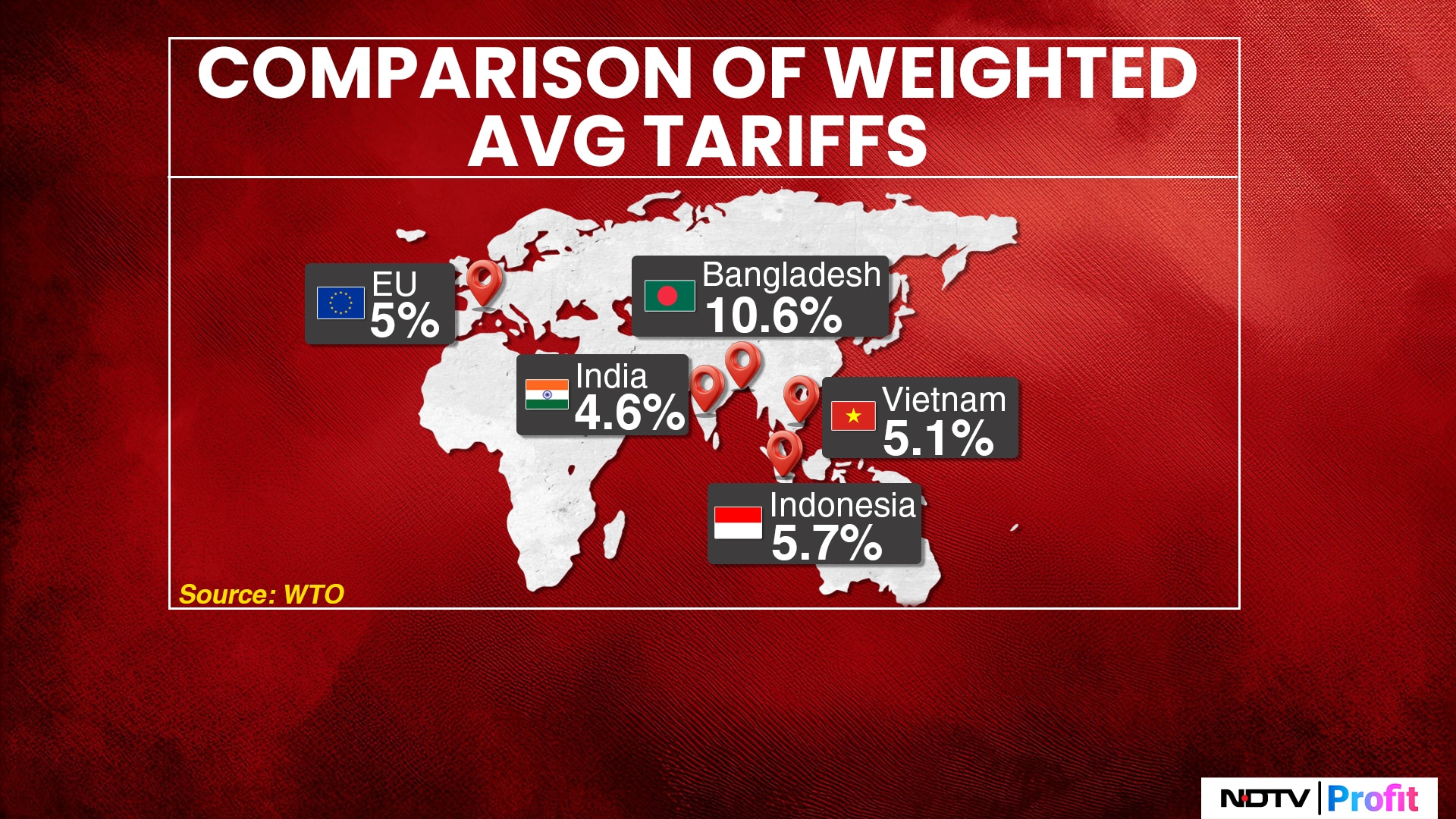

- India's applied weighted mean tariff is 4.6%, lower than Brazil, Argentina, Cambodia, and South Korea

- India's simple average tariff is 15.98%, reduced from 80.9% in 1990 following economic reforms

- US exports to India face low tariffs under 5% on key goods like petroleum, pharmaceuticals, and machinery

US President Donald Trump has ratcheted up trade tensions with India with unilateral tariff and non-tariff measures, blaming New Delhi's purported protectionist policies that he claims keep American goods out of its market.

A reality check based on data from notable international bodies like the World Trade Organisation and the World Bank shows India treats foreign goods with lower tariffs and non-tariff barriers than many Asian and developing peers.

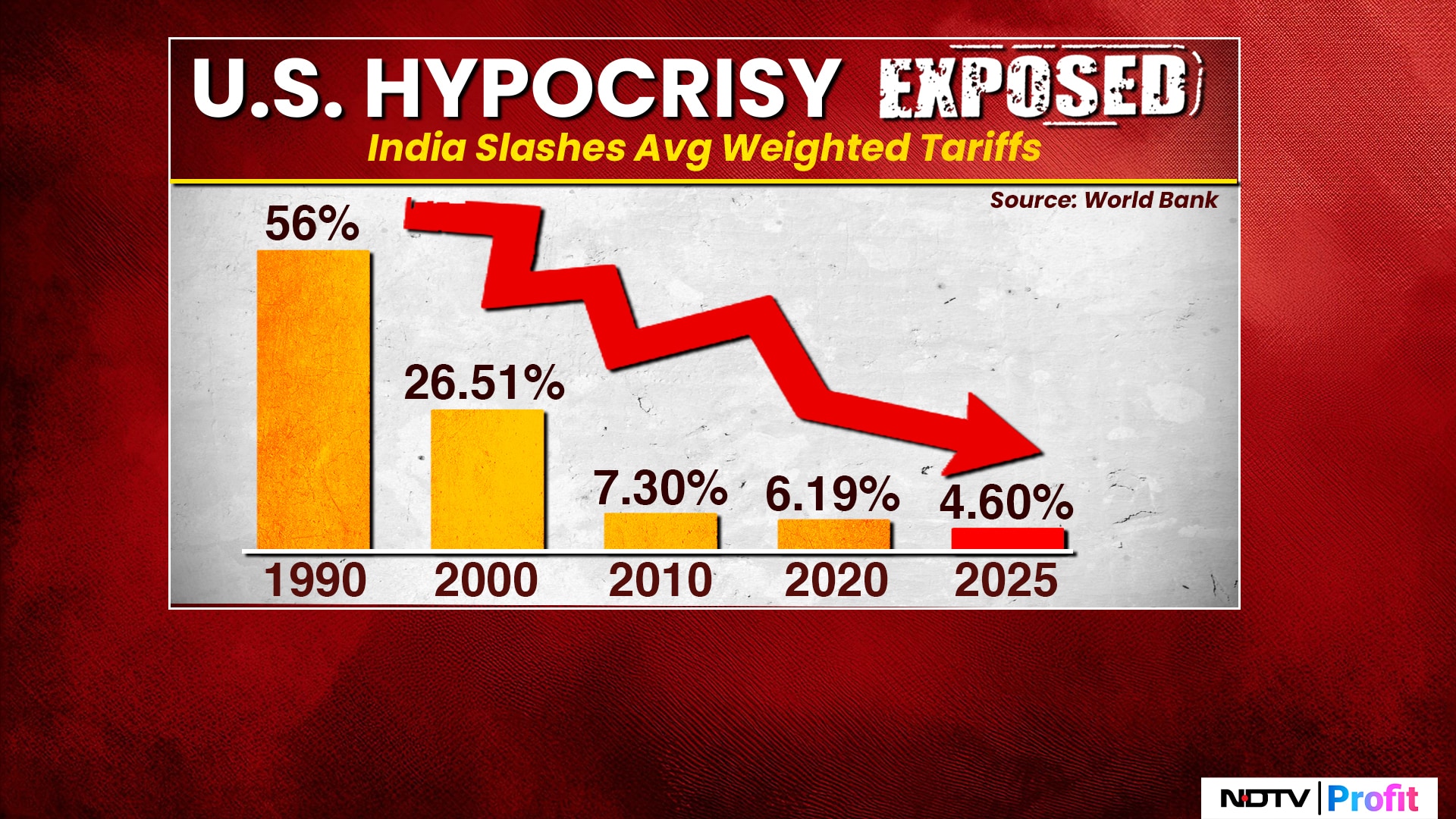

The Indian economy has consistently opened up to foreign trade and investment since the reforms of 1991. The claim that the country has high tariffs often arises from conflating simple average tariffs with import-weighted tariffs.

Simple averages treat all products equally, while trade-weighted averages reflect the actual duties paid based on import volumes, offering a more accurate picture of market access.

World Bank data shows India's applied weighted mean tariff stands at 4.6%, comparable to, and in many cases lower than, several major economies. For example, Brazil's rate is 7.26%, Argentina's is 6.45%, Cambodia's is 7.2% and South Korea's is 5.66%.

India's simple average is 15.98%, while Argentina and South Korea tax at 13.4% and Turkey at 16.2%.

In 1990, the average tariff stood at a steep 80.9%. Following the reforms of 1991, this was brought down to 56%, further reduced to 33% by 1999, and finally now to 15.98%.

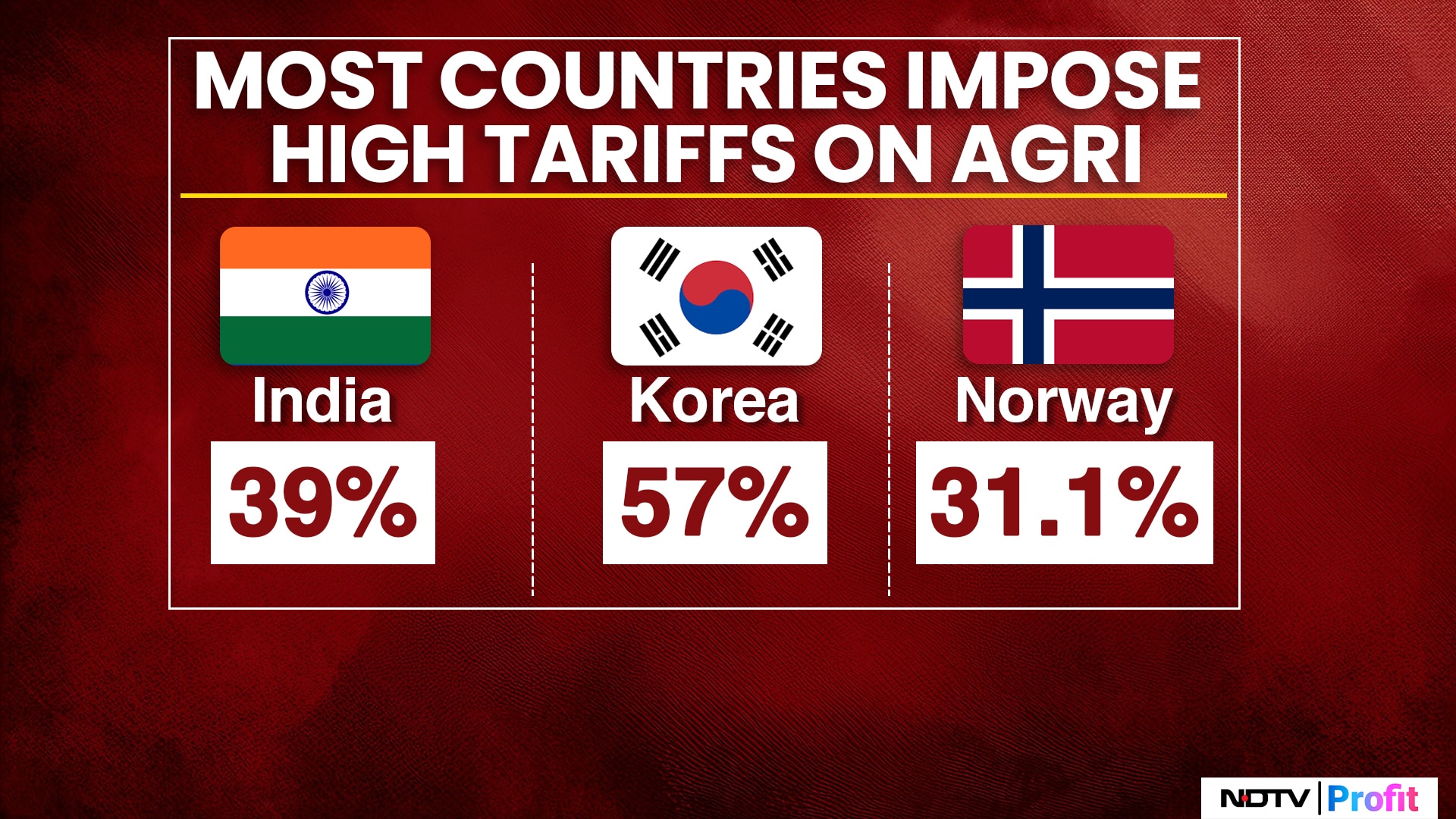

Besides, the gap between simple average and weighted mean tariff shows that higher tariffs are concentrated in a few low-import sectors like agriculture and automobiles, which form a small share of US-India trade.

Duties That US Goods Face In India

The bulk of American exports to India pharmaceuticals, energy products, machinery, and chemicals face relatively low tariffs.

The top six US export categories to India are petroleum, liquified natural gas, coal, pharmaceuticals, machinery parts, and fertilisers. They account for over 45% of total merchandise exports to India and face tariffs under 5% on average, and rarely exceed 10%, as per WTO data.

Besides, India has been increasingly buying American energy as a way to address Washington's concern over its trade deficit.

Additionally, retaliatory tariffs on key US agricultural exports like apples, walnuts, and almonds were withdrawn in 2023 after the resolution of WTO disputes, as per the US Department of Agriculture.

Non-Tariff Barriers

Trump has repeatedly claimed that, other than tariffs, India uses non-tariff barriers like product standards and procedural delays to discourage imports.

Over the past decade, New Delhi has made significant progress in simplifying and streamlining its trade procedures, focusing on harmonising regulations with international standards and reducing procedural complexity.

A 2021 report from the Office of the United States Trade Representative says economies such as the European Union and Japan, implement some of the world's strictest non-tariff measures, especially in sectors like agriculture, chemicals, and industrial goods.

China, often dubbed the world's factory, enforces a complex regime of technical regulations and licensing requirements that often serve to protect domestic industry. Beijing maintains a vast and persistent body of non-tariff barriers that significantly affect market access.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.