- The Supreme Court questioned Trump's broad tariff powers, creating uncertainty for businesses and partners

- India, China, Brazil, and Switzerland are majorly affected by US tariffs and potential changes

- China-US tariff tensions persist despite recent partial tariff rollbacks and ongoing export declines

The Supreme Court's questioning of President Donald Trump's use of broad powers to justify much of his sweeping tariffs leaves businesses that actually pay the levies facing months of potential uncertainty.

While the same lack of clarity applies to US trading partners — both those that have already inked deals and those still in negotiations — there's also a recognition that Trump will likely fall back on other tools to tax imports if his use of the 1977 International Emergency Economic Powers Act is deemed unconstitutional.

(Photo Source: Bloomberg)

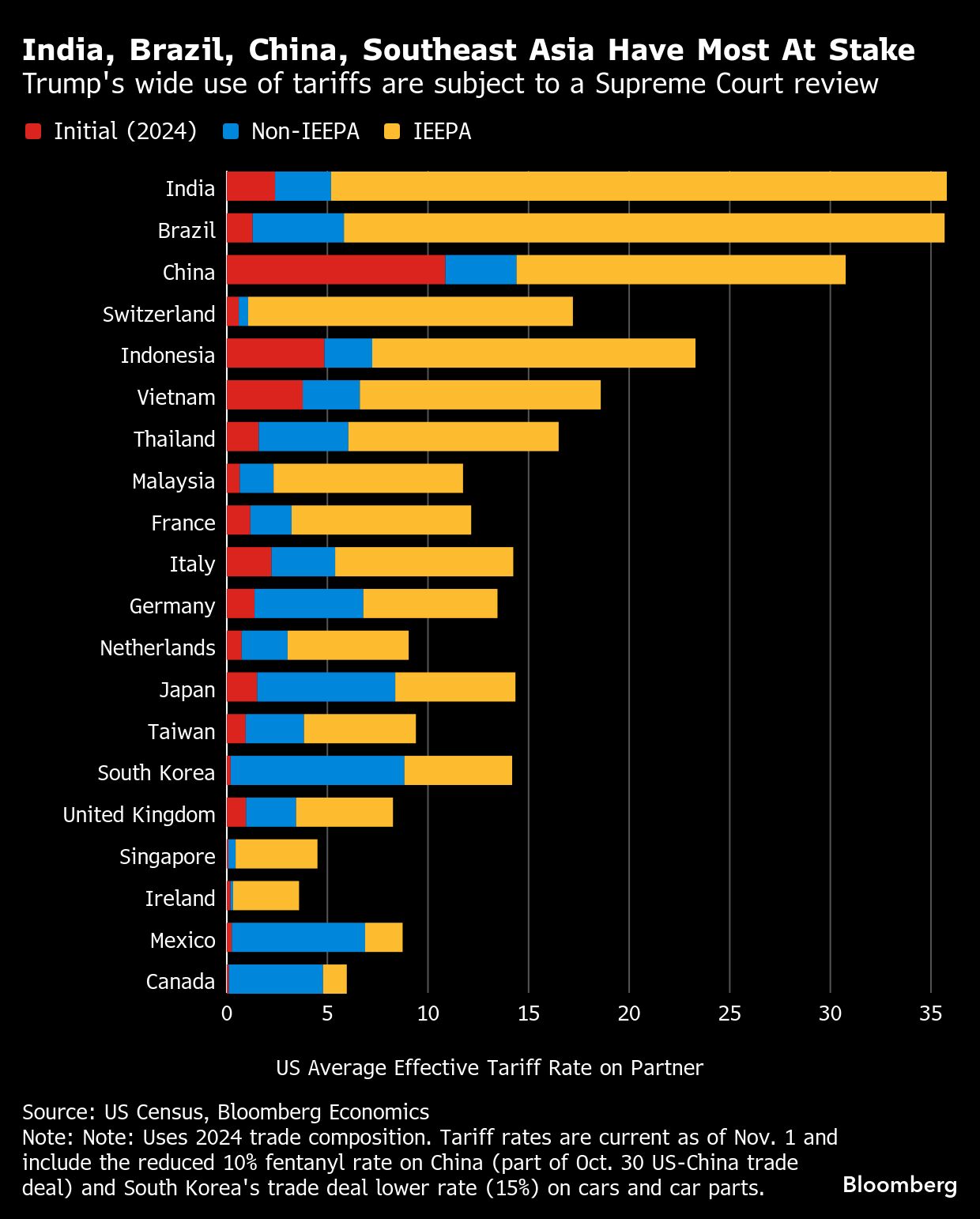

Here's a look at the tariff calculations confronting economies around the globe if the Supreme Court does end up ruling against the administration.

Who's Possibly Affected?

India and China have been among the biggest targets of US tariffs, while Brazil has also been hit with a very high impost. Switzerland was a surprise target, too.

According to Bloomberg Economics, a broad ruling against Trump would cut the US average effective tariff rate to 6.5%, a level not seen since before the president's April 2 Rose Garden announcement of his “Liberation Day” tariffs on dozens of countries. The average effective tariff rate is different (and usually lower) than the headline rate that has been announced by the US due to various exemptions and pre-existing levies.

(Photo Source - Bloomberg)

China

Trump and Chinese President Xi Jinping agreed last week to lower US tariffs by 10% and to continue to suspend other threatened tariffs for a year, which provides some certainty for companies. Trump could use other legal authorities to justify tariffs if needed, and many of the issues between the rival superpowers come down to their chokeholds on key products, meaning ongoing tensions aren't likely to fade anytime soon.

Already, Chinese exports to the US have seen seven straight months of double-digit declines, with shipments down more than 25% in October from a year earlier, according to data released on Friday.

(Photo Source: Bloomberg)

“US-China tensions are a trend and not a blip even if it is de-escalated,” said Trinh Nguyen, senior economist for emerging Asia at Natixis SA. “Diversification isn't just a pure tariff calculation but a shift in geopolitics and that isn't going to change. Companies need to establish diversified supply chains.”

Some Chinese researchers are skeptical that the Supreme Court could stop Trump, given his massive executive power. State media outlets had intensive coverage on how Supreme Court judges were questioning the legitimacy of Trump's tariffs, but also noted that it is quite unlikely for the court to completely terminate Trump's tariff policies. The reports also mentioned Treasury Secretary Scott Bessent's earlier comments that the US government would maintain the current tariff levels.

China's Ministry of Commerce didn't respond Thursday to a question asking them about the court case.

North Asia

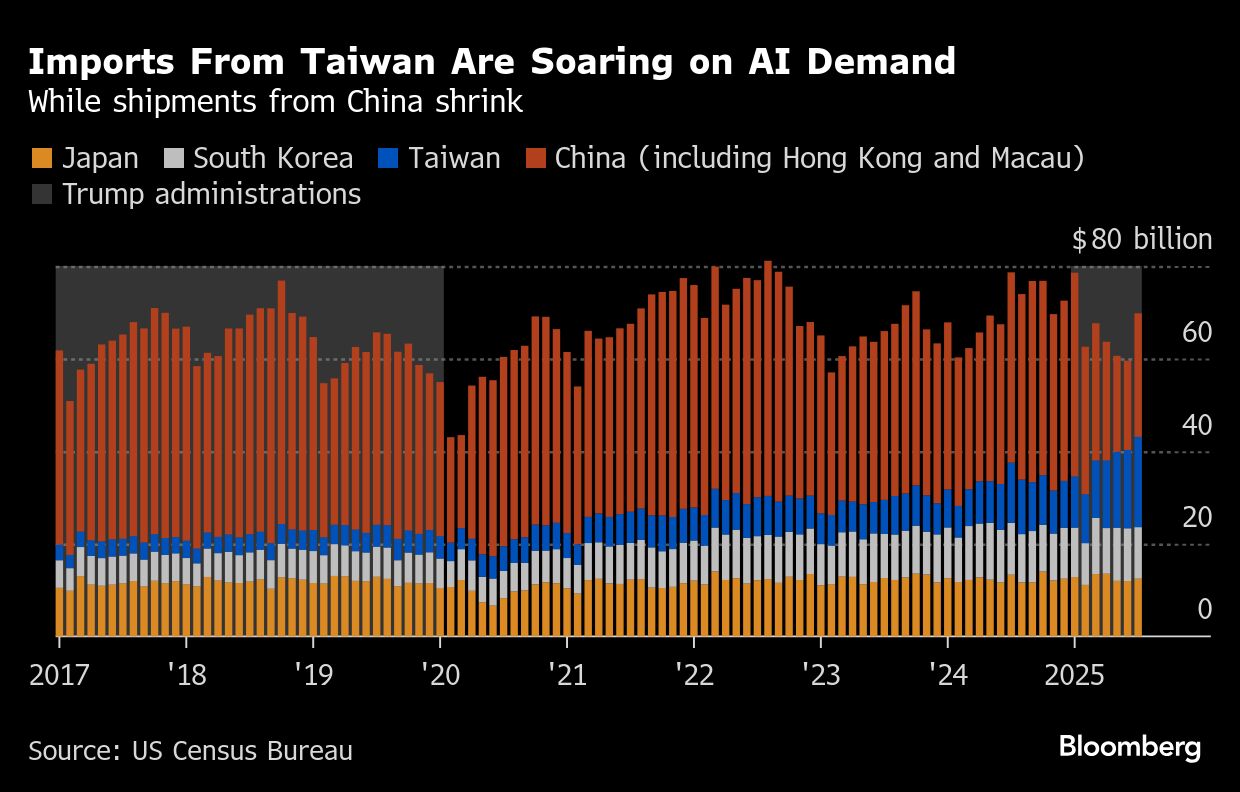

Taiwan has seen a massive spike in its exports to the US this year, driven by the AI boom. However, it's unlikely to be affected by whatever the Supreme Court rules because a lot of high-tech gear is exempt from US tariffs.

(Photo Source: Bloomberg)

Similarly, trade with Japan and South Korea is unlikely to be substantially altered. Japan has already signed a tariff and investment deal with the US, while South Korea has yet to put pen to paper on its recent agreement. It seems unlikely either nation would tear up those hard-fought agreements.

“We expect most trading partners that announced agreements with the Trump administration earlier this year to remain in those agreements to avoid renewed tariff uncertainty,” Goldman Sachs Group Inc. economists led by Alec Phillips and Jan Hatzius wrote in a note.

“However, as it is the US importers who pay the tariffs and not trading partners, the willingness of other countries to stick to the agreed deals might not be relevant,” they wrote. “The most likely solution would be for the administration to use its other authorities to impose the tariffs called for under the deals, but the process of doing so would create renewed uncertainty.”

Southeast Asia

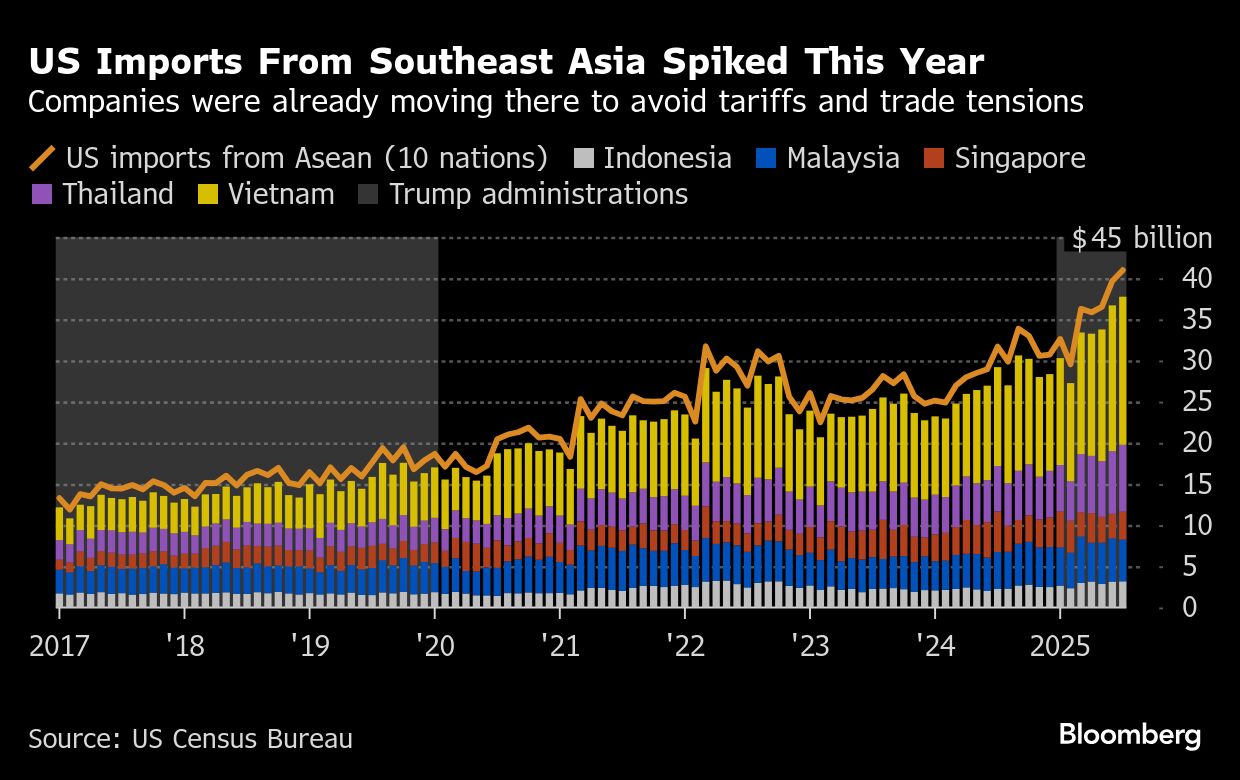

The effect on trade flows from Southeast Asia could potentially be larger, as exports from Vietnam, Thailand and other places have jumped this year, partly due to companies trying to get ahead of US tariffs. If those tariffs were to be removed or lowered, it could prompt another flood of goods.

But even in this region the exact effect on trade flows is murky as a substantial portion of those flows are semiconductors. Right now these are exempted but that might change if the US does impose new levies on that trade, and Trump has indicated that semiconductor-related levies are coming soon and has threatened tariffs as high as 300%.

(Photo Source: Bloomberg)

India

India has been negotiating with the US to bring down a 50% tariff rate, one of the highest in the world, after Trump targeted the country for its purchases of Russian oil. Trump has softened his criticism in recent weeks, and both sides have sought to defuse tensions, raising optimism that a trade agreement may be in the offing.

Officials in New Delhi say a Supreme Court ruling against Trump won't make much difference to the trade talks. The White House could use other tools to achieve its trade objectives, taking executive action, or possibly using non-tariff barriers, the officials said, asking not to be identified because the discussions are private.

The court action gives Indian negotiators more reason to push for language in the trade pact that's compatible with World Trade Organization rules and would be legally-binding, one of the officials said. A ruling against Trump would strengthen New Delhi's case for sticking to its position, the person said.

India's Ministry of Commerce and Industry didn't immediately respond to a request for comment. The Ministry of External Affairs declined to comment.

Europe

The European Union and the US concluded a trade arrangement in July under which Washington will increase its tariffs to 15% for most EU goods, including cars.

In return, Brussels agreed to remove low duties for US industrial goods and some non-sensitive agrifood products to avoid a costly dispute with its largest trading partner and secure its badly needed security cooperation to counter threats from Russia.

The agreement, described as asymmetrical by top EU officials, was criticized by member states and the European Parliament, and failed to remove punitive tariffs on some EU metals.

The European Commission, the EU's executive arm, is pushing the Trump administration to lower a 50% duty on steel and aluminum exports and avoid that the levy keeps spreading to more products using these metals. In addition, EU lawmakers are discussing amendments to the agreement before giving its blessing, such as the introduction of a sunset clause.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.