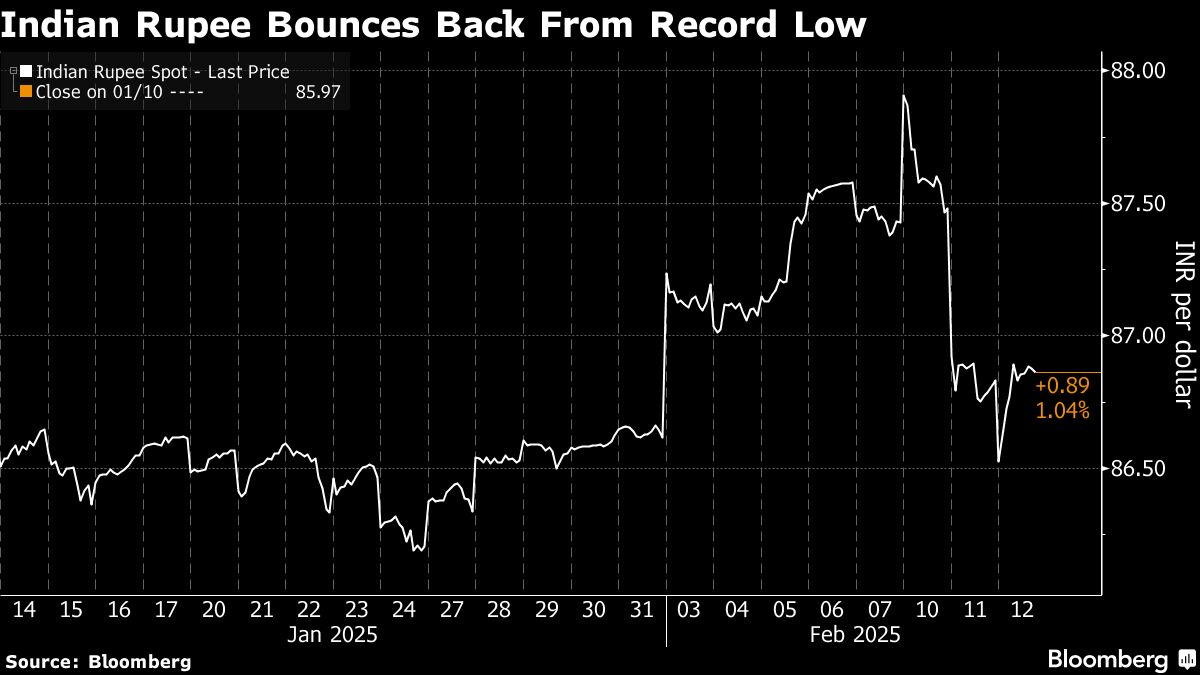

The Indian rupee's biggest one-day jump in almost two years caught traders off guard, but the gains may be short-lived due to monetary easing and rising global volatility.

DBS Bank Ltd. sees the currency weakening to 88.8 per dollar by mid-2025, while IDFC First Bank Ltd. predicts a decline to 89.50 by December. The currency recorded its best one-day performance since March 2023 on Tuesday, before ending at 86.89 on Wednesday.

The rupee's recent gyrations mark a departure from its stability in the past two years, and the moves are testing new central bank chief Sanjay Malhotra's tolerance in dealing with swings in the foreign-exchange market. The Reserve Bank of India was said to have stepped in to curb speculation this week, with some traders estimating that authorities intervened to the tune of $11 billion over two days.

Analysts, however, don't expect the central bank to continue to offer support on a similar scale as the focus will shift to policy easing and boosting financial-system liquidity. India's inflation eased to a five-month low in January, data showed Wednesday, bolstering hopes of more rate cuts in the coming months.

“We are still slightly bearish on the rupee in the three- to six-month period,” said Jeff Ng, head of Asia macro strategy at Sumitomo Mitsui Banking Corp. “RBI rate cuts, and allowance of some currency movements may allow slight rupee weakness.”

The rupee's rally on Tuesday triggered stop losses across trading floors and spawned theories that Indian authorities were signaling a conciliatory tone on the currency ahead of Prime Minister Narendra Modi's meeting with President Donald Trump in the US. India is among the countries that are most exposed to risks from Trump's tariffs and a stronger rupee can help allay some concerns on its impact on trade.

Looking ahead, the currency may come under pressure as the dollar remains supported amid a slower pace of US interest-rate cuts. Foreign investors have pulled about $10 billion from Indian equities this year after slower economic growth and weak corporate earnings added to their concerns.

The dollar-rupee risk reversals — the premium to protect against dollar strength in the options market — have seen an easing.

“We are not seeing anyone looking at downside USD/INR,” said Saurabh Tandon, global head of FX options at Standard Chartered Plc in Singapore. “We saw some people take profit on the rupee move higher but general views for the topside still remain.”

Barclays Plc has grabbed the opportunity to take profit on its short Chinese yuan trade against the rupee amid sharp gains in the latter.

Tight liquidity conditions in India may also play a role in limiting the central bank's intervention in the foreign exchange market. The RBI has been ramping up its cash injections to ease tight liquidity and more dollar sales will only add to the shortage of rupee.

“Every policy action has a trade-off and one key drawback of intervention has been tightening system liquidity,” said Michael Wan, senior currency analyst at MUFG Bank Ltd. “The corollary to this trade off is that the central bank will necessarily have to let the rupee find a weaker level over time.”

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.