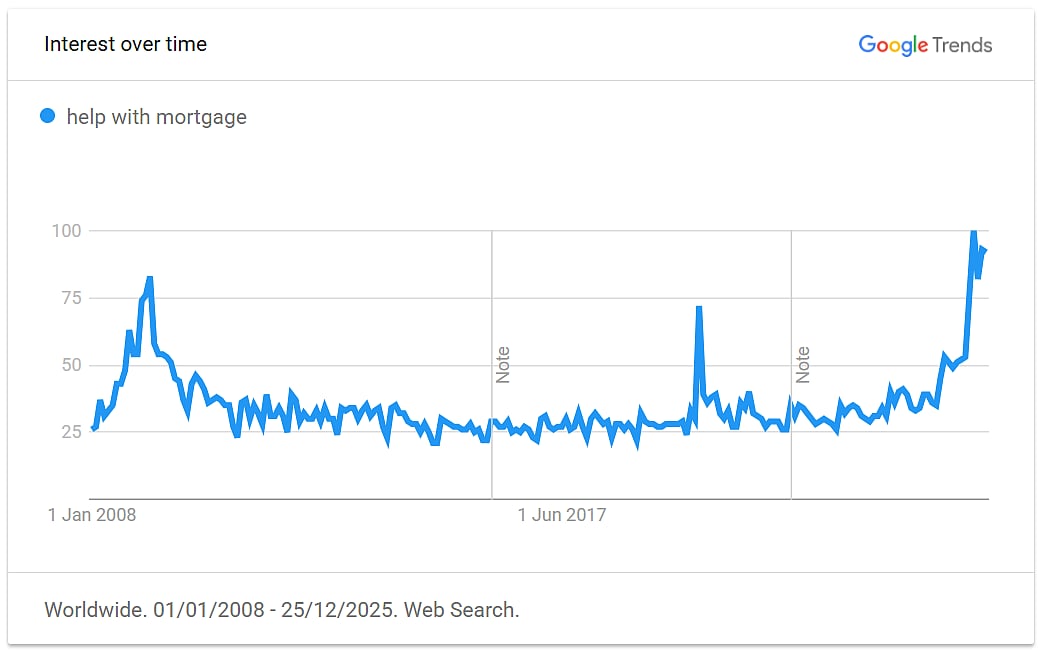

Image: Google Trends

In tandem with rising cost burdens, Google searches for 'help with mortgage' have climbed sharply, reaching levels similar to those seen around the time of the 2008 financial crisis.

Direct historical comparison of search volume is challenging due to changes in how Google Trends measures data. However, interest in search terms related to mortgage help recently hit its highest level, and has now surpassed peaks associated with the 2008 crisis.

The 2008 financial crisis itself was rooted in the housing market and mortgage lending. In the years leading up to the bust, the ratio of median home prices to median household income increased dramatically — from roughly 3:1 in the late 1990s to about 4.6:1 by 2006 — fueled by lax lending standards and rapid home price appreciation.

By September 2008, housing prices had fallen more than 20% from their mid-2006 peak, and mortgage delinquencies surged. And by August 2008, around 9% of all U.S. mortgages were delinquent or in foreclosure, rising to 14.4% by September 2009.

Unlike the earlier crisis — where defaults, foreclosures and collapsing mortgage-backed securities were central — current elevated search interest for mortgage help reflects concerns about affordability rather than widespread payment failures.

Data, however, suggests that mortgage delinquency rates remain relatively low compared with the peaks of the Recession. This is despite online search data suggesting that homeowners and prospective buyers are actively seeking information and assistance in dealing with high housing costs.