11_07_24.jpg?downsize=773:435)

Indian rupee continued to face pressure and closed lower on Wednesday, after two sessions of record lows ahead of the Reserve Bank of India's key interest rate decision this week.

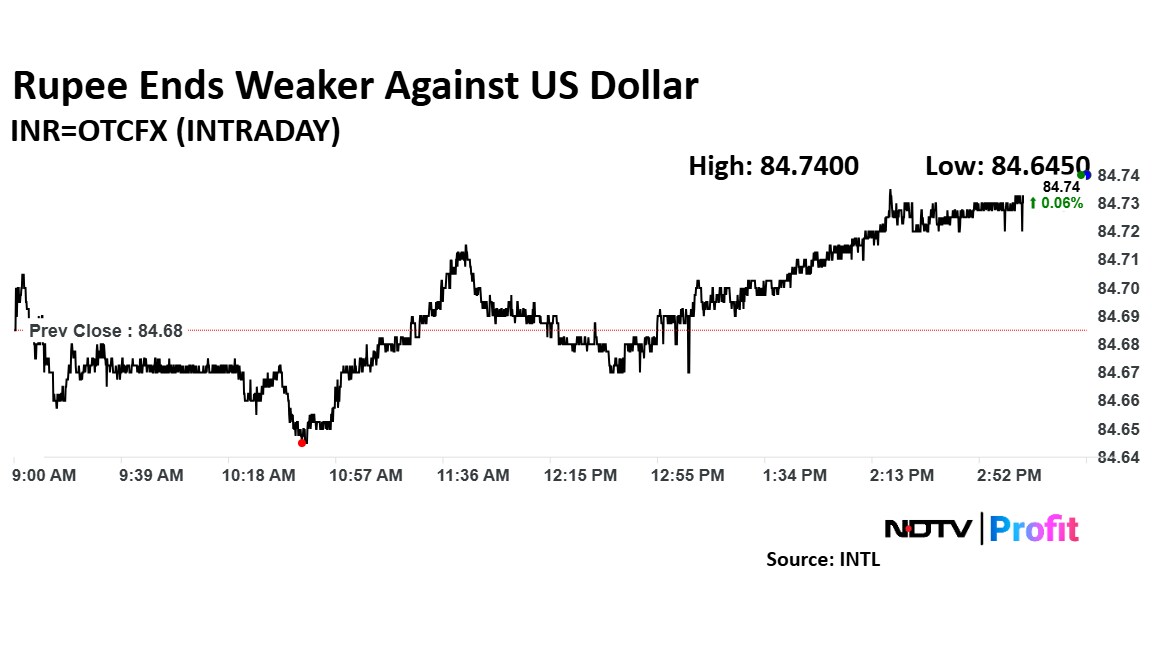

The domestic currency weakened by four paise to close at 84.73 against the US dollar, according to Bloomberg data. The rupee had closed at 84.69 against the greenback on Tuesday.

The Reserve Bank of India's monetary policy committee will meet from Wednesday to Friday to decide on the key policy rates after the country's economic growth fell to the slowest in nearly two years. The gross domestic product grew 5.4% in the July-September quarter, compared to 6.7% in the April-June quarter.

Meanwhile, overseas investors turned net buyers of Indian equities after three consecutive sessions of selling after having stocks over Rs 21,600 crore in November, according to data on National Securities Depository Ltd.

The dollar index resumed its advance following a rise after Donald Trump demanded a “commitment” from BRICS nations that they will not create a new currency as an alternative, or endorse any other currency to replace the dollar.

The dollar index—which tracks the greenback's performance against a basket of 10 leading global currencies—was trading 0.10% higher at 106.47.

International benchmark brent oil was priced 0.60% up at $74.06 per barrel after US imposed more sanctions on Iranian crude. West Texas Intermediate was up 0.54% higher at $70.32 a barrel.

While Indian equities have delivered commendable year-to-date returns, the rupee has struggled, hovering near its all-time lows, according to Amit Pabari, managing director, CR Forex Advisors. "As contributing factors include a liquidity deficit limiting the RBI's ability to intervene through dollar sales."

With the Fed leaning towards a December rate cut and a more dovish 2025 outlook, alongside slowing FII outflows and the RBI's vigilance, the rupee is unlikely to breach the 85.00 level, Pabari said. "In the short term, USD/INR is expected to trade within the range of 84.5–85.0."

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.