Indian rupee strengthened against the US dollar with the central bank stepping in, traders told NDTV Profit. The domestic currency sustained its gains from the open, peeling away from the 87-mark as the day progressed.

Reserve Bank of India has been intervening heavily in the market both yesterday and today, traders familiar with the development said.

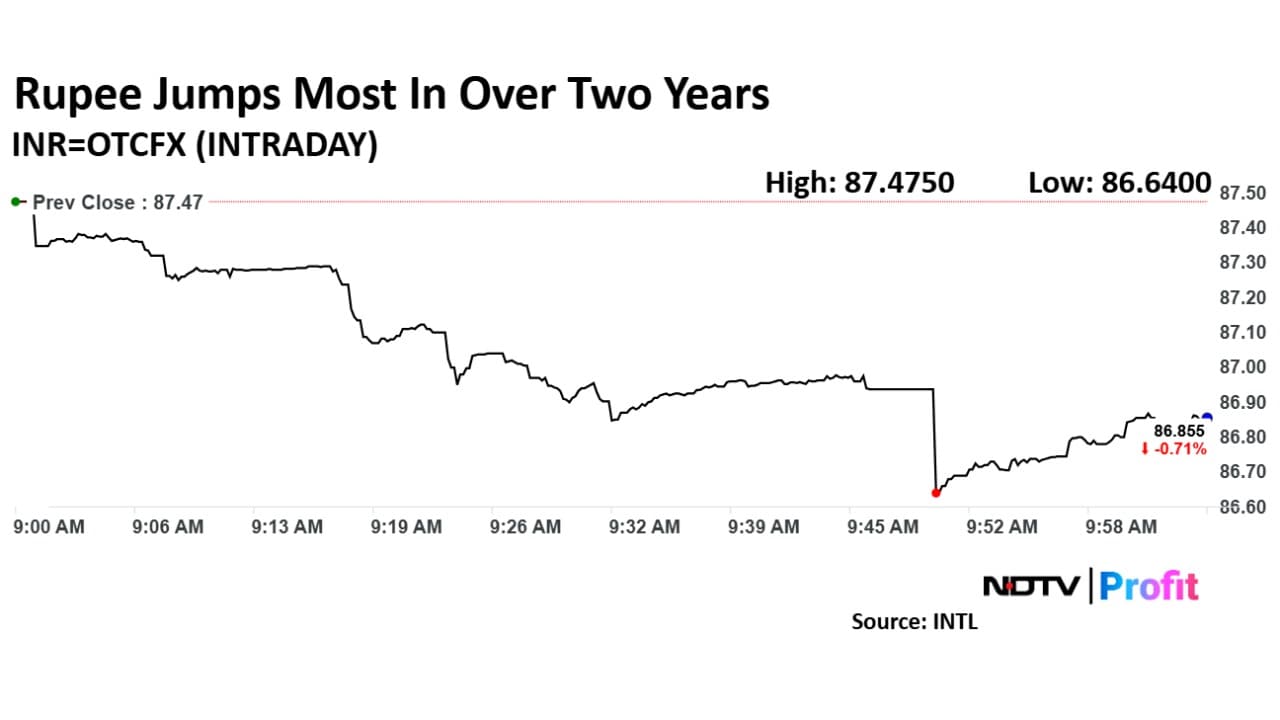

The Indian rupee strengthened against the US dollar on Tuesday, gaining 13 paise to open at 87.35. The pair was trading at 86.88 as of 11:45 today

The rupee had weakened significantly on Monday, reaching 87.92 against the dollar, following fresh threats of tariffs on steel and aluminum imports. The US administration's announcement of a 25% tariff on these imports, coupled with hints of further action on other goods, had triggered a flight to safety, boosting the dollar. The rupee-dollar pair closed the volatile trade at 87.48 per dollar yesterday.

Over the last few sessions, there was significant speculation that the rupee might touch 90 against the US dollar. In response, the RBI has stepped in to control the volatility, signaling to the market that while they will tolerate some level of speculation, they will not allow the rupee to depreciate too quickly, the traders said.

However, the rupee managed to recover most of its losses later in the day, due to strong intervention from the Reserve Bank of India. Market participants also cited dollar selling by exporters and profit-booking by speculators as factors contributing to the rupee's recovery. The currency eventually closed the day at 87.48.

“The rupee weakened to 87.95 against the dollar before closing at 87.4750. However, the unit managed to pare most of its losses due to strong central bank intervention, exporters' selling dollars and profit-booking by speculators, who were holding long Rupee-dollar positions,” said Kunal Sodhani of Shinhan Bank.

Looking ahead, market analysts expect continued volatility in the currency markets. “With a rise in the dollar index and a fall in Asian currencies due to the imposition of tariffs, the Indian rupee is set to open weaker,” noted Anil Kumar Bhansali, head of treasury and executive director at Finrex Treasury Advisors LLP, before Tuesday's market opening.

“The rupee was allowed to fall up to 87.9575, its lowest level till date, before RBI stepped in. Importers covered this dip on the dollar. Today, the range of 87.40 to 87.80 should be honoured, as volatility in the currency increases," he added.

Bhansali also suggested that exporters may wait and watch market movements before making decisions, while importers should buy on dips.

Meanwhile, Chief Economic Advisor V Anantha Nageswaran said that rupee's depreciation has not hindered India from providing returns to investors. Speaking at the IVCA Conclave 2025, Nageswaran noted that the rupee's annual depreciation has historically been around 3%.

Uncertainty whether rupee will continue its fall, the CEA suggested that if India maintains an inflation rate of around 3–4%, the decline might slow down significantly. He also pointed out that the rupee's depreciation is a direct consequence of the dollar's strength.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.