- Exporters seek RBI approval to convert US earnings at 15% lower rupee rate than current levels

- The rupee is trading near a record low of 88.33 to the dollar amid US 50% tariffs on Indian goods

- Exporters request loan repayment moratorium, lower interest, wage support, and credit relief from government

Indian exporters said they will lobby the central bank to allow them to temporarily convert proceeds from their US business at a rupee rate that's 15% lower than current levels, to help cushion the blow from President Donald Trump's punitive tariffs.

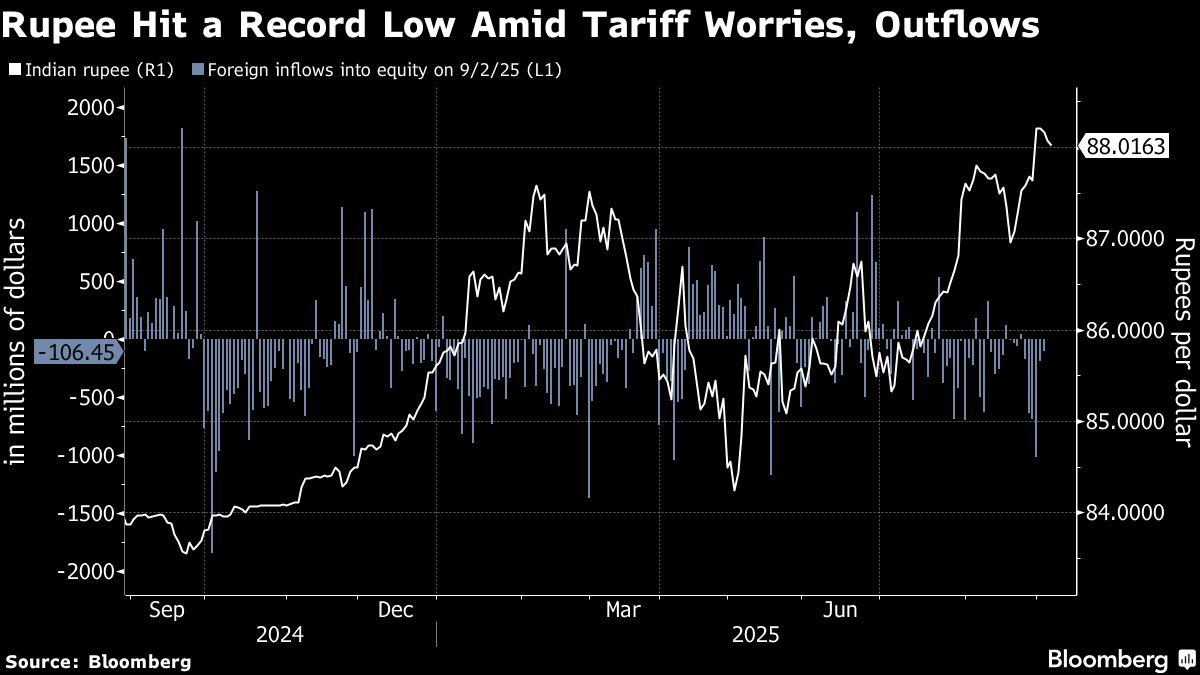

Exporters are seeking a rupee exchange rate of around 103 per dollar for US earnings, Pankaj Chadha, chairman of the Engineering Export Promotion Council of India, said in a phone interview. The rupee is currently trading close to Monday's record low of 88.33 to the dollar.

The businesses will make their case to Reserve Bank of India Governor Sanjay Malhotra at a meeting next week, Chadha said. They are facing a loss of about 30% in US-bound shipments because of the higher tariffs, and they want the government to shoulder at least half of the burden, he said.

The RBI didn't respond to an email seeking further information.

Trump last week slapped 50% tariffs on Indian goods shipped to the US, to penalize the nation for its trade barriers and purchases of Russian oil. The tariffs are the highest in Asia, making Indian goods uncompetitive compared with manufacturing rivals like Vietnam and Bangladesh. The US is India's biggest export market, and the tariffs are expected to hurt labor-intensive businesses like textiles and jewelry the most.

Some analysts say the RBI is already allowing the rupee to drift lower to offset the damage. The currency has weakened 2.8% against the dollar this year, making it Asia's worst performer.

“The pace of INR depreciation has picked up post the 50% tariffs on India,” said Gaura Sen Gupta, chief economist at IDFC First Bank. “Depreciation of INR is the only policy tool in the near-term to reduce the negative impact on exports.”

Chadha said the special currency rate would be an interim measure for shipments already booked by US buyers “to take care of existing orders that have to be shipped at 50% tariff.”

A weaker rupee rate for exporters would be risky for the central bank, though. It could damage broader sentiment toward the currency, which, in turn, could force the central bank to step up intervention in the foreign exchange market, causing a rapid erosion of India's reserves.

“To me, it makes no sense,” said Jamal Mecklai, chief executive officer of currency consultant Mecklai Financial Services Ltd. “Subsidy, if at all, should come from the government and not from the exchange rate side,” said Mecklai, who also advises exporters.

The rupee is already quite weak, and in the recent past has stayed stable even when the dollar weakened, he said. “One may think the exporters have already enjoyed a favorable exchange rate for a long time,” he said.

Loan Repayments

Exporters have also lobbied the government for more financial assistance. In recent meetings with the officials, exporters have sought a moratorium on loan repayments, lower interest rates for their credit, collateral-free working loans, wage support, and relief from statutory contribution, people familiar with the matter said, asking not to be identified to discuss freely on the issues raised with the government.

The government has said it will ensure ample liquidity for exporters struggling with US tariffs. The Ministry of Commerce and Industry didn't respond to an email seeking comments.

A former central bank official argued the exchange rate can't be the only tool to help cushion exporters from the tariff fallout, saying a weaker currency would hurt importers and foreign investor sentiment.

“Exchange rate depreciation to help exports is not the right policy tool, and RBI never does that,” said R. Gandhi, who was deputy governor from 2014 to 2017. “There are other options to help exporters such as interest rate subventions, allowing a longer period for export credit or export bill tenors, subsidies by the government etc. But not a conscious overall currency depreciation.”

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.