While the long-drawn negotiations between India and the United States over a possible trade deal have left investors and fund managers guessing, Samir Arora, founder of Singapore-based India-focused investment firm Helios Capital, said he is not waiting with bated breath for an agreement between the two countries.

The negotiations, which were expected to result in a mini trade deal between India and the US earlier this month, are yet to yield any concrete result.

Arora expects the US tariff rate for Indian exports to be between 15% and 20%, placing New Delhi in relatively better terms than Asian peers like China, Vietnam and Bangladesh.

"We have got some advantage over others in areas like textile exports, but beyond that, there isn't much," he told NDTV Profit in a televised conversation.

The US is "close" to a trade deal with India while negotiations are underway, President Donald Trump said on Wednesday.

“We had one (deal) yesterday. We have another one coming up, maybe with India….I don't know, we're in negotiation. When I send out a letter, that's a deal," Trump said.

"The best deal we can make is to send out a letter. And the letter says that you'll pay 30%, 35%, 25%, 20%," he added. "We're very close to a deal with India where they open it up."

This comes a day after Trump told the press that his administration was working with India on "similar line" with Indonesia. The tariff on the Southeast Asian economy was lowered to 19%, as part of the trade pact announced on Tuesday.

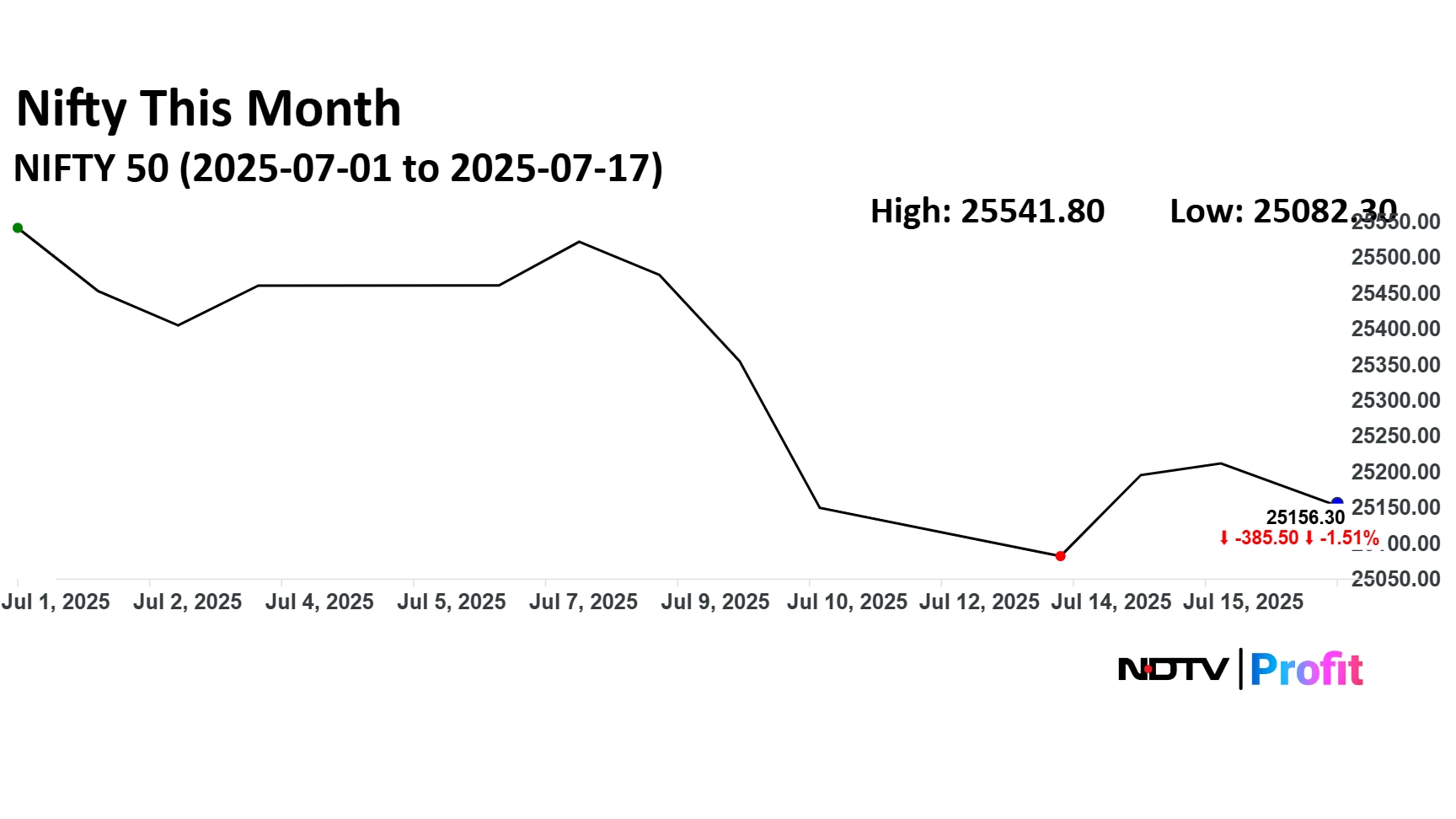

The Nifty is down 1.5% sofar in July over trade woes.

Indian stock markets are trading below the world average this month over trade concerns. While the MSCI World Index is up 0.4%, the benchmark Nifty 50 has fallen 1.5%.

Despite the underperformance, Arora said India is prime to benefit from capital diversifying away from US assets that is weighed by the Trump administration's trade and fiscal policies.

"The rest of the world is outperforming US this year. The dollar is down nearly 10%. People also feel that we need to move some money into other markets," he said.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.